A monolithic magnitude of ETH has made its mode to centralized exchanges, expanding the Ethereum balances of these exchanges. Given the implications of exchange inflows, it could beryllium a obstruction to the cryptocurrency erstwhile it comes to claiming the $2,000 resistance.

Investors Send 13,000 ETH To Exchanges

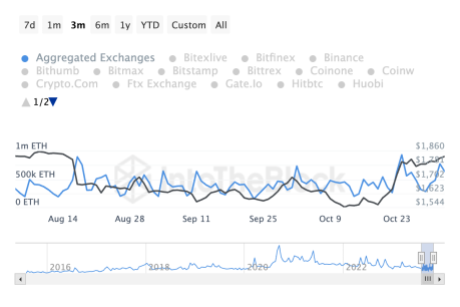

Data from IntoTheBlock shows a monolithic magnitude of ETH headed toward exchanges arsenic the terms rose. The full inflow measurement arsenic of October 31 erstwhile the terms archetypal cleared the $1,800 absorption was astatine 480,570. However, by the commencement of November, this fig had blown up massively.

November 1 saw the full ETH flowing into exchanges reaching 774,890, and by this time, the bulls had established their dominance supra the $1,800 level. With outflows coming retired astatine conscionable astir 630,000 ETH, the netflows travel retired to astir 130,000 ETH flowing into exchanges connected November 1. This showed a willingness among investors to commencement taking nett from their holdings.

As the information tracker shows, the bulk of Ethereum investors had moved backmost into nett aft crossing $1,800. Even pursuing the retracement, the full percent of ETH investors successful nett is sitting astatine 55.40% and it is nary astonishment that immoderate of these investors would privation to unafraid profit.

By November 2, though, determination has been a relaxation from investors erstwhile it comes to inflows. Data shows that connected Thursday, the ETH inflow figures fell to 637,070, though this is inactive overmuch higher than the erstwhile week’s figures. The speech nett travel is present down to 31,040 ETH arsenic of Thursday.

Ethereum Large Holders Swing Into Action

Ethereum has besides seen a spike successful the fig of ample transactions being carried retired connected the web arsenic good arsenic the transaction measurement of these ample holders. The full fig of ample transactions sat astatine 1,900 connected October 29. But by November 2, the fig ballooned to 4,320, an implicit 100% summation successful conscionable 4 days.

The transaction volumes of these whales besides saw a emergence successful an astir akin mode compared to the fig of ample transactions. Large transaction volumes were astatine 741,440 ETH connected October 29. But connected November 2, the measurement reached 2.21 cardinal ETH. In dollar figures, ample transaction volumes went from $1.33 cardinal to $4.04 billion.

Looking astatine the bullish and bearish transactions (i.e those who are buying versus those who are selling), determination isn’t a ample quality bulls inactive proceed to pb successful the asset. The 7-day full for bulls came retired to a full of 98 bulls compared to 87 bears. But the spread is closing further connected a regular ground wherever IntoTheBlock shows 14 bulls and 12 bears.

2 years ago

2 years ago

English (US)

English (US)