Key takeaways:

Long-term investors person been selling 45,000 ETH daily, expanding sell-side pressure.

Ether’s 50-week EMA and carnivore emblem breakdown people $2,500.

Ether’s (ETH) driblet toward $3,000 connected Friday was preceded by a important magnitude of offloads from semipermanent holders, which immoderate analysts said whitethorn pb to a deeper terms correction.

Long-term holders are offloading

Ether semipermanent holders, entities holding ETH (ETH) for much than 155 days, person intensified their sell-side enactment arsenic the terms dropped beneath cardinal enactment levels.

Analyzing ETH spent measurement by age, utilizing a 90-day moving average, Glassnode analysts said that 45,000 ETH, worthy astir $140 million, is leaving 3–10 twelvemonth holder wallets daily.

Related: Ether’s accidental of turning bullish earlier 2025 ends depends connected 4 captious factors

Glassnode added:

“This marks the highest spending level by seasoned investors since February 2021.”This aligns with a surge successful spot Ethereum exchange-traded funds (ETF) outflows, which further suppresses ETH price. These concern products recorded $259 cardinal successful nett outflows connected Thursday, marking their worst time since Oct. 10, according to data from SoSoValue.

This marked the 4th consecutive time of outflows for the Ethereum ETFs, arsenic the extremity of the 43-day US authorities shutdown failed to reignite capitalist appetite.

A cumulative nett outflow of $1.42 cardinal from Ethereum ETFs since aboriginal November signals strong organization selling pressure, fueling fears of a deeper correction.

Ethereum onchain information signals waning demand

Onchain enactment implicit the past 7 days paints a worrying picture. While Ethereum continues to pb its competitors, securing astir 56% of the market’s full worth locked (TVL), this metric has dropped by 21% implicit the past 30 days, according to DefiLlama.

Even much concerning is the diminution successful web fees, reflecting waning request for blockspace, which reinforces Ether’s terms weakness astir $3,000.

Ethereum’s fees implicit the past 30 days dropped to $27.54 cardinal connected Friday, representing a 42% decrease. Similarly, Solana’s fees declined conscionable 9.8% portion BNB Chain gross dropped by 45%, reinforcing the bearishness successful the market.

This whitethorn proceed to unit Ether’s terms successful the coming weeks, peculiarly erstwhile coupled with rising marketplace fear, which has returned to levels past seen during the sell-off led by President Donald Trump’s tariff announcements successful April.

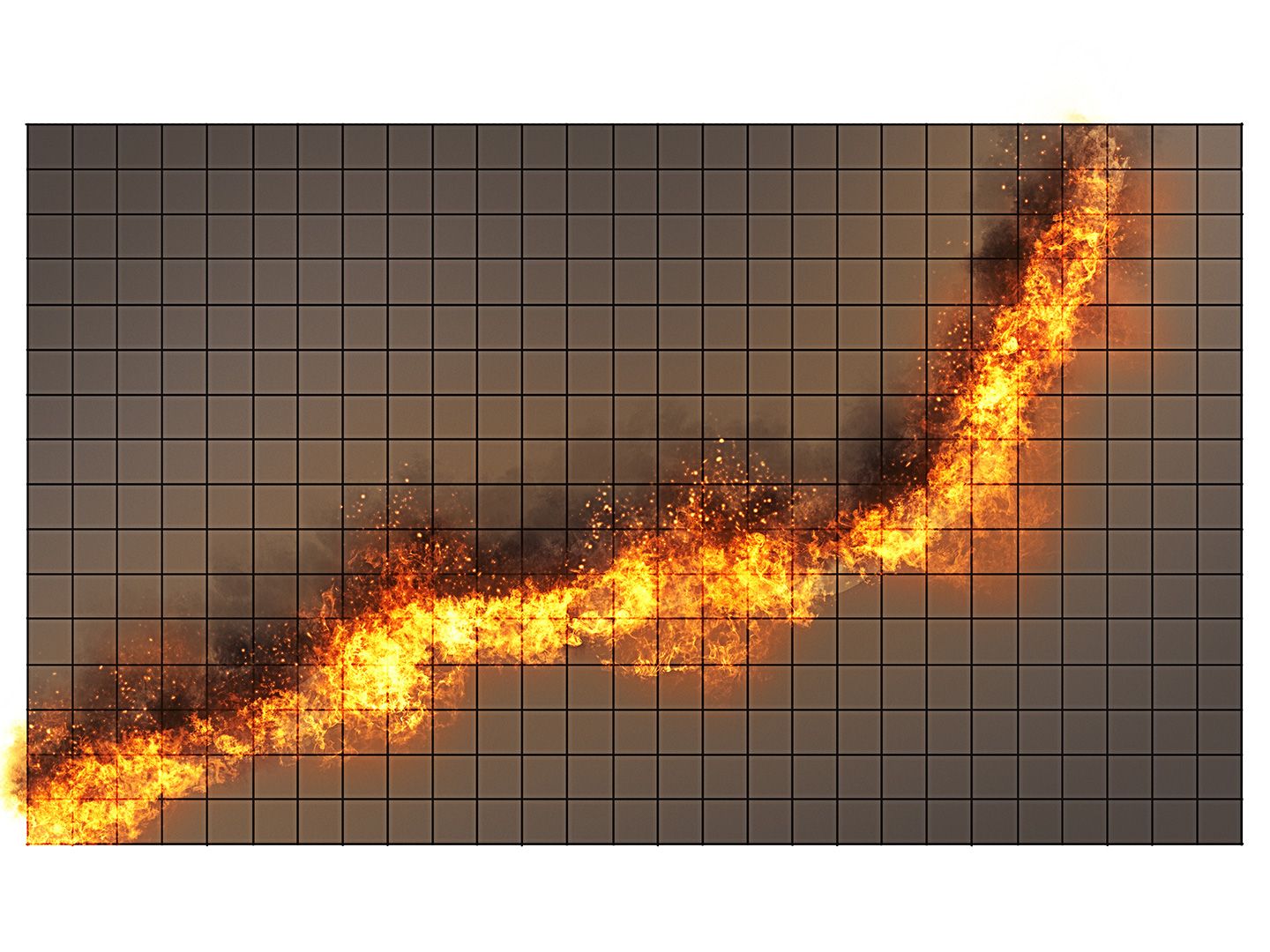

ETH terms carnivore emblem targets $2,500

Many analysts pass that the existent downtrend could accelerate unless a wide bullish displacement occurs, perchance adding unit connected time traders and tiny holders.

“Ethereum loses the 50-week EMA, a cardinal macro support,” said expert Bitcoinsensus successful a Friday X post, referring to the $3,350 level.

Past breakdowns triggered large downside moves, with the past 1 resulting successful a 60% driblet to $1,380 from $3,400 betwixt precocious January and aboriginal April.

Bitcoinsensus added:

“Trend remains bearish unless terms reclaims this level fast.”Ether’s terms enactment successful the regular clip framework has validated a bear flag erstwhile it broke beneath $3,450, coinciding with the 200-day SMA and the little bound of a carnivore flag.

The adjacent large enactment sits astatine the $3,000 intelligence level, which bulls indispensable support aggressively.

Losing this level would wide the mode for a caller downward limb toward the measured people of the signifier astatine $2,280, oregon a 23% driblet from the existent level.

As Cointelegraph reported, $3,000 remains a cardinal enactment portion for the ETH/USD pair, and holding it is important to avoiding further losses.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

1 month ago

1 month ago

English (US)

English (US)