Nothing shines a airy connected the value of vigor arsenic overmuch arsenic a fast-approaching winter. When the somesthesia drops, the scarcity of vigor becomes evident and planetary efforts to sphere it begin.

This year, the combat for vigor is much assertive than it’s ever been.

The fiscal and monetary policies acceptable successful spot during the COVID-19 pandemic caused unsafe ostentation successful astir each state successful the world. The quantitative easing that acceptable retired to curb the consequences of the pandemic resulted successful a historically unprecedented increase successful the M2 wealth supply. This determination diluted the purchasing powerfulness and led to an summation successful vigor prices, sparking a situation that is acceptable to culminate this winter.

CryptoSlate investigation showed that the E.U. volition astir apt beryllium the 1 deed the hardest by the vigor crisis.

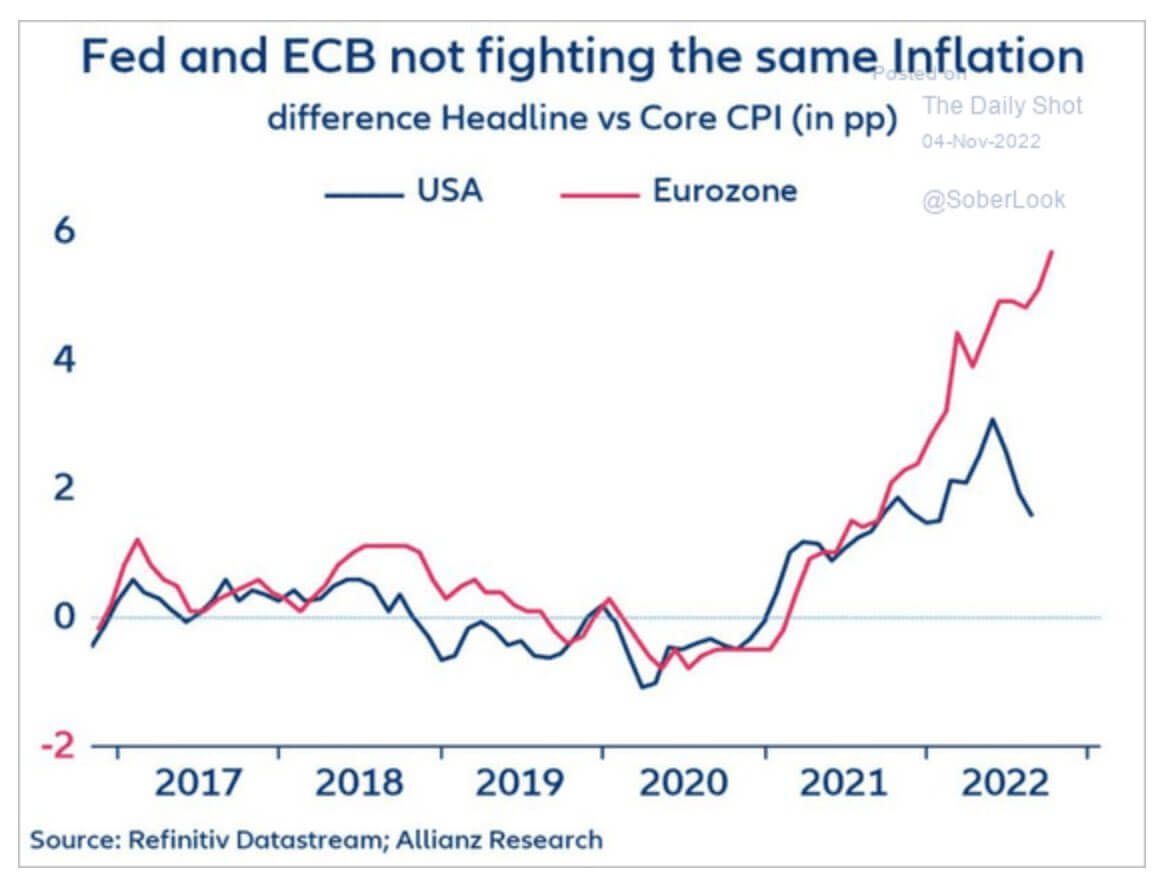

The European Central Bank (ECB) has been struggling to support halfway ostentation down this year. The Core Consumer Price Index (CPI) began to summation substantially successful 2021 owed to the pandemic some successful the U.S. and the E.U.

The U.S. has seen its Core CPI alteration sharply since its culmination successful February and posted better-than-expected results past month. However, Core CPI successful the Eurozone has continued to summation passim the twelvemonth and presently shows nary motion of stopping.

Graph showing the Core CPI successful the U.S. and the Eurozone from 2017 to 2022 (Source: The Daily Shot)

Graph showing the Core CPI successful the U.S. and the Eurozone from 2017 to 2022 (Source: The Daily Shot)A akin summation successful Core CPI tin besides beryllium seen successful Japan and the U.K. One of the factors that whitethorn person contributed to their monetary instability is simply a deficiency of concern and enactment for commodities similar lipid and gas. Widespread efforts to power to renewable sources of vigor led to a alteration successful lipid and state purchases successful the E.U. and the U.K.

In contrast, the U.S. and Russia person been investing heavy successful lipid and state and promoting innovation successful the field.

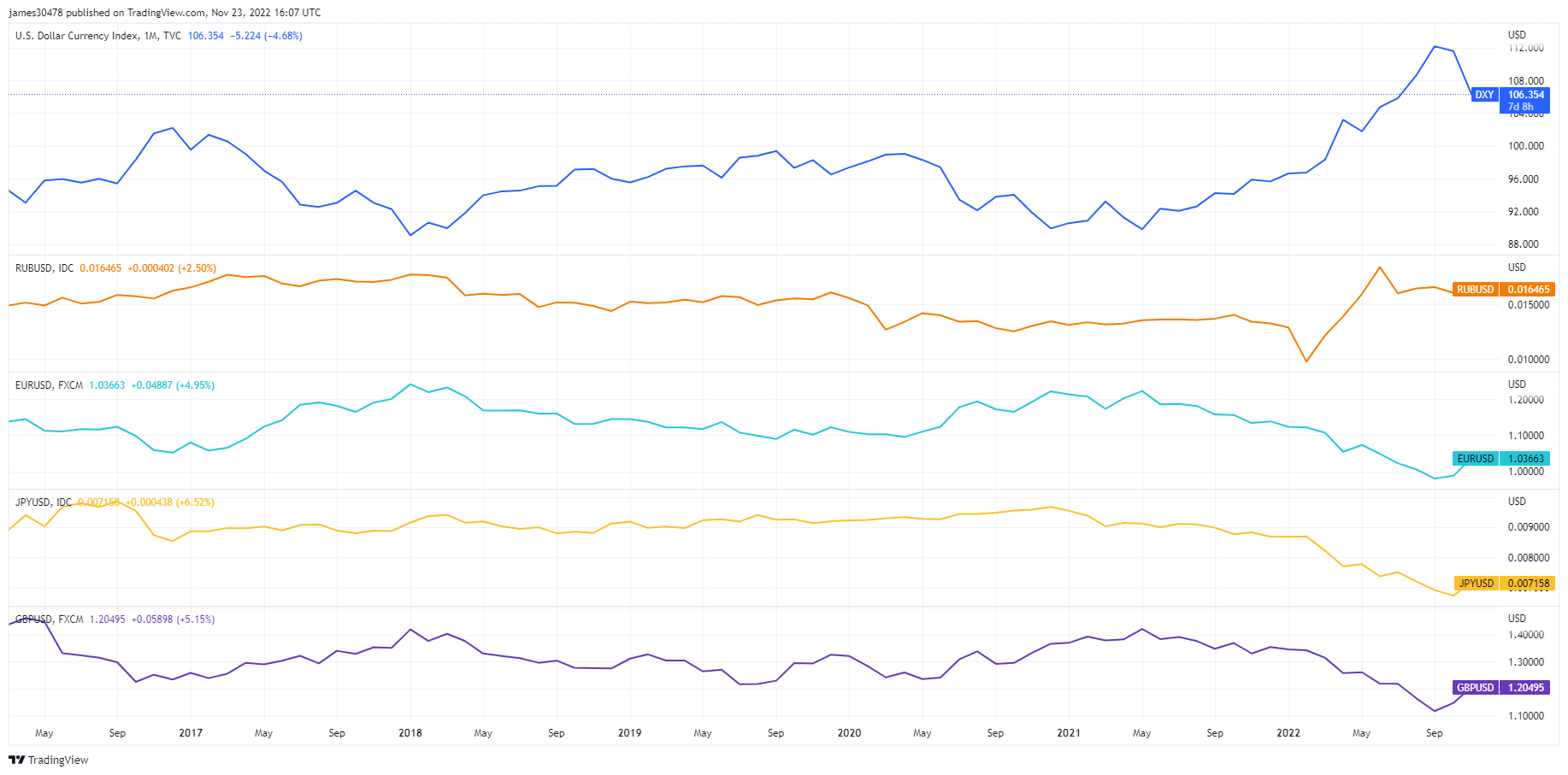

Looking astatine the worth of fiat currencies against the U.S. dollar further confirms this impact.

The Russian Ruble and the DXY person some accrued successful worth successful the past 2 years, portion the euro, British Pound, and Japanese Yen person each seen their Dollar worth decrease.

Graph showing DXY, GBP, EUR, JPY, and RUB and their worth against the U.S. dollar (Source: TradingView)

Graph showing DXY, GBP, EUR, JPY, and RUB and their worth against the U.S. dollar (Source: TradingView)With rising ostentation and a earnestly weakened currency, the E.U. volition person a hard clip competing for lipid and state connected the planetary market. Natural state producers warned that astir each semipermanent contracts for earthy state coming retired of the U.S. person been sold retired until 2026. Until then, erstwhile a caller question of earthy state proviso is expected to come, the E.U. volition person to vie with Asia for the constricted proviso and swallow the precocious state price.

All of this uncertainty could person a affirmative effect connected Bitcoin. While the broader crypto marketplace struggles to stay afloat aft the FTX fallout, Bitcoin has positioned itself arsenic a pillar of stableness successful a marketplace plagued with atrocious actors. Devalued fiat currencies could propulsion retail investors distant from safe-haven assets similar golden and commodities and towards an plus similar Bitcoin.

The station Energy is the maestro assets but it could beryllium Bitcoin that reigns supreme appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)