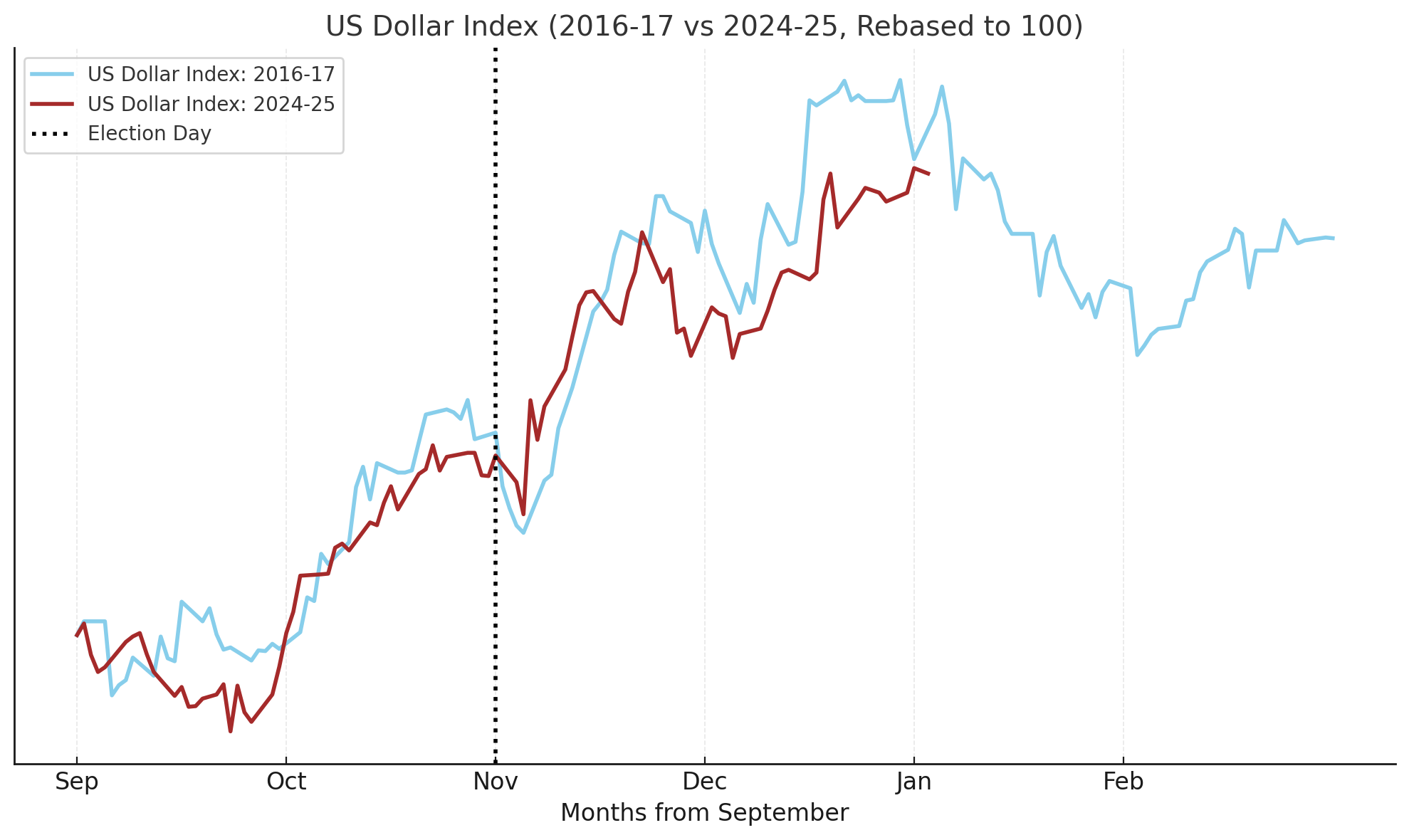

Since U.S. President-elect Donald Trump's convincing predetermination triumph 2 months ago, the dollar has strengthened much than 3% against its peers, matching its trajectory aft his erstwhile triumph successful 2016.

Last clip circular the DXY Index, which measures the currency's worth against a handbasket of the U.S.' large trading partners, peaked successful December earlier trailing disconnected for the adjacent 12 months, coinciding with bitcoin's (BTC) 2017 bull run.

It's imaginable the communicative volition beryllium antithetic this clip around. The scale has not shown signs of tailing off, and Trump's economical policies and the Federal Reserve's actions are apt to underpin the greenback's rally.

Yet, portion a beardown dollar is considered antagonistic for hazard assets, the incoming president has expressed his enactment for bitcoin and the largest cryptocurrency has changeable up since his election. That rally, which saw it touching aggregate grounds highs, whitethorn not proceed astatine rather the aforesaid pace, according to Andre Dragosch, Bitwise's caput of probe successful Europe. BTC is presently priced astir 10% beneath the grounds of astir $108,300 it deed successful mid-December.

"The Fed is stuck betwixt a stone and a hard spot astatine the moment," Dragosch said successful an interrogation implicit X. "Either hazard a U.S. recession by doing excessively little, excessively precocious oregon hazard a important acceleration successful ostentation again."

Trump has vowed to enforce tariffs connected large trading partners, which has the imaginable to exacerbate planetary geopolitical uncertainty, fueling further request for the dollar, which is perceived arsenic a haven during times of unrest.

We are besides seeing beardown economical show from the U.S. compared with different markets, with implicit 3% maturation successful gross home merchandise (GDP) and higher-than-targeted inflation, which keeps national funds rates elevated and lone 2 interest-rate cuts forecast for 2025.

The Fed has "communicated to markets that they volition bash lone 2 cuts successful 2025 - importantly little than antecedently anticipated," Dragosch said. "That’s wherefore the dollar has been appreciating, and yields person continued to determination up. I deliberation that’s what’s been weighing connected BTC arsenic well. Macro is simply a headwind close now."

8 months ago

8 months ago

English (US)

English (US)