Declining sentiment for cryptocurrencies stemming from a mediocre economical outlook successful broader markets led to a market-wide diminution connected Tuesday that caused hundreds of millions of dollars successful losses for traders betting connected higher prices, information show.

Bitcoin (BTC) mislaid enactment astatine the pivotal $40,000 level connected Tuesday evening, dropping to arsenic debased arsenic $38,121 connected Wednesday greeting earlier a nominal summation successful Asian hours. Ether (ETH) mislaid the $3,000 level to arsenic overmuch arsenic $2,781.

Bitcoin slid beneath a pivotal enactment level, but recovered successful Asian hours connected Wednesday. (TradingView)

A autumn successful bitcoin and ether led to steep declines successful different large assets. In the past 24 hours, tokens of dogecoin (DOGE) fell 10% aft a two-day run, portion Terra’s LUNA dropped 7.2%. BNB Chain’s BNB and Solana’s SOL emerged arsenic outperformers, falling conscionable 2% arsenic different assets fell astatine slightest 4%.

Some $281 cardinal worthy of “longs” were mislaid to liquidations connected crypto-tracked futures, representing 81% of each futures trades successful the past 24 hours. Liquidations successful the crypto marketplace hap erstwhile a trader has insufficient funds to money a borderline telephone – oregon a telephone for other collateral demanded by the speech to support the trading presumption funded.

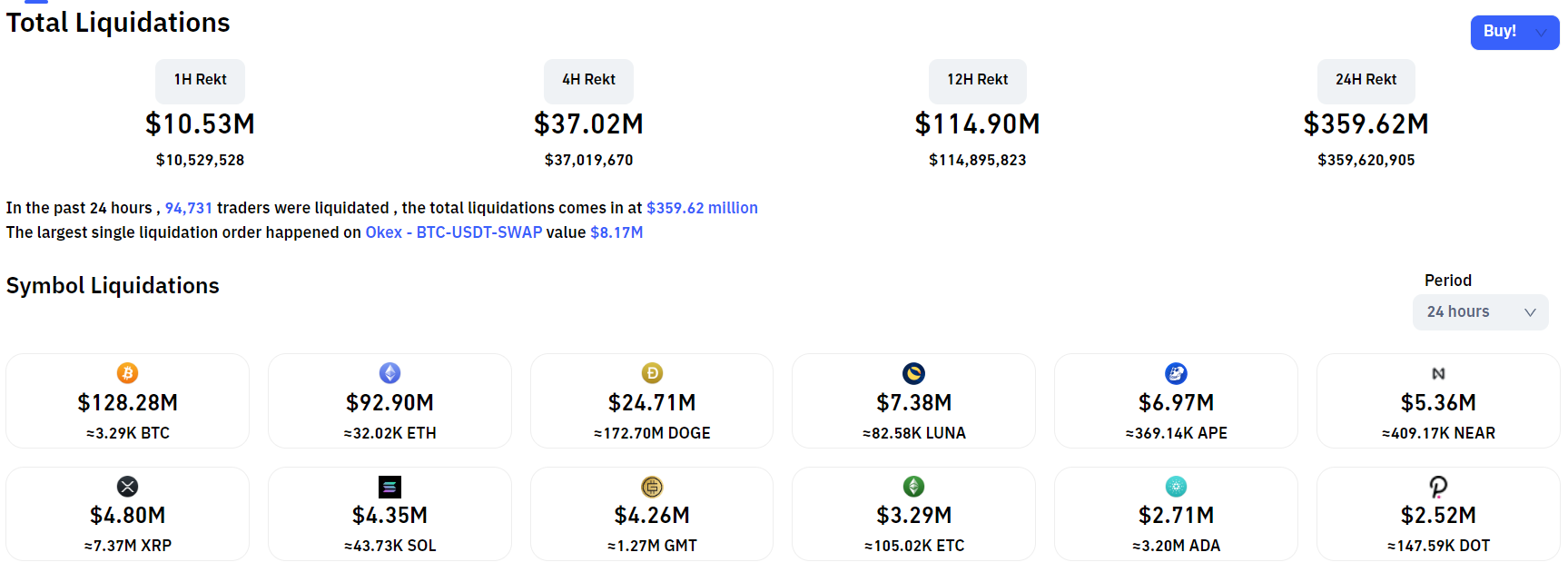

Crypto markets saw implicit $350 cardinal successful losses to liquidations implicit the past 24 hours. (Coinglass)

Overall liquidations successful the crypto marketplace exceeded $350 million, the third-largest level successful April. Over $128 cardinal of these arose from bitcoin-tracked futures, portion $92 cardinal arose from ether futures. Futures tracking dogecoin mislaid $24 million, akin to Tuesday’s losses.

Troubles successful Asia and U.S. causing diminution successful crypto sentiment

The market-wide diminution successful cryptocurrencies connected Tuesday arose amid falling optimism successful broader markets.

China continued to conflict coronavirus outbreaks, starring to a autumn successful Asian markets, portion the U.S. Federal Reserve inched person to a key gathering adjacent week, 1 that is expected to bring distant a large involvement complaint hike to tighten monetary argumentation successful the country.

Russian troubles roiled equities successful Europe. Reports suggest the state whitethorn chopped state supplies to the region, which whitethorn choke maturation and stifle section economies. Russia has already chopped disconnected supply to Poland and Bulgaria, starring to a surge successful European state prices.

Sentiment, however, seemed to stabilize connected Wednesday. Equities indices successful Europe were up since open, with Stoxx 600 and Germany’s DAX rising 0.29%. Futures connected U.S. indices for S&P500 and Nasdaq roseate 1%, portion Shanghai Composite gained 2.5% arsenic China vowed much infrastructure projects to bolster the section economy.

A alleviation successful Asian and European markets saw bitcoin somewhat retrieve astatine penning time, adding $500 since Asian greeting hours connected Wednesday. But failing to regain the $40,000 level could beryllium bearish for bitcoin arsenic per immoderate analysts.

“Bitcoin has abruptly fallen beneath a captious enactment line, a bearish signal,” shared Alex Kuptsikevich, the elder fiscal expert astatine FxPro, successful an email to CoinDesk. “At the aforesaid time, the uptrend breakdown failed to beryllium confirmed by buying adjacent erstwhile section lows.”

However, Kuptsikevich noted organization investors withdrew considerably little superior from crypto exchanges compared to the erstwhile week, citing CoinShares data. “The nett outflow of funds past week was $7.2 million, though it was down from the erstwhile 2 weeks erstwhile investors withdrew much than $231 million,” helium stated.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)