Ether’s proviso connected crypto exchanges has dropped to its lowest level since November 2015, starring immoderate analysts to foretell a large terms rally contempt caller bearish sentiment.

“Ethereum's holders person present brought the disposable proviso connected exchanges down to 8.97M, the lowest magnitude successful astir 10 years (November, 2015),” crypto analytics level Santiment said successful a March 20 X post.

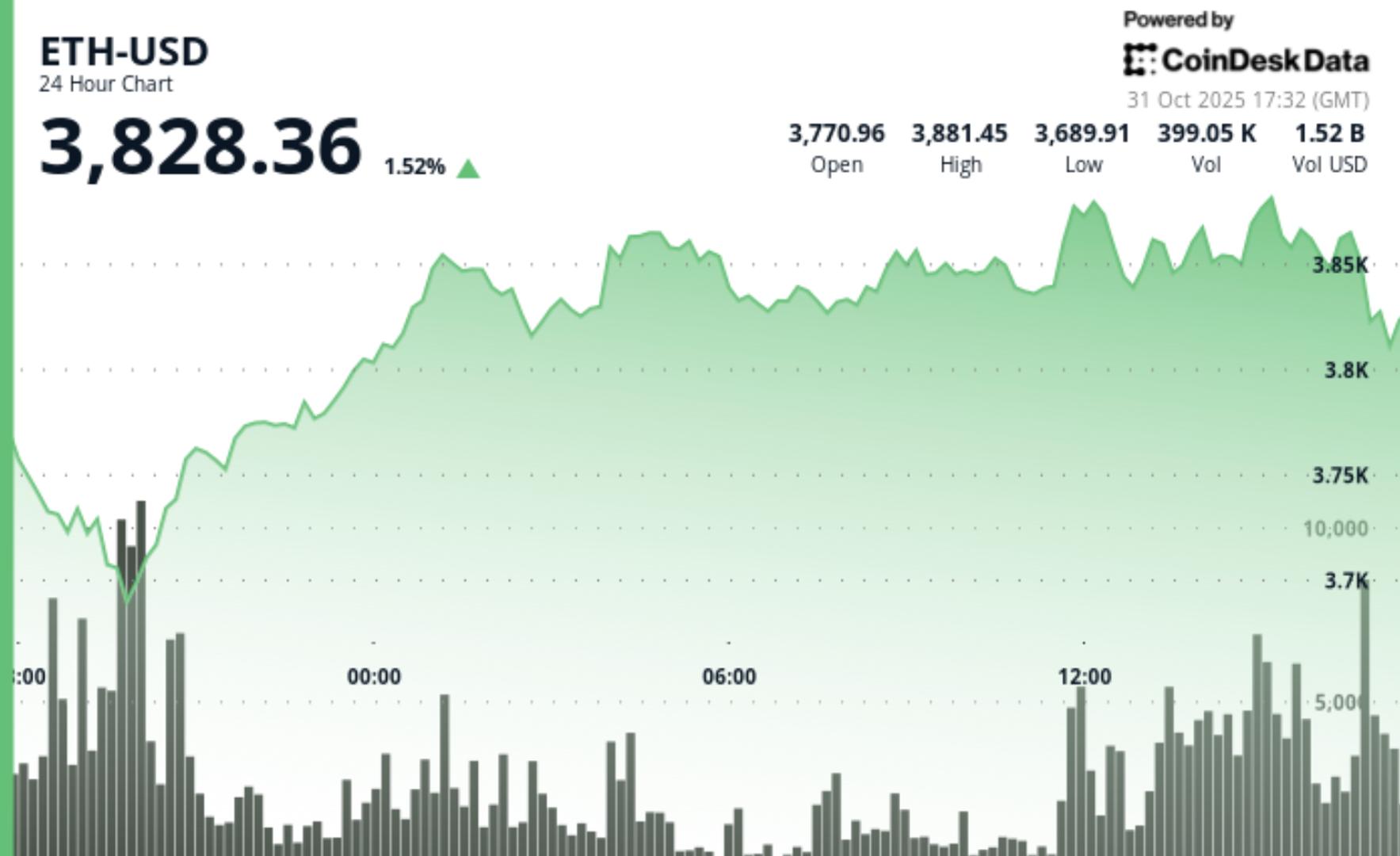

Ether’s proviso connected crypto exchanges has reached its lowest constituent since November 2015. Source: Santiment

Santiment said ETH had been rapidly leaving crypto exchanges, with balances present 16.4% little than astatine the extremity of January. This suggests that investors are moving their ETH into acold retention wallets for semipermanent holding, perchance holding much condemnation that Ether’s (ETH) terms volition emergence successful the future.

A important diminution successful ETH proviso crossed crypto exchanges tin awesome a imaginable terms surge soon, commonly known arsenic a “supply shock.” However, a surge volition lone hap if request remains beardown oregon increases to outpace the reduced supply.

It was precocious seen successful Bitcoin (BTC). On Jan. 13, Bitcoin reserves connected each crypto exchanges dropped to 2.35 cardinal BTC, hitting a astir seven-year debased that was past seen successful June 2018. Just a week later, Bitcoin surged to a caller precocious of $109,000 amid the inauguration of US President Donald Trump.

Some crypto traders and analysts expect a akin script for Ether.

Crypto trader Crypto General told their 230,800 X followers that it is “Just a question of clip earlier the large proviso shock.”

Crypto commentator Ted said successful a March 19 X station that with ETH proviso connected crypto exchanges decreasing by the day, “buyers volition soon compete, starring to bidding wars.”

Related: ‘Successful’ ETH ETF little cleanable without staking — BlackRock

Meanwhile, crypto trader Naber said successful an X station connected the aforesaid time that the largest ETH accumulation is taking place, and it whitethorn pb to Ether reaching the $8,000 to $10,000 terms range. Even astatine the little extremity of $8,000, Ether would beryllium up 64% from its all-time precocious of $4,878, reached successful November 2021.

While the proviso diminution is giving crypto traders anticipation for ETH, different signals person precocious formed a bearish shadiness implicit the asset.

Its show against Bitcoin has been astatine its lowest successful 5 years. Daan Crypto Trades said successful a March 19 X station that it is “unlikely to spot this anyplace adjacent its highs anytime soon.”

Ether is down 26% implicit the past 30 days. Source: CoinMarketCap

Ether is presently trading astatine $1,971, down 26% implicit the past period according to CoinMarketCap data. Meanwhile, spot Ether ETFs person had 12 consecutive days of outflows totaling $370.6 million, according to Farside data.

“This has been 1 brutal downtrend,” Daan Crypto Trades added.

Scott Melker, aka “The Wolf of All Streets,” said, “Either Ethereum bounces present and this is simply a generational bottom, oregon it’s over.”

Magazine: Memecoins are ded — But Solana ‘100x better’ contempt gross plunge

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

7 months ago

7 months ago

English (US)

English (US)