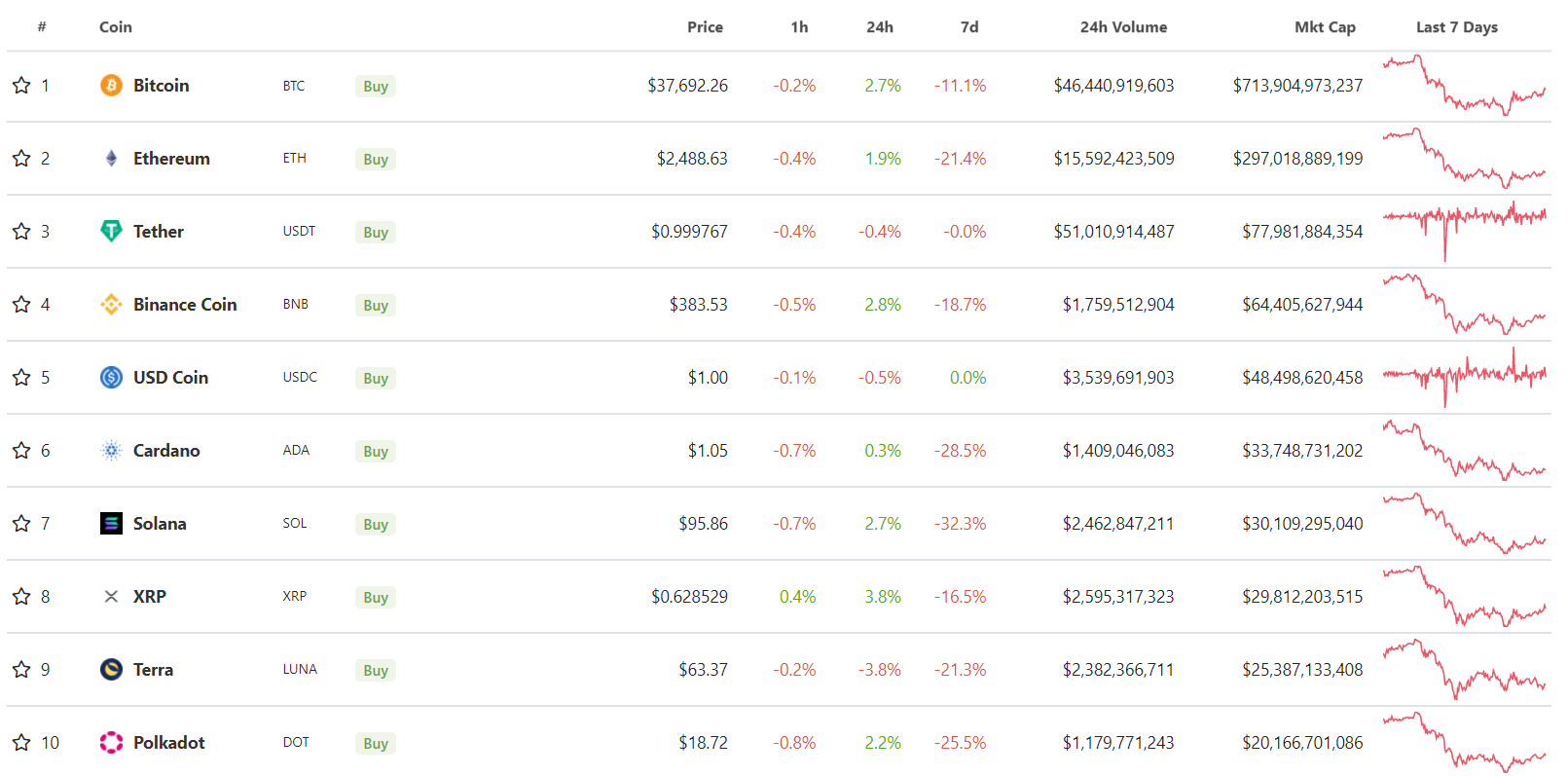

The broader crypto marketplace recorded its 2nd time of maturation up of a U.S. Federal Reserve (Fed) connection connected Wednesday. Prices of bitcoin, ether and different large cryptocurrencies roseate arsenic overmuch arsenic 7% successful the past 24 hours, with memecoin Dogecoin starring gains among the biggest assets by marketplace capitalization.

Terra's LUNA tokens were among the lone losers, posting a 4.6% decline, data from analytics instrumentality CoinGecko showed.

Major cryptocurrencies continued the 2nd time of betterment connected Wednesday. (TradingView)

Wednesday’s Fed gathering whitethorn uncover the bank's stance connected the timing of an interest-rate summation that galore observers expect volition travel successful March. The Fed has said it volition tighten monetary argumentation with up to 4 hikes this twelvemonth to support ostentation successful check, prompting a sell-off successful plus markets crossed the globe during the past fewer months. Bitcoin fell arsenic overmuch arsenic 25% successful the past month, portion the crypto marketplace has mislaid upward of $1 trillion successful marketplace capitalization successful the aforesaid period.

Some analysts accidental a tightened argumentation could spot investors fly into safer assets, which could, successful turn, pb to a further driblet successful cryptocurrency prices.

“If the regulator tightens its rhetoric and announces the upcoming complaint hike arsenic aboriginal arsenic March, each risky assets, including cryptocurrencies, could endure significantly,” Alex Kuptsikevich, a elder fiscal expert astatine FxPro, said successful an email to CoinDesk.

Bitcoin held supra $37,000 successful European greeting hours connected Wednesday aft dropping to nether $33,500 connected Monday, a determination that caused the majors to autumn arsenic overmuch arsenic 25% astatine the time. The marketplace has since recovered, with bitcoin, Solana (SOL) and ether rebounding to past week’s terms levels.

Tokens of immoderate furniture 1 blockchains led gains extracurricular of the apical 10 cryptocurrencies by marketplace capitalization. Polygon (MATIC) and Near (NEAR) person surged implicit 11% successful 24 hours arsenic capitalist request rebounded aft Monday’s drop.

Prices of MATIC were buoyed by the appointment of ex-Youtube gaming caput Ryan Wyatt arsenic CEO of Polygon Studios, a improvement laboratory that supports the instauration of blockchain games and non-fungible tokens connected the Polygon network. Wyatt antecedently led YouTube's virtual- and augmented-reality projects and is expected to operation partnerships and investments successful the Polygon ecosystem.

MATIC deed absorption astatine $1.60 aft a surge successful the past 24 hours. (TradingView)

Some traders said a correlation betwixt crypto prices and risky assets specified arsenic exertion stocks exists arsenic they stock a akin acceptable of investors.

“Crypto is owned by the aforesaid radical that ain maturation stocks," Haseeb Qureshi, laminitis of crypto concern money Dragonfly Capital, said successful a telephone interview. "When they commencement cutting risk, they chopped backmost connected crypto. That’s however the correlation is built.”

Cause for interest whitethorn beryllium abbreviated lived. “[There are] tons of reasons to judge that the secular macro complaint of involvement is inactive low. Interest rates are debased due to the fact that of incremental exertion growth. Crypto is 1 of the fewer things that radical recognize has wide maturation potential,” Qureshi said.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)