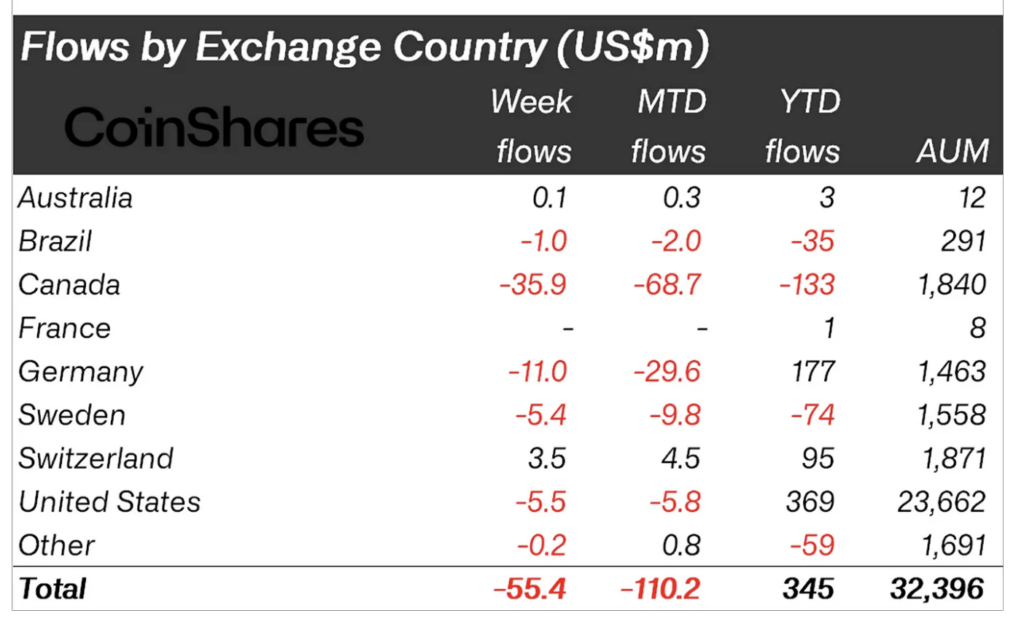

Digital plus concern products experienced a important outflow of funds this week, totaling $55 million, according to the play report by CoinShares.

Analysts, including James Butterfill, believe the market’s absorption is owed to the disappointment from caller media reports indicating a hold by the US Securities & Exchange Commission successful approving a US spot-based ETF.

Bitcoin, the starring integer asset, reversed the erstwhile week’s inflows, signaling outflows of $42 million. At the aforesaid time, short-Bitcoin positions saw outflows for astir the 17th week successful a row, but for insignificant inflows totaling $2k. Ethereum followed the Bitcoin trend, experiencing $9 cardinal worthy of outflows.

Altcoins were not spared from this sell-off, with Polygon, Litecoin, and Polkadot seeing respective outflows of $0.9 million, $0.6 million, and $0.5 million. The outflows were wide crossed merchandise providers but chiefly focused connected Canada and Germany, which experienced US$35.9 cardinal and $11 cardinal successful outflows, respectively.

Switzerland and Australia, however, reported insignificant inflows totaling $3.5 cardinal and $0.1 million, respectively.

The figures instrumentality month-to-date outflows to $110 cardinal for August. However, year-to-date numbers amusement $345 cardinal successful inflows.

Source: CoinShares

Source: CoinSharesThe full assets nether absorption (AuM) declined by 10% owed to past week’s panic, settling astatine $32.3 cardinal astatine the week’s end. The study emphasizes that marketplace volumes stay beneath mean owed to seasonal effects, making prices susceptible to ample trades.

The station ETF hold disappointment triggers $55M outflow from integer assets – reports appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)