The beneath is from a caller variation of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

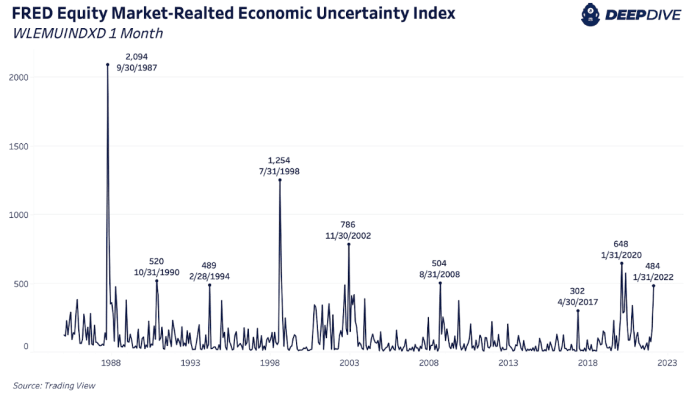

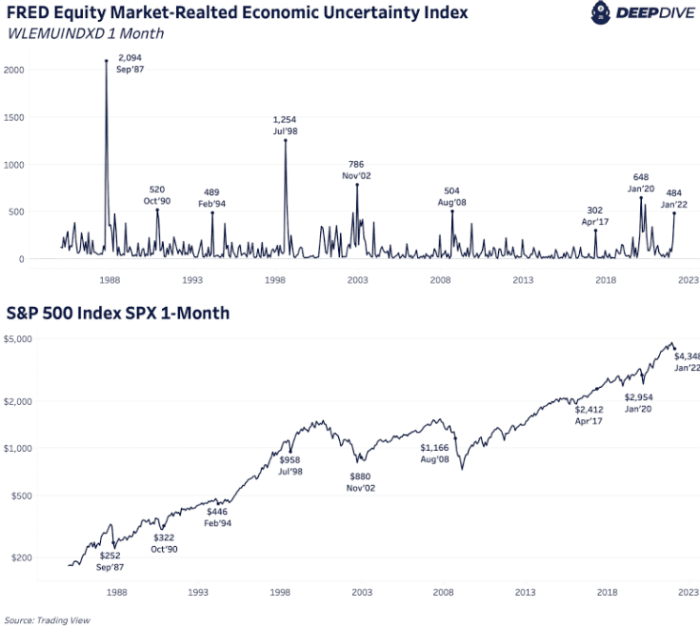

The FRED Equity-Related Economic Uncertainty Index reached its sixth-highest speechmaking ever today, arsenic liquidity continues to adust up for hazard assets. Spikes successful this scale typically coincide with important drawdown periods successful the S&P 500 Index.

FRED equity market-related economical uncertainty demonstrates cardinal macroeconomic issues and yet impacts the bitcoin price.

As ostentation has reached 40-year highs successful the U.S. (as good arsenic precocious readings passim the remainder of the world), investment-grade bonds fundamentally ceased to beryllium with nominal yields acold beneath the ostentation complaint without accounting for recognition (default) hazard whatsoever.

We person continued to authorities successful The Deep Dive that bitcoin’s monetary contention isn’t conscionable gold, but alternatively the monetary premium that has nestled itself into planetary enslaved and adjacent equity markets amidst the everything bubble.

The Everything Bubble

We proceed to usage the word “Everything Bubble” successful The Deep Dive to framework the authorities of the planetary monetary system, but what bash we really mean?

The Federal Reserve Board, and its actions arsenic “lender of past resort” for the U.S. dollar (with the dollar serving arsenic the satellite reserve currency) person acted arsenic a volatility suppression strategy for decades.

Most notably starting with Alan Greenspan and the “Greenspan put” (later to beryllium known arsenic the Fed put), fiscal markets came to larn that the Fed would prevention the time by bailing retired recognition markets and keeping the casual wealth flowing. Now successful 2022, with the Fed’s money complaint inactive astatine the zero little bound, the Fed has go a governmental liability, and is caught underprepared attempting to tighten arsenic liquidity crossed fiscal markets is pulling back.

In The Daily Dive #142 we discussed the implications of the existent recognition marketplace sell-off:

“The consequences of the falling prices successful indebtedness instruments is higher financing costs successful the broader economy, arsenic a forty-year precocious successful the user terms scale on with a somewhat hawkish Federal Reserve Board has lenders looking for higher yields.

“What should beryllium watched going guardant is however recognition markets trade, arsenic this has a nonstop interaction connected equity markets from a firm financing position but besides a marketplace valuation perspective.

“This is thing we volition support a precise adjacent oculus connected implicit the coming months, into a imaginable Fed complaint hike cycle.”

3 years ago

3 years ago

English (US)

English (US)