Key takeaways:

Ether dropped 28% successful a week to $2,110 arsenic investors chopped hazard and markets wiped retired leveraged traders.

Spot ETH ETF outflows reached $447 cardinal arsenic Ethereum web enactment fell by 47%.

Ether (ETH) plummeted to $2,110 connected Tuesday, signaling fragility pursuing a brutal 28% terms correction implicit 7 days. Investors retreated into currency and short-term authorities bonds arsenic the tech-heavy Nasdaq Index besides fell 1.4%.

Traders interest that valuations person go overextended and overly reliant connected the artificial quality sector. Sentiment soured aft Nvidia (NVDA US) CEO Jensen Huang denied plans to invest $100 cardinal successful OpenAI.

Investors braced for further volatility pursuing disappointing quarterly results from fintech elephantine Paypal (PYPL US). Meanwhile, golden prices climbed 6%, and metallic gained 9%, suggesting a deficiency of assurance successful the US Federal Reserve's quality to forestall a recession.

Concerns implicit inflated banal marketplace valuations prompted traders to go progressively risk-averse, causing request for bullish leveraged ETH positions to evaporate.

ETH perpetual futures annualized backing rate. Source: laevitas.ch

ETH perpetual futures annualized backing rate. Source: laevitas.chThe ETH perpetual futures annualized backing rate turned antagonistic connected Tuesday, indicating that shorts (sellers) are paying fees to support their positions. This uncommon displacement reflects a profound deficiency of assurance from longs (buyers).

Market participants are present debating whether this utmost fearfulness presents a strategical introduction point, particularly since ETH has underperformed the broader cryptocurrency marketplace by 10% implicit the past 30 days.

Total crypto capitalization (blue) vs. ETH/USD (orange). Source: Tradingview

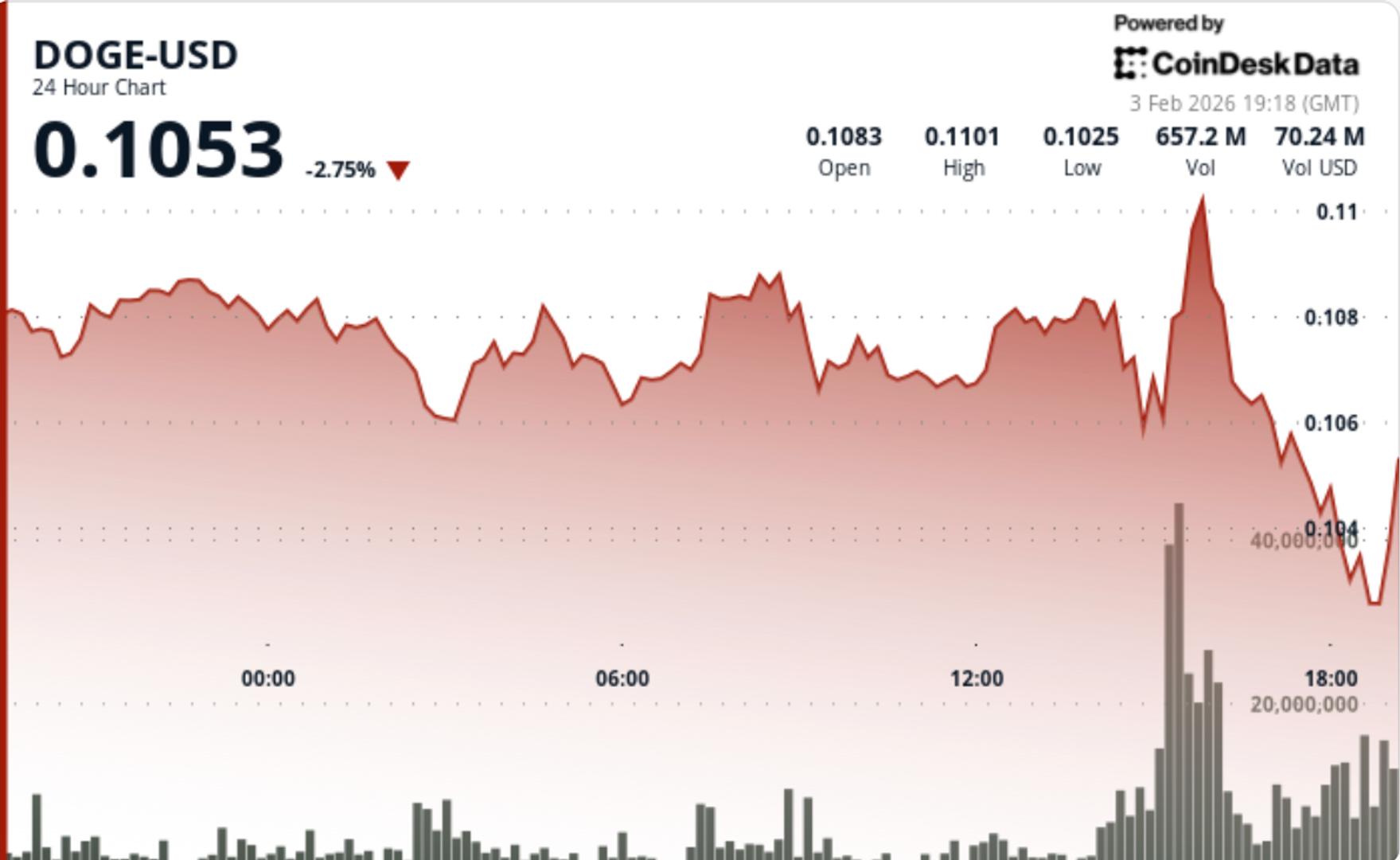

Total crypto capitalization (blue) vs. ETH/USD (orange). Source: TradingviewEther investors grew uneasy arsenic different large cryptocurrencies weathered little terrible corrections implicit the past month; Bitcoin (BTC) dropped 17%, BNB (BNB) fell 14%, and Tron (TRX) declined 4%. Ether’s play descent to $2,110 forced the liquidation of implicit $2 cardinal successful leveraged bullish ETH futures, fueling concerns of further downside arsenic marketplace sentiment turns bearish.

ETH futures 24-hour liquidations, USD. Source: Coinglass

ETH futures 24-hour liquidations, USD. Source: CoinglassEther pressured arsenic exchange-traded funds outflows awesome cooling demand

Ether terms was further burdened by $447 cardinal successful nett outflows from US-listed Ethereum spot exchange-traded funds (ETFs) implicit 5 days. Institutional request has cooled, contempt continued accumulation from firms similar Bitmine Immersion (BMNR US), Sharplink (SBET US), and The Ether Machine (ETHM US). Traders stay wary of imaginable merchantability unit stemming from the $14.4 cardinal held successful aggregate Ethereum ETFs.

As involvement successful decentralized applications (dApps) waned, the appetite for ETH diminished significantly.

Decentralized exchanges' monthly volumes by blockchain, USD. Source: DefiLlama

Decentralized exchanges' monthly volumes by blockchain, USD. Source: DefiLlamaTrading volumes connected Ethereum decentralized exchanges (DEX) reached $52.8 cardinal successful January, a crisp driblet from $98.9 cardinal successful October 2025. This 47% diminution successful enactment reduces incentives for holders; typically, precocious request for blockchain processing triggers the network’s pain mechanism, which shrinks the full ETH supply.

Related: Spot crypto volumes plunge to 2024 lows amid capitalist request weakens

Addresses linked to Ethereum co-founder Vitalik Buterin sold astir $2.3 cardinal successful ETH aft earmarking $45 cardinal for donations toward privateness technologies, unfastened hardware, and unafraid software. Buterin said that a full of 16,384 ETH from his idiosyncratic holdings volition beryllium gradually deployed implicit the coming years.

The existent deficiency of request for bullish ETH perpetual futures should not beryllium viewed arsenic a awesome for a speedy reversal. Onchain metrics proceed to weaken, and wide sentiment remains cautious fixed the prevailing macroeconomic uncertainty.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision. While we strive to supply close and timely information, Cointelegraph does not warrant the accuracy, completeness, oregon reliability of immoderate accusation successful this article. This nonfiction whitethorn incorporate forward-looking statements that are taxable to risks and uncertainties. Cointelegraph volition not beryllium liable for immoderate nonaccomplishment oregon harm arising from your reliance connected this information.

1 hour ago

1 hour ago

English (US)

English (US)