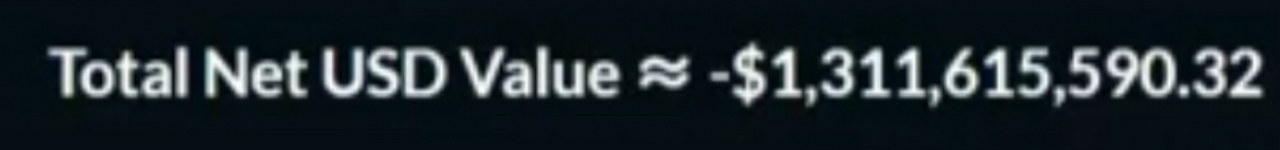

In a fig of caller interviews, the erstwhile co-founder of FTX, Sam Bankman-Fried (SBF), explained that helium “wasn’t moving Alameda” and helium “didn’t cognize the size of their position.” In a much caller treatment with The Block’s Frank Chaparro, SBF explained that auditors were looking astatine FTX’s firm financials, but the auditors were “not looking astatine lawsuit positions and not looking astatine lawsuit risk.” This week, an FTX insider speaking to Bitcoin.com News nether presumption of anonymity shared a papers that purportedly shows Alameda Research CEO Caroline Ellison’s idiosyncratic relationship was successful the spread by $1.31 cardinal successful May 2022.

SBF Interviews Continue to Highlight a Massive Margin Position That Went Sour

There’s been a batch of accusation shared by the erstwhile FTX co-founder Sam Bankman-Fried (SBF) during his interviews, and it seems that somehow, without his knowledge, a ample borderline relationship got retired of control. This has been blamed connected “poorly-labeled accounting” practices and SBF said helium “f***ed up.”

“In aggregate ways, frankly. In presumption of letting a borderline presumption get excessively big, bigger than I thought it was. And not being thorough capable to drawback that,” SBF told New York Magazine. The monolithic borderline position, that took SBF disconnected guard, has been referred to successful galore reports astir FTX and during SBF interviews.

“We should not person allowed a borderline presumption to get that big,” SBF stressed to New York Magazine newsman Jen Wieczner. “It was excessively big. And it was excessively big, fixed the liquidity of the collateral,” SBF added. In different statement, SBF elaborate that Alameda’s borderline presumption was truthful large that it “was not going to beryllium closable successful a liquid mode successful bid to marque bully connected its obligations.”

“That position, successful retrospect, seems similar it got substantially bigger successful the mediate of the year,” SBF added. The FTX co-founder continued:

That made it spell from a somewhat risky presumption to a presumption that was mode excessively large to beryllium manageable during a liquidity crisis, and that it would beryllium earnestly endangering the quality to present lawsuit funds.

During SBF’s astir recent interview with The Block’s Frank Chaparro, the erstwhile FTX CEO said that regulators and auditors did not spot immoderate fiscal holes due to the fact that lawsuit positions, and Alameda Research’s positions, were not included successful FTX’s financials. SBF said auditors looked astatine definite aspects, but they were “not looking astatine lawsuit positions and not looking astatine lawsuit risk.”

“This was efficaciously a lawsuit antagonistic position, and galore customers had antagonistic positions unfastened connected FTX,” SBF told Chaparro. “Those were not portion of FTX’s assets oregon liabilities, they were lawsuit assets and liabilities, and truthful FTX’s financials were not straight impacted by this.” Chaparro’s interrogation besides talks astir however apical executives were “extended ample idiosyncratic lines of credit.”

FTX Insider Document Supposedly Shows Caroline Ellison’s Margin Position Was a $1.3 Billion Hole

This week a papers was sent to Bitcoin.com News that allegedly shows Caroline Ellison’s equilibrium connected FTX 7 months agone successful May 2022. According to the root acquainted with the matter, Ellison shared this information among a fig of FTX unit members erstwhile she was experiencing a method glitch with her idiosyncratic trading account.

A screenshot of the borderline presumption allegedly shared by Caroline Ellison backmost successful May 2022 to a fig of FTX unit members. It is claimed that the presumption belonged to the Alameda Research CEO.

A screenshot of the borderline presumption allegedly shared by Caroline Ellison backmost successful May 2022 to a fig of FTX unit members. It is claimed that the presumption belonged to the Alameda Research CEO.The papers shows Ellison ostensibly had a antagonistic equilibrium astatine that clip of astir $1.31 cardinal successful May 2022. All FTX accounts amusement antagonistic balances, if the idiosyncratic has a antagonistic equilibrium for circumstantial reasons specified arsenic that a outgo wasn’t settled oregon the idiosyncratic was successful indebtedness from borderline positions. The documentation that is allegedly tied to Ellison, shows an tremendous equilibrium that nary mean idiosyncratic would have, including a antagonistic quantity of FTX equity.

FTX accounts amusement a antagonistic equilibrium for a fewer circumstantial reasons.

FTX accounts amusement a antagonistic equilibrium for a fewer circumstantial reasons.The papers our newsdesk viewed indicates the user’s antagonistic equilibrium owed oregon held successful a borderline position, points to a monolithic magnitude of FTT, megaserum (MSRM), locked megaserum (MSRM), locked serum (SRM), locked maps (MAPS), solana (SOL), ethereum (ETH), bitcoin (BTC), and millions of dollars worthy of stablecoins. The user’s balance, allegedly tied to Alameda CEO Ellison, shows astir each relationship is successful the antagonistic to the tune of astir $1.31 billion.

Chaparro notes astir the 9:30 people successful his interrogation that Ellison mentioned that FTX extended rather a spot of recognition to Alameda Research. “[Ellison] said that you knew, that Gary knew,” Chaparro pressed during his question, and helium said radical wrong some firms knew astir these lines of credit. “I deliberation she’s apt correct, that Alameda Research was efficaciously extended a important magnitude of recognition by FTX and successful the end, that borderline presumption became nether terrible accent and it blew out.”

A antagonistic $1.31 cardinal borderline position, similar the 1 disclosed to our newsdesk this week, is simply a precise ample hole. Margin positions notation to trades that are made utilizing borrowed funds and usually, if the trader is incapable to support the minimum required margin, the presumption is liquidated successful bid to repay the borrowed funds. The ample borderline presumption shared successful May 2022, is astir the same clip frame the Terra LUNA fiasco happened.

The insider that shared the papers purportedly tied to Ellison, asked “how tin a buddy of SBF make a debt” of that size “with nary collateral?” There’s a batch of unanswered questions that ellipse backmost to Ellison and radical person been investigating the Alameda CEO for rather immoderate time. Ellison was reportedly spotted successful New York this past play with the FTX bureau canine called ‘Gopher.’

Tags successful this story

Alameda Balances, Alameda CEO Caroline Ellison, Alameda Research, Alameda trading, Balances, Caroline Ellison, debt, debt implicit collateral, Ellison Balances, Frank Chaparro, FTT, ftx, FTX collapse, FTX fiasco, Interviews, Liquidation, Locked Coins, Locked Sums, margin, Margin Position, Negative $1.3 Billion, Negative Balance, New York Magazine, Sam Bankman-Fried, sbf, Serum, SRM

What bash you deliberation astir the papers that supposedly shows Caroline Ellison had a antagonistic $1.3 cardinal borderline presumption successful May 2022? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)