The ether (ETH) marketplace is astatine a captious juncture arsenic a whale snapped up ether (ETH) worthy millions, positioning itself bullishly against the cryptocurrency's archetypal play nonaccomplishment successful implicit a month.

Programmable blockchain Ethereum's autochthonal token, ether, has dropped astir 10% this week, hitting lows nether $3,400 astatine 1 point, CoinDesk information show. The diminution follows a robust five-week winning streak, signaling profit-taking oregon de-leveraging alongside losses connected Wall Street.

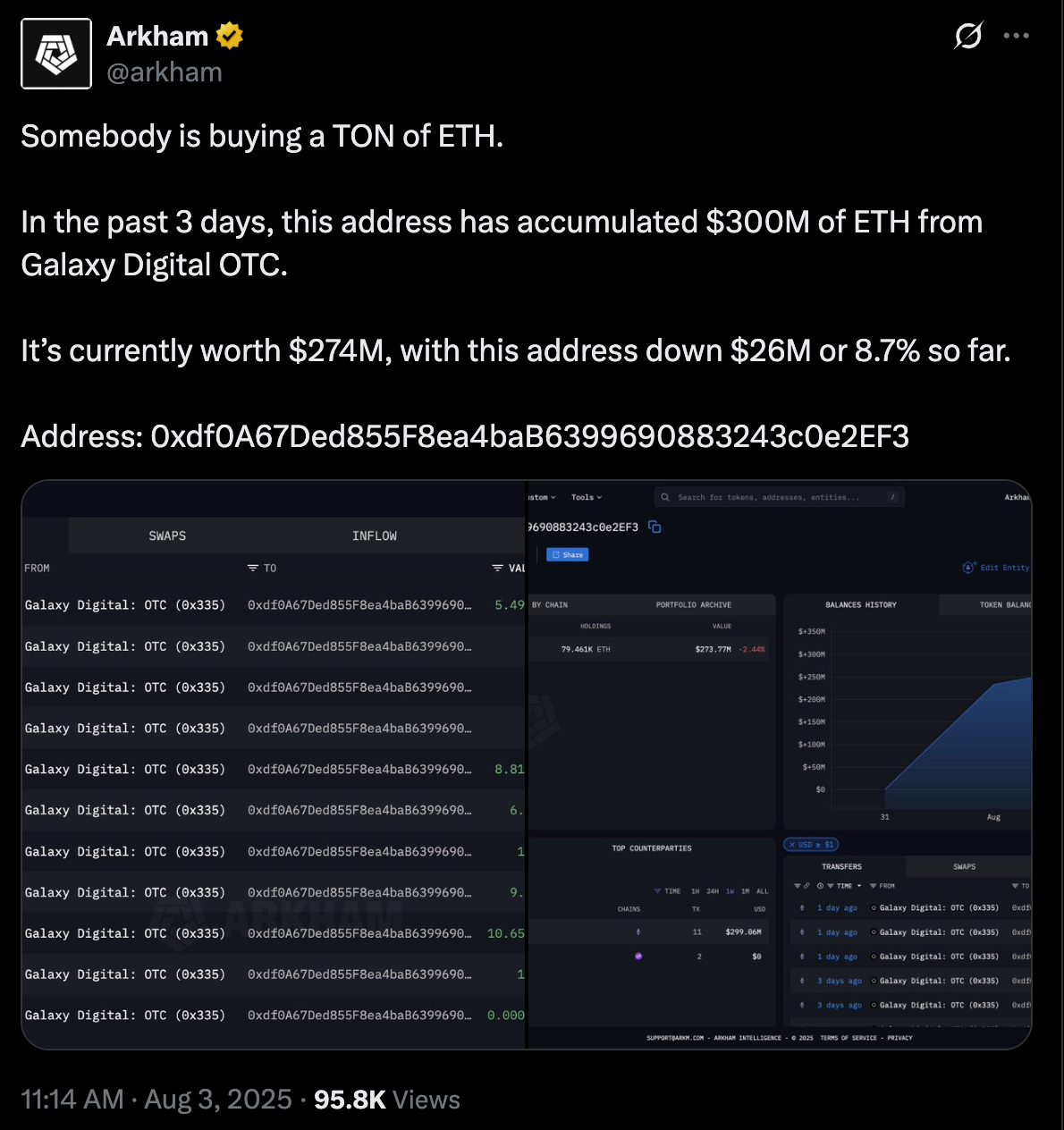

The bearishness, however, contrasts with a almighty awesome of semipermanent condemnation from a whale. According to on-chain information tracked by Arkham Intelligence, a azygous entity snapped up a monolithic $300 cardinal worthy of ether arsenic prices fell, executing a large "buy the dip" operation.

It's the lawsuit of bullish divergence. While the play terms enactment suggests a nonaccomplishment of contiguous upward momentum and imaginable profit-taking, the important whale acquisition indicates a content that the caller downturn is simply a impermanent setback.

The connection is clear: As the terms driblet flushes retired weaker hands, the process if being met with determined buying from a high-conviction entity.

A caller bout of macro jitters, sparked by the buoyant U.S. dollar and Friday's disappointing U.S. jobs data, has enactment the crypto marketplace connected the backmost foot.

Bitcoin, the largest integer plus by marketplace value, has held comparatively resilient, down conscionable 4.5% for the week. BTC's outperformance comparative ETH confirms the alteration successful marketplace sentiment sentiment against ETH that was archetypal signaled by the options market.

4 months ago

4 months ago

English (US)

English (US)