Ethereum prices are steadfast astatine spot rates, inactive trading supra the $2,000 level, and aggregate different factors constituent to imaginable inclination continuation.

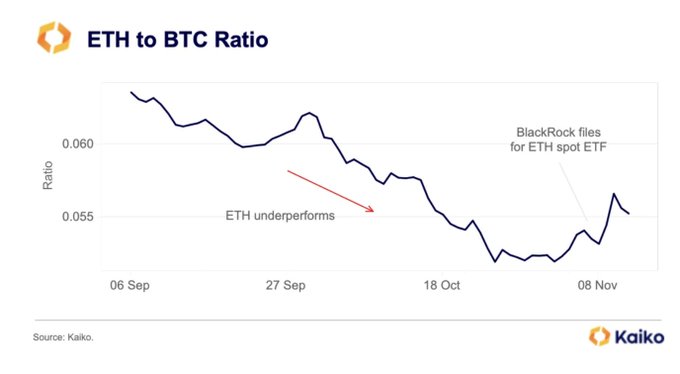

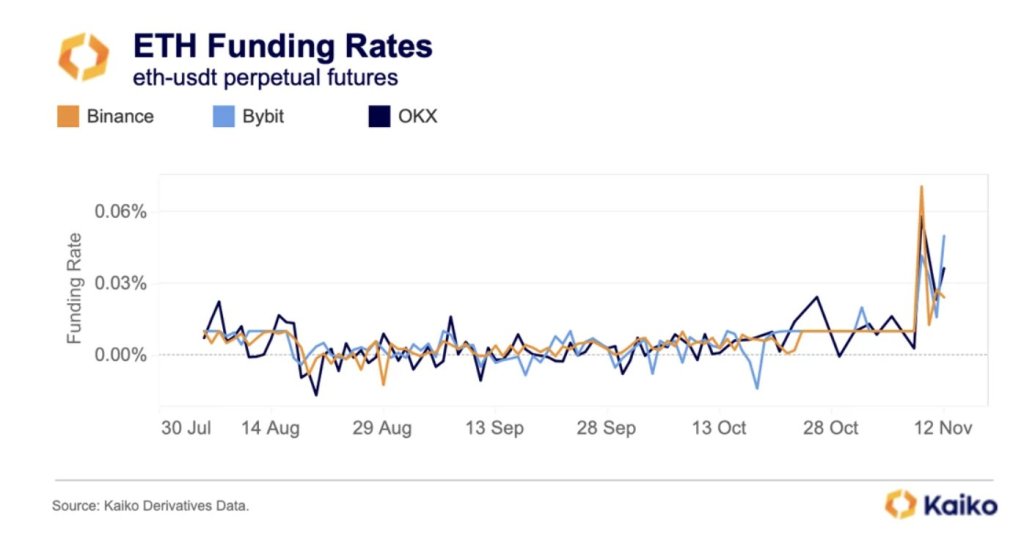

According to Kaiko’s data connected November 12, not lone is the ETH-BTC ratio shifting and reversing aft extended periods of little lows, but besides determination is simply a notable uptick successful trading measurement with backing rates successful crypto derivative platforms shifting from antagonistic to positive, suggesting expanding demand.

ETHBTC ratio | Source: Kaiko

ETHBTC ratio | Source: KaikoEthereum Breakout Above $2,000

As of penning connected November 13, Ethereum is comparatively steadfast and changing hands astatine astir the $2,090 level. Despite the expected contraction successful trading measurement implicit the past mates of days pursuing the rally connected November 9, the uptrend remains successful place.

So far, the contiguous enactment level method analysts are watching stay astatine $2,000, marking July 2023 highs. Conversely, the $2,100 zone, marking the April high, is simply a captious liquidation level that optimistic bulls indispensable interruption for a bargain inclination continuation pattern.

As it is, traders are optimistic. However, whether the uptrend volition proceed depends chiefly connected trader sentiment and if existing cardinal factors mightiness spark much demand, lifting ETH to caller 2023 highs. Thus far, adjacent though the wide ETH enactment basal remains upbeat, the coin, dissimilar Bitcoin (BTC), is struggling to interruption cardinal absorption levels recorded successful H1 2023, which is simply a concern.

ETHBTC Turning Bullish As Funding Rate Flips Positive

On the affirmative side, looking astatine the ETHBTC candlestick statement successful the regular chart, the crisp reversal of ETH fortunes connected November 9 could anchor the adjacent limb up, signaling a caller displacement successful a inclination that favors Ethereum buyers. Looking astatine the ETHBTC formation, Bitcoin bulls person had the precocious manus successful 2023.

Related Reading: XRP Price Path To $1: Exploring Two Potential Outcomes From The $0.66 Resistance Level

To quantify, BTC is up 33% versus ETH, with the climactic sell-off of October 23 pushing BTC to the highest constituent against the 2nd astir invaluable coin successful 2023. However, the crisp betterment connected November 9 and the consequent nonaccomplishment of BTC bulls to reverse losses suggest that ETH has the precocious hand.

Thus far, ETHBTC prices are trending wrong the November 9 bullish engulfing barroom astatine the backmost of airy trading volumes, a nett affirmative for bullish ETH holders.

ETH backing rates affirmative | Source: Kaiko

ETH backing rates affirmative | Source: KaikoFollowing this surge, Kaiko notes that the backing complaint of the ETHUSDT brace is positive, signaling expanding request successful the crypto derivatives scene. When backing rates crook affirmative from negative, it means “long” traders are paying “short” traders to support their positions open. This improvement indicates that much traders are agelong ETH, expecting prices to emergence successful the sessions ahead.

Feature representation from Canva, illustration from TradingView

2 years ago

2 years ago

English (US)

English (US)