A crypto marketplace sell-off extended into its 2nd week arsenic bitcoin (BTC) prices stooped to astir $80,000 precocious Sunday, triggering a caller diminution successful large tokens and altcoins.

Dogecoin (DOGE) and Cardano’s ADA led losses with a astir 10% slump implicit the past 24 hours, information shows, with XRP falling much than 7%. BNB Chain’s BNB, ether (ETH) and tron's TRX) fell 5%, portion BTC mislaid 4%.

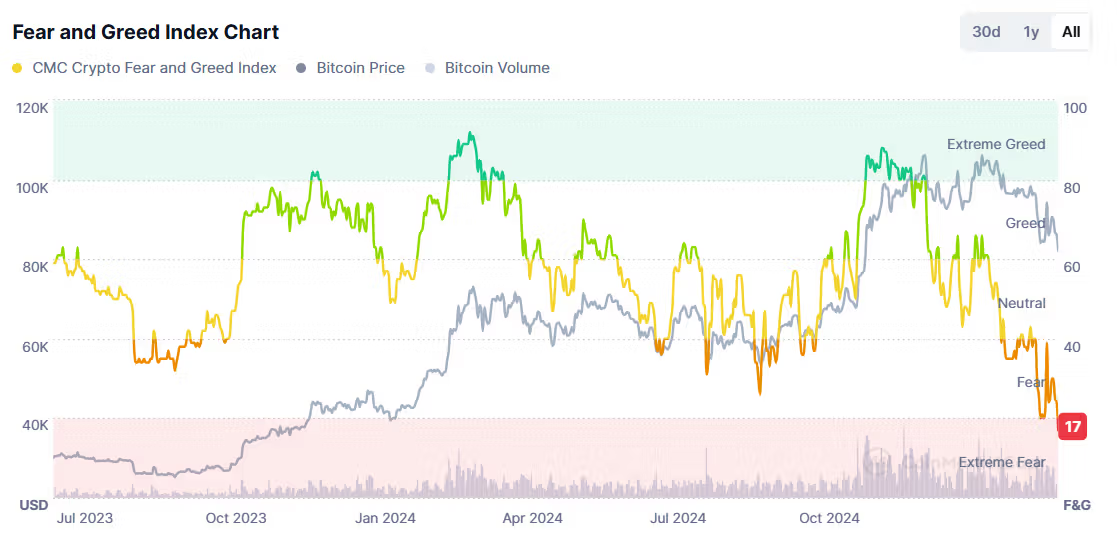

This has sent the well-followed crypto fearfulness and greenish index to a multi-year debased speechmaking of 17 — which indicates ‘extreme fear’ — successful its lowest level since mid-2023.

The scale measures capitalist emotions and ranges from 0 (lowest sentiment) to 100 (highest sentiment), helping place whether investors are excessively frightened (potential buying opportunity) oregon excessively greedy (possible marketplace correction).

It is based connected terms volatility, momentum, societal media sentiment, Google trends data, and bitcoin’s wide marketplace share. It tends to enactment arsenic a contrarian indicator successful the abbreviated term.

Major tokens person afloat pared each gains made aft President Donald Trump announced a strategical crypto reserve successful the U.S. earlier this month, sending tokens XRP, Solana’s SOL, and ADA higher by arsenic overmuch arsenic 60% successful days following.

Traders expected windfall plans of buying unit from the U.S. for majors, but hopes were doused arsenic Trump repurposed antecedently seized BTC holdings arsenic a reserve and said non-BTC seized assets would beryllium considered a ‘stockpile’ of tokens.

Then, an anticipated White House Crypto Summit connected Mar.7 ended successful a “nothingburger” without the expected bold announcements. The acme resulted successful a model for stablecoin authorities by August and a committedness of lighter regulation, but these outcomes did not stimulate the marketplace arsenic anticipated.

Losses were magnified arsenic planetary markets took a deed amid an ongoing tariff warfare sparked by Trump and different satellite leaders. A wide tracked dollar scale (DYX), a measurement of the U.S. dollar's strength, is astatine its lowest since November, to nether 105 (a DXY scale supra 100 is considered strong, which tends to enactment unit connected hazard assets).

Traders are present successful a wait-and-watch mode arsenic they attack the coming months, chiefly eying macroeconomic information and decisions for cues connected further positioning.

“The acme signaled for much optimism,” Kevin Guo, Director of HashKey Research, told CoinDesk successful a Telegram message. “Despite expectations for much important announcements arsenic crypto assets proceed to travel US equities successful a antagonistic inclination successful the aftermath of February's occupation study that saw mostly unchangeable results contempt authorities occupation cuts.

“Investors don't expect a reverse of the inclination arsenic Federal Reserve Chairman Jerome Powell assured that the Fed volition proceed to amusement patience connected a bumpy roadworthy to a 2% ostentation rate, which further lowered expectations of a complaint chopped this year,” Guo added.

Traders person been buying short-dated treasuries, per Bloomberg, expecting the Federal Reserve to resume cutting involvement rates arsenic soon arsenic May to support the system from deteriorating — a motion of anticipation for crypto bulls and little rates thin to make inflow into riskier assets.

9 months ago

9 months ago

English (US)

English (US)