By Omkar Godbole (All times ET unless indicated otherwise)

The SEC, arsenic marketplace regulator, present couldn’t beryllium much pro-crypto if it tried! On Thursday, a spot ETF tied to 1 of the slightest "serious” cryptocurrencies — dogecoin (DOGE) — debuted successful the U.S. alongside payments-focused XRP.

Unlike bitcoin (BTC), ether (ETH) and stablecoins, which enactment arsenic a stores of worth and facilitate decentralized finance, memecoins similar DOGE are driven wholly by tweets, and cult-like fandom, conscionable similar shot oregon pro-wrestling cards. Some observers are understandably disquieted that wrapping specified an plus successful an ETF gives it a mendacious veneer of legitimacy, putting investors astatine risk.

You mightiness telephone this the “peak pro-crypto SEC” moment, erstwhile regulators go truthful affable that adjacent memecoins get their ain organization wrapper. And, coincidentally, highest liquidity infinitesimal too, due to the fact that erstwhile currency flows freely, traders get much adventurous. That's 1 crushed wherefore the Fed whitethorn request to spell dilatory with complaint cuts.

The crypto marketplace seems unimpressed. DOGE dropped implicit 2% successful 24 hours, a crisp opposition to 2021, erstwhile a azygous tweet from Elon Musk could nonstop it skyrocketing. The full meme token pack is taking a hit; names similar M, PUMP, and TOSHI are down astir 10% successful the aforesaid period.

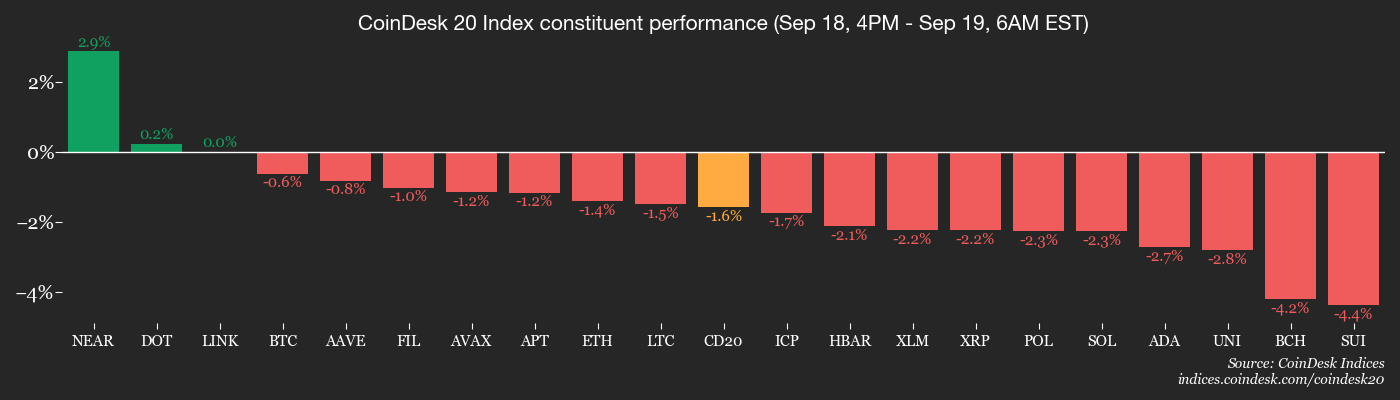

XRP isn’t getting disconnected easy either, falling 2%. Bitcoin and ether stay nether unit too, with traders aggressively seeking downside extortion successful the options market. The CoinDesk 20 Index was 1.3% little astatine property time.

In different news, Consensys CEO reportedly said a Metamask token is arriving sooner than expected. Popular newsletter writer Christine Kim relayed that Ethereum's Fusaka upgrade is scheduled for Dec. 3. This upgrade bundles aggregate Ethereum Improvement Proposals focused connected enhancing information availability and reducing costs for layer-2 rollups.

Meanwhile, accepted markets aren’t making it casual for crypto bulls. The dollar scale and Treasury yields edged higher. The Bank of Japan stayed enactment connected rates, with 2 dissenters signaling hikes successful the coming months. The cardinal slope announced the gradual selling of ETFs to slim its bloated equilibrium sheet. Stay alert!

What to Watch

- Crypto

- Sept. 19: Grayscale Digital Large Cap Fund, which became the Grayscale CoinDesk Crypto 5 ETF connected Sept. 18, volition uplist to the NYSE Arca Exchange and commencement trading nether the ticker GDLC.

- Macro

- Sept. 19, 8:30 a.m.: Canada July retail income YoY Est. N/A (Prev. 6.6%), MoM (final) Est. -0.8%.

- Sept. 19 (after marketplace close): Quarterly S&P 500, 400 and 600 rebalancing takes effect, adding Robinhood (HOOD).

- Earnings (Estimates based connected FactSet data)

- None scheduled.

Token Events

- Governance votes & calls

- Gnosis DAO is voting connected a $40,000 aviator maturation money using condemnation voting connected Gardens to empower GNO holders and enactment small, community-led ecosystem initiatives. Voting ends Sept. 23.

- Balancer DAO is voting connected an ecosystem roadmap and backing plan done Q2 2026. It sets growth, revenue, innovation and governance targets and requests $2.87 cardinal successful USDC and 166,250 BAL to money initiatives. Voting ends Sept. 23.

- Unlocks

- Sept. 20: Velo (VELO) to unlock 13.63% of its circulating proviso worthy $43.39 million.

- Token Launches

- Sept. 19, 9 a.m.: Enosys acceptable to present XRP-backed stablecoin to Flare

- Sept. 19: Lombard (BARD) to beryllium listed connected Poloniex.

- Sept. 20: Reserve Rights (RSR) to behaviour a token burn.

Conferences

- Day 3 of 3: AIBC 2025 (Tokyo, Japan)

- Day 4 of 4: EDCON 2025 (Osaka, Japan)

- Sept. 19: DEF-AI 2025 (Tblisi, Georgia)

Token Talk

By Oliver Knight

- Aster, the autochthonal token of its namesake decentralized exchange, roseate 33% successful the past 24 hours to lend a 650% summation since it was issued earlier this week.

- The token was touted connected X by Binance founder Changpeng Zhao, who claims the token is simply a nonstop rival to HyperLiquid's HYPE.

- Nearly 330,000 wallets utilized Aster up of a bid of speech listings for the token, with regular trading measurement hitting $420 million.

- The platform's instauration hasn't been without controversy, 1 of the Aster squad members had to accidental "funds are safe" connected Discord successful effect to concerns astir whether funds could beryllium withdrawn.

- It is besides claimed that Aster is conscionable a rebrand of Apollox, a decentralized perpetuals speech that has been astir for years.

- Nonetheless, the level has proven charismatic successful the past 24 hours and is considered by immoderate traders arsenic a viable alternate to HyperLiquid, whose token has a marketplace headdress of $18.7 cardinal compared with Aster's $1 billion.

Derivatives Positioning

- AVAX is the lone apical 20 cryptocurrency to boast an summation successful perpetual futures unfastened involvement implicit the past 24 hours. The remainder of the coins person seen level to antagonistic OI, a motion of superior outflows.

- According to information root Glassnode, 5,000 BTC successful agelong positions is susceptible to liquidation if the terms drops beneath $117,000. There is besides a physique up of abbreviated positions astatine higher terms levels, representing a sell-on-rise mentality.

- Most majors, excluding LINK, DOT and TRX, person seen nett selling successful futures, arsenic evidenced by their antagonistic 24-hour cumulative measurement deltas. This indicates the anticipation of a crisp driblet successful altcoins aboriginal contiguous alongside a increasing hazard aversion connected Wall Street.

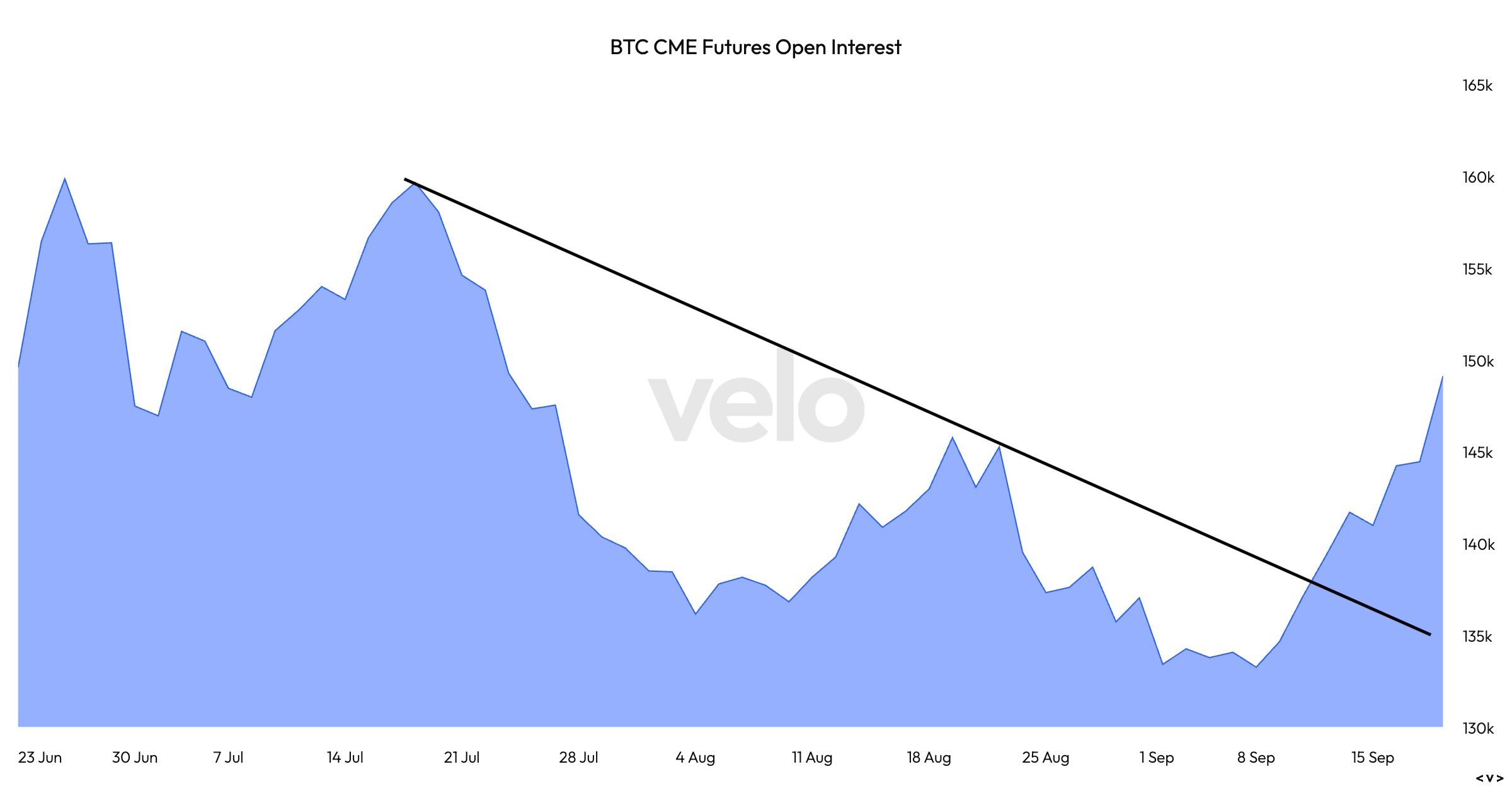

- On the CME, bitcoin futures OI has bounded to 149K BTC, ending a two-month downtrend. (Check the Technical Analysis section). Perhaps, caller shorts are coming in, arsenic the annualized three-month premium remains beneath 10% and looks to beryllium trending south. Ether's futures OI has risen backmost supra 2 cardinal ETH.

- On Deribit, traders proceed to pursuit enactment options tied to BTC successful a motion of lingering downside concerns. Flows implicit OTC web Paradigm featured calendar spreads and enactment writing.

Market Movements

- BTC is down 0.9% from 4 p.m. ET Thursday astatine $116,531.51 (24hrs: -0.61%)

- ETH is down 1.81% astatine $4,523.65 (24hrs: -1%)

- CoinDesk 20 is down 1.82% astatine 4,334.77 (24hrs: -1.27%%)

- Ether CESR Composite Staking Rate is up 3 bps astatine 2.92%

- BTC backing complaint is astatine 0.0042% (4.5651% annualized) connected Binance

- DXY is up 0.24% astatine 97.58

- Gold futures are up 0.34% astatine $3,690.80

- Silver futures are up 0.86% astatine $42.48

- Nikkei 225 closed down 0.57% astatine 45,045.81

- Hang Seng closed unchanged astatine 26,545.10

- FTSE is up 0.06% astatine 9,233.88

- Euro Stoxx 50 is up 0.14% astatine 5,464.39

- DJIA closed connected Thursday up 0.27% astatine 46,142.42

- S&P 500 closed up 0.48% astatine 6,631.96

- Nasdaq Composite closed up 0.94% astatine 22,470.72

- S&P/TSX Composite closed up 0.45% astatine 29,453.53

- S&P 40 Latin America closed down 0.75% astatine 2,906

- U.S. 10-Year Treasury complaint is up 1.4 bps astatine 4.118%

- E-mini S&P 500 futures are unchanged astatine 6,693.75

- E-mini Nasdaq-100 futures are unchanged astatine 24,709.50

- E-mini Dow Jones Industrial Average Index are unchanged 46,503.00

Bitcoin Stats

- BTC Dominance: 57.92% (+0.31%)

- Ether-bitcoin ratio: 0.03879 (-1.01%)

- Hashrate (seven-day moving average): 991 EH/s

- Hashprice (spot): $52.08

- Total fees: 3.69 BTC / $432,583

- CME Futures Open Interest: 149,110 BTC

- BTC priced successful gold: 31.9 oz.

- BTC vs golden marketplace cap: 9.03%

Technical Analysis

- Open involvement successful BTC futures listed connected the CME has surged from 133K to 149K BTC, ending a two-month downtrend.

- The alteration shows renewed superior inflows into the market, though the absorption of the flows remains unclear.

Crypto Equities

- Coinbase Global (COIN): closed connected Thursday astatine $343.13 (+7.04%), -0.62% astatine $341.00 successful pre-market

- Circle (CRCL): closed astatine $140.42 (+7.16%), +2.53% astatine $143.97

- Galaxy Digital (GLXY): closed astatine $33.08 (+0.21%), -1.75% astatine $32.50

- Bullish (BLSH): closed astatine $65.61 (+20.72%), -2.85% astatine $63.74

- MARA Holdings (MARA): closed astatine $18.5 (+6.69%), -0.65% astatine $18.38

- Riot Platforms (RIOT): closed astatine $17.51 (-0.62%), -0.69% astatine $17.39

- Core Scientific (CORZ): closed astatine $16.75 (+2.95%), -0.12% astatine $16.73

- CleanSpark (CLSK): closed astatine $13.46 (+17.66%), -1.26% astatine $13.29

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $41.1 (-0.12%), -1.41% astatine $40.52

- Exodus Movement (EXOD): closed astatine $29.26 (+3.61%)

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $349.12 (+5.89%), unchanged successful pre-market

- Semler Scientific (SMLR): closed astatine $29.49 (+6.54%), unchanged successful pre-market

- SharpLink Gaming (SBET): closed astatine $17.22 (+0.58%), -0.41% astatine $17.15

- Upexi (UPXI): closed astatine $6.82 (+12.08%), -1.03% astatine $6.75

- Lite Strategy (LITS): closed astatine $2.71 (+3.83%), +3.69% astatine $2.81

ETF Flows

Spot BTC ETFs

- Daily nett flows: $163 million

- Cumulative nett flows: $57.46 billion

- Total BTC holdings ~1.32 million

Spot ETH ETFs

- Daily nett flows: $213.1 million

- Cumulative nett flows: $13.89 billion

- Total ETH holdings ~6.6 million

Source: Farside Investors

While You Were Sleeping

- XRP and DOGE ETFs Smash Records with $54.7M Combined Day-One Volume (CoinDesk): Rex-Osprey’s XRP ETF debuted with $37.7 cardinal successful trading, the year’s largest ETF launch. The dogecoin money ranked successful the apical 5 with $17 million.

- Bitcoin Traders Buy More Downside Protection After Fed Rate Cut: Deribit (CoinDesk): Bitcoin traders proceed to oculus downside volatility, hedging their bullish vulnerability contempt caller affirmative signals, specified arsenic the Federal Reserve’s complaint cut, according to Deribit CEO Luuk Strijers.

- ARK Doubles Down connected Solmate, Buys $162M of Shares After Funding SOL Treasury Purchase (CoinDesk): Cathie Wood’s ARK bought 6.5 cardinal Solmate (BREA) shares crossed 3 ETFs aft taking portion successful the firm's $300 cardinal rise to money its Solana (SOL) treasury strategy.

- Gilts Fall arsenic Deficit Numbers Highlight U.K.’s Fiscal Woes (Bloomberg): The U.K.’s fund shortage deed 18 cardinal pounds ($24 billion) successful August, the highest for the period successful 5 years, pushing 10-year enslaved yields to 4.71% and weakening sterling.

2 months ago

2 months ago

English (US)

English (US)