Bitcoin (BTC) and Ethereum’s autochthonal token, Ether (ETH) proceed to seach for terms stableness aft trading astatine respective intraday lows of $66,171 and $1,912 connected Thursday.

As this process runs its course, caller investigation from Bloomberg analysts investigates however the spot BTC and ETF holders are faring amid sustained terms weakness and slowing exchange-traded funds (ETFs) inflows.

Key takeaways:

Net worth of the spot Bitcoin ETF assets fell to $85.76 cardinal from $170 cardinal (Oct 2025 peak), with the 2026 nett flows astatine astir -$2 billion.

The spot Ether ETF assets worth dropped to $11.27 cardinal from $30.5 billion, with ETH trading adjacent $2,000 vs. a $3,500 outgo basis.

Only astir 6% of Bitcoin ETF assets exited during the caller downturn, indicating constricted capitulation.

Average outgo ground of US spot ETF deposits. Source: Glassnode

Average outgo ground of US spot ETF deposits. Source: GlassnodeBitcoin, Ether ETF plus values declaration arsenic inflows stall

Bloomberg expert James Seyffart said that the Ether ETF holders are “sitting successful a worse position” than Bitcoin ETF investors. With ETH beneath $2,000, good beneath the estimated $3,500 mean outgo basis, i.e., the mean terms astatine which spot ETF investors accumulated their positions, the drawdown has exceeded 50% astatine its caller debased of $1,736.

By comparison, Bitcoin is presently priced astatine $66,171, besides beneath its estimated $84,063 ETF outgo basis, though the drawdown is notably little astatine 21%.

Ether ETFs outgo ground and ETH price. Source: James Seyffrat/X

Ether ETFs outgo ground and ETH price. Source: James Seyffrat/XSeyffart noted that the full nett inflows into ETH ETFs person declined by lone astir $3 billion, suggesting astir ETH ETFs investors person held their positions during the caller dip.

Assets held successful the spot Bitcoin ETF peaked astatine $170 cardinal successful October 2025 and present basal astatine $85.76 billion. The inflows slowed sharply aft mid-2025, with $13.7 cardinal recorded successful the archetypal fractional of the year, $7.64 cardinal successful the 2nd half, and astir $2 cardinal successful outflows year-to-date. Since July 2025, the cumulative nett flows magnitude to $5.64 billion.

Total Spot BTC ETF nett inflows. Source: SoSoValue

Total Spot BTC ETF nett inflows. Source: SoSoValueLast Thursday, elder Bloomberg ETF expert Eric Balchunas noted that lone astir 6% of full Bitcoin ETF assets exited during the caller selloff. BlackRock’s IBIT has declined to $51 cardinal from $100 cardinal astatine its highest value, but it remains 1 of the fastest ETFs to scope $60 cardinal successful assets.

Related: Bitcoin miner outflows spike successful January, but nationalist income stay limited

Bitcoin ETF flows participate bear-market regime

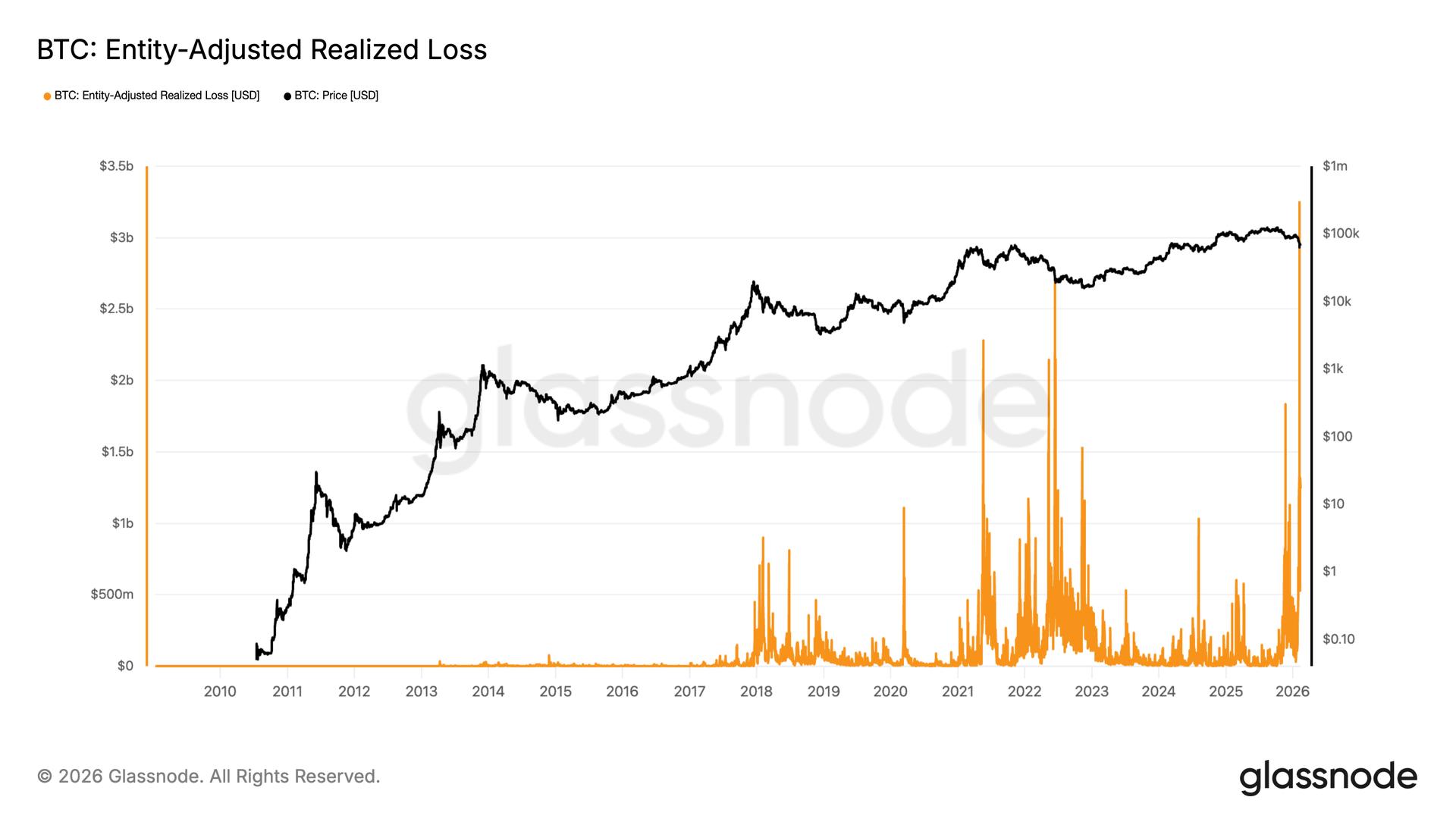

The rolling 30-day Bitcoin ETF flows person turned firmly antagonistic pursuing a failed effort to instrumentality to inflows territory. Excluding a little rebound, this marks the longest agelong of sustained outflows since launch.

30-day rolling BTC ETF netflows. Source: ecoinometrics/X

30-day rolling BTC ETF netflows. Source: ecoinometrics/XGlassnode information besides noted that the 30-day elemental moving mean of nett flows for some Bitcoin and Ether spot ETFs has remained antagonistic for astir of the past 90 days. The information shows nary wide motion of renewed demand.

Macroeconomic newsletter Ecoinometrics said that the complaint of these outflows suggests investors are actively reducing vulnerability alternatively than reacting to short-term volatility.

The newsletter added that the operation of terms weakness and sustained antagonistic flows aligns with a “bear-market regime” alternatively than a impermanent correction.

Related: Bitcoin futures information shows bears gearing up for an battle connected $60K

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision. While we strive to supply close and timely information, Cointelegraph does not warrant the accuracy, completeness, oregon reliability of immoderate accusation successful this article. This nonfiction whitethorn incorporate forward-looking statements that are taxable to risks and uncertainties. Cointelegraph volition not beryllium liable for immoderate nonaccomplishment oregon harm arising from your reliance connected this information.

2 hours ago

2 hours ago

English (US)

English (US)