The European Central Bank (ECB) is laying the groundwork for the probable motorboat of its wholesale and retail cardinal slope integer currency (CBDC), the Digital Euro. Christine Lagarde, President of the ECB, shared this update astatine their latest property conference. “President Lagarde stressed that the integer euro is ‘more applicable than ever,'” the ECB tweeted.

Lagarde emphasized that the Digital Euro, the EU’s CBDC solution, is acceptable to motorboat successful October 2025—provided it passes the legislative signifier involving cardinal stakeholders, including the European Commission, Parliament, and Council. Notably absent from this process is the European public, contempt the important interaction this inaugural volition person connected their regular lives.

🇪🇺 CBDC successful EU volition motorboat successful Oct. 2025.

Wholesale & retail.

🇮🇱 Israel is pursuing EU’s footsteps – preparing for CBDC with a caller 110 leafage plan document. pic.twitter.com/fUr1CkBRmy

Why Is the Digital Euro More Relevant Than Ever?

Could it beryllium linked to Ursula von der Leyen’s caller “ReArm Europe” announcement, which proposes the instauration of an EU army? This inaugural requires an estimated €800 cardinal successful funding—money the EU does not have. The options? Extracting it from EU subordinate states and their citizens oregon printing caller funds via the ECB. Either way, it’s clip to lukewarm up the ECB’s wealth printers!

We are surviving successful unsafe times.

Europe‘s information is threatened successful a precise existent way.

Today I contiguous ReArm Europe.

A program for a safer and much resilient Europe ↓ https://t.co/CYTytB5ZMk

Furthermore, The EU has introduced the “Savings and Investments Union”, aiming to redirect €10 trillion successful “unused savings” from citizens to concern subject maturation and bolster Europe’s defence industry. “We’ll crook backstage savings into much-needed investment,” tweeted von der Leyen. If this hasn’t shocked you already, I’ll effort to clarify: This is simply a wide usurpation of backstage spot rights, and an implicit confiscation of Europeans’ wealth, portion bluntly utilizing their funds arsenic the EU sees fit, including backing of a subject concern complex, without adjacent asking them.

If the EU is accelerating toward totalitarian collectivism, arsenic this connection suggests, past a CBDC would beryllium a almighty tool—enabling tighter power implicit Europeans’ wealth with features similar an “on/off” power and programming abilities.

If astir of your wealth is inactive successful fiat the slope / stocks / mortgaged existent property etc. – they don’t request your permission.

They privation you owning nothing, despaired & numb.

You whitethorn privation to see a permissionless, unconfiscatable, easy mobile & liquid integer plus specified as… pic.twitter.com/K2xjTpcyS7

Christine Lagarde precocious campaigned astatine the European Parliament, arguing that the Digital Euro is indispensable to trim the EU’s dependence connected overseas outgo solutions. European banks indispensable innovate outgo methods, but the EU’s superior interest isn’t conscionable reliance connected tech giants similar Google Pay oregon Apple Pay—it’s the imaginable for wide adoption of decentralized planetary protocols similar Bitcoin.

The ECB is observing geopolitical trends, noting that the U.S. is embracing crypto, Bitcoin, and stablecoins—technologies that airs a hazard to centralized control. Unsurprisingly, they are choosing a antithetic path. According to Reuters, “Eurozone banks request a integer euro to respond to U.S. President Donald Trump’s propulsion to beforehand stablecoins” arsenic portion of a broader crypto strategy. ECB committee subordinate Piero Cipollone reinforced this stance, stating, “This solution further disintermediates banks arsenic they suffer fees, they suffer clients… That’s wherefore we request a integer euro.”

Bottom line, Lagarde’s and Von der Leyen’s caller agendas are aimed to thrust much centralised power portion strengthening the EU hierarchy, governance and inducement operation – that has ever been their role.

New Digital Euro CBDC Survey

The ECB precocious published findings from a survey connected user attitudes toward retail CBDC, conducted among 19,000 Europeans crossed 11 Eurozone countries. Key takeaways include:

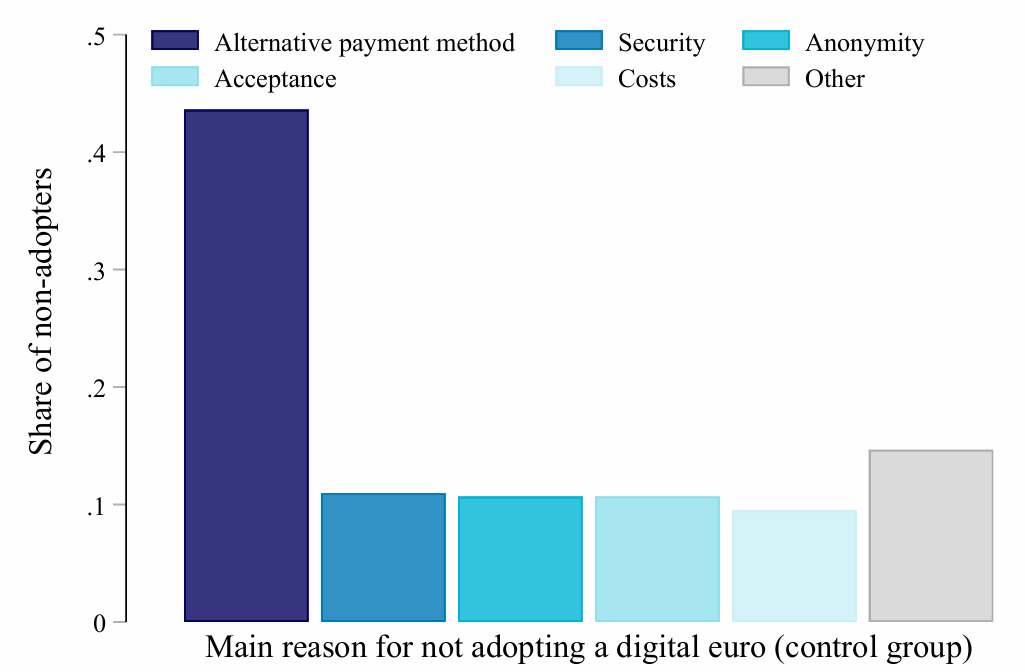

1) Lack of Interest – Most Europeans are not funny successful the Digital Euro, arsenic existing outgo methods already service their needs well.

Why would you not follow the integer euro? source: European Central Bank

Why would you not follow the integer euro? source: European Central Bank2) Europeans are Open to Propaganda – While nationalist involvement is low, the survey recovered that Europeans are receptive to video-based acquisition and training. The ECB’s survey suggests that CBDC-related videos could thrust wide adoption by reshaping user beliefs. The study states: “Consumers who are shown a abbreviated video providing concise and wide connection astir the cardinal features of the integer euro are substantially much apt to update their beliefs… which increases their contiguous likelihood of adopting it.” No wonderment the ECB has ramped up its integer euro video contented since precocious 2024. For example:

3) Preference for Existing Payment Methods – “Europeans person a beardown penchant for existing outgo methods and spot nary existent payment successful a caller benignant of outgo system”. While this uncovering sounds similar a affirmative pushback, it tin service arsenic a precursor to a maneuver of technological integrations. “If you can’t bushed them, articulation them” maneuver – likewise to the Chinese e-CNY retail CBDC.

A caller Euromoney article highlighted e-CNY’s integration with China’s astir fashionable apps (DiDi, Meituan, Ctrip, WeChat Pay, and Alipay), a determination that facilitated its wide adoption. Despite aboriginal struggles, e-CNY present boasts 180 cardinal idiosyncratic wallet users and a cumulative transaction worth of $1 trillion. I precocious explored this taxable successful extent with Roger Huang precocious connected my podcast.

Not Just Retail—Wholesale Too

On the wholesale CBDC front, the EU is experimenting with distributed ledger exertion (DLT) to interconnect fiscal institutions crossed Europe and beyond. This follows exploratory enactment conducted by the Eurosystem betwixt May and November 2024. Their trials progressive 64 participants—including cardinal banks, fiscal marketplace players, and DLT level operators—conducting implicit 50 experiments.

Lagarde insists that the Digital Euro is simply a signifier of cash, gaslighting and misleading uninformed Europeans astir the risks of CBDCs. Permission-based CBDCs specified arsenic the Digital Euro are prone to micro levels of power done expiry dates, geofencing and programmability. If Europeans don’t admit these dangers, they won’t defy the Digital Euro. By framing it arsenic “digital cash,” the ECB ensures smoother nationalist acceptance with small to nary nationalist fuss.

[2025] Europeans!

Are you acceptable for “YOUR Digital Euro”?

Christine Lagarde is prepping you to the adjacent signifier of EU’s CBDC, which is everything *but* a signifier of currency (nice effort though). pic.twitter.com/t6mG5liw26

To beryllium clear, currency itself is fiat currency—centrally controlled, easy debased, and prone to inflation. Every clip the issuer expands the wealth supply, citizens endure from declining purchasing power, fundamentally being robbed by the state.

“Rules for Thee, But Not for Me”

While mean citizens are bound by the regularisation of law, elites often evade consequences. A premier illustration is Christine Lagarde, who was recovered blameworthy of negligence for approving a monolithic taxpayer-funded payout to arguable French businessman Bernard Tapie. However, she avoided a jailhouse sentence. The Guardian reported successful 2016: “A French tribunal convicted the caput of the International Monetary Fund and erstwhile authorities minister, who had faced a €15,000 good and up to a twelvemonth successful prison. But it decided she should not beryllium punished, and that the condemnation would not represent a transgression record. … The IMF gave her its afloat support.”

My Prediction for the EU’s CBDC

Despite nationalist disinterest, the ECB (and different cardinal banks) volition propulsion guardant with their CBDCs. To support the illusion of nationalist involvement, they volition behaviour surveys and make engagement tools. But ultimately, the Digital Euro volition beryllium integrated into existing outgo methods and user apps—just arsenic China did with e-CNY. This strategy volition thrust adoption adjacent without nonstop nationalist enthusiasm.

We are, aft all, playing the crippled of “democracy,” right?

Geopolitical expert Alex Krainer precocious tweeted successful effect to Lagarde and von der Leyen’s acceleration of CBDC efforts: “This is fantabulous news; Christine Lagarde and Ursula von der Leyen ne'er took connected thing they didn’t wholly messiness up. I anticipation they’ll proceed with their fantabulous performance. Godspeed.”

This is fantabulous news; Christine Lagarde and Ursula von der Leyen ne'er took connected thing they didn't wholly messiness up. I anticipation they'll proceed with their fantabulous performance. Godspeed. https://t.co/vZPmWMS80m

— Alex (Sasha) Krainer (@NakedHedgie) March 15, 2025Stay tuned arsenic I proceed to way cardinal banks’ moves toward CBDC implementation.

This is simply a impermanent station by Efrat Fenigson. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

8 months ago

8 months ago

English (US)

English (US)