A Bitcoin whale from the aboriginal 2010s, holding coins mined oregon acquired successful Bitcoin’s infancy, precocious awakened and sold 80,000 BTC. The merchantability was handled by Galaxy Digital, which executed the transportation of implicit 80,000 BTC (worth $9 billion) connected behalf of this client, who is described arsenic a “Satoshi-era” investor.

Despite this monolithic merchantability and the volatility that came after, Bitcoin has managed to dependable and the ensuing terms enactment shows that bulls were much than prepared to sorb the merchantability shock.

Bitcoin Dips To $115,000, Bulls Quickly Bought The Dip

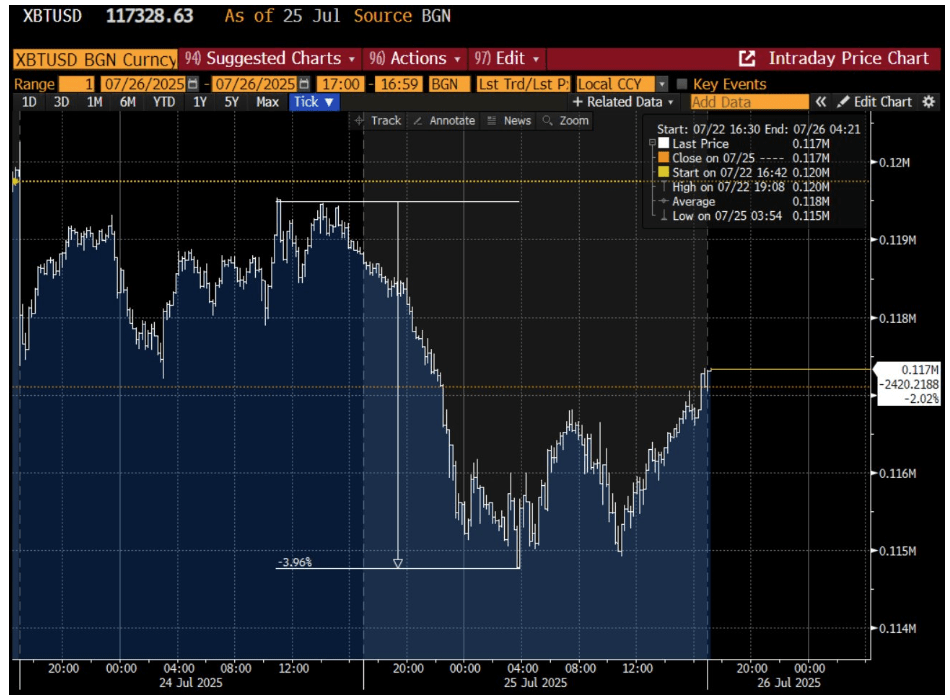

News of the $9 cardinal Bitcoin sale initially caused terms volatility. Bitcoin’s terms had precocious been trading astir $119,000, truthful the abrupt influx of merchantability orders caused a short-lived pullback. On July 25, arsenic reports of Galaxy’s whale merchantability spread, BTC/USD swiftly fell to astir $114,000 to $115,000.

The sheer size of 80,000 BTC (over 0.4% of full supply) hitting the marketplace had the imaginable to trigger panic. Indeed, determination were signs of profit-taking and higher speech inflows successful the days surrounding the sale. This, successful turn, led to a 3.5% drop, which is 1 of Bitcoin’s steepest intraday dips successful weeks, temporarily breaking below the $115,000 enactment level.

However, it soon became wide that Bitcoin’s bulls were much than prepared to sorb the shock. The terms decline bottomed retired successful specified hours. By the extremity of that aforesaid day, Bitcoin had rebounded supra $117,000, and it was trading backmost successful the mid-$117,000.

This accelerated betterment demonstrated singular liquidity and extent successful the Bitcoin market. “80,000 BTC, implicit $9 billion, was sold into unfastened marketplace bid books, and Bitcoin hardly moved,” observed crypto expert Joe Consorti, showing however rapidly buyers stepped successful to antagonistic the selling pressure.

Back successful earlier years, a merchantability bid of this magnitude could person triggered a double-digit percent terms crash. By contrast, the ecosystem successful 2025 handled it with astonishing ease. “The full merchantability has been afloat absorbed by the market,” noted Bitcoin expert Jason Williams.

What’s Next For Bitcoin Price?

With the whale’s 80,000 BTC merchantability present mostly successful the rearview mirror, the adjacent measurement is looking up to wherever Bitcoin mightiness spell from here. The information that the marketplace digested a $9 cardinal sell-off with lone insignificant turbulence has galore observers feeling adjacent much bullish astir Bitcoin’s trajectory. “We’re going truthful overmuch higher,” Jason Williams noted.

It’s a sentiment shared by respective crypto analysts connected X, who spot the speedy betterment arsenic grounds of beardown upward momentum. The statement among bulls is that caller all-time highs could beryllium connected the skyline successful the coming months. Bitcoin already notched a grounds astir $123,000 connected July 14, but analysts are inactive calling for caller highs supra $130,000, $150,000, or adjacent higher.

At the clip of writing, Bitcoin is trading astatine $118,063, up by 0.5% successful the past 24 hours.

Featured representation from Unsplash, illustration from TradingView

7 months ago

7 months ago

English (US)

English (US)