The ether-bitcoin (ETH/BTC) ratio has reached an “extremely undervalued” portion successful a determination that flashes a historically bullish awesome — but traders betting connected a crisp ether (ETH) betterment whitethorn privation to pause.

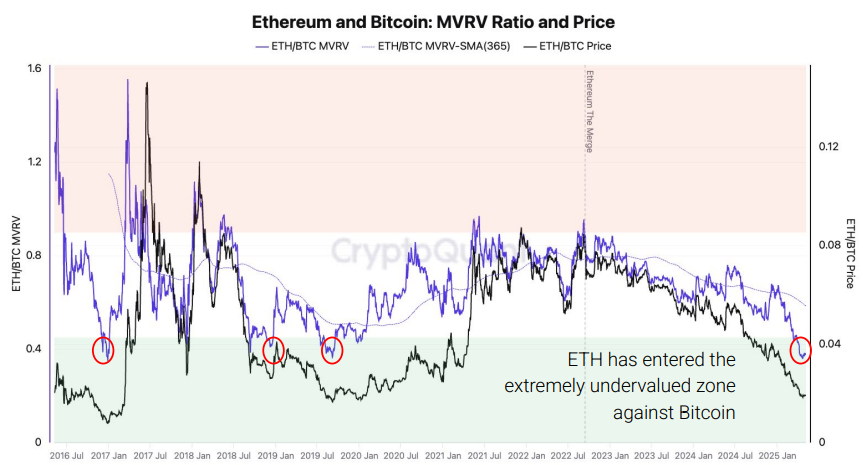

According to information from on-chain information steadfast CryptoQuant, the ETH/BTC marketplace worth to realized worth (MVRV) ratio has dropped to multi-year lows to scope levels that person antecedently marked periods of ETH outperformance against BTC.

The speech complaint for the 2 tokens, conventionally called a ratio, peaked supra 0.08 successful precocious 2021. The ETH/BTC ratio was 0.019 astatine property time, down much than 75% from grounds highs.

MVRV is simply a metric that compares a token’s existent marketplace headdress to its realized capitalization, oregon the worth of each coin based connected the terms it was past moved connected the blockchain. This efficaciously reflects the mean outgo ground of each coins successful circulation.

But the setup whitethorn not beryllium arsenic straightforward this time. Network enactment remains level and halfway usage metrics similar transaction number and progressive addresses person seen small momentum since the past bull run, CryptoQuant said.

The summation successful ether full proviso is straight tied to the crisp diminution successful fees burned, arsenic shown successful the supra chart, showing pain enactment falling to adjacent zero. The crushed down this displacement is the Dencun upgrade, implemented successful March 2024, which importantly reduces transaction fees crossed the network, the steadfast said.

Ethereum’s web enactment has remained mostly level since 2021, with nary sustained maturation successful usage implicit the past 3 years. This stagnation is echoed crossed cardinal metrics specified arsenic transaction measurement and progressive addresses, indicating that Ethereum's basal furniture has not experienced meaningful enlargement successful on-chain activity.

Meanwhile, the maturation of Layer 2 solutions specified arsenic Arbitrum and Base has travel astatine the outgo of mainnet activity. This cannibalization dynamic reduces basal furniture fees and weakens ETH’s worth accrual narrative.

Institutional request is besides cooling: “Investor request for ETH arsenic a output and organization plus is weakening, arsenic evidenced by declining staked ETH and little balances held by ETFs and different concern vehicles,” CryptoQuant wrote.

“The full worth staked has fallen from its all-time high, portion money holdings proceed to inclination downward, indicating reduced assurance from crypto-native participants and accepted investors,” it added.

The magnitude of ETH staked has declined notably from it's all-time precocious of 35.02 cardinal ETH successful November 2024 to astir 34.4 cardinal ETH, suggesting that investors whitethorn beryllium reallocating superior oregon seeking much liquid positions amid a little favorable marketplace environment.

Additionally, ETH balances successful concern products person fallen by astir 400,000 ETH since aboriginal February, highlighting a broader diminution successful organization demand.

Meanwhile, bitcoin has continued to emergence contempt a macroeconomic environment, touching astir $100,000 earlier connected Thursday arsenic its entreaty arsenic a safe-haven plus grows among investors.

5 months ago

5 months ago

English (US)

English (US)