Institutional funds presently clasp about 3.3 cardinal ether (ETH), oregon astir 3% of the circulating supply, done exchange-traded funds (ETFs). With 27% of ETH already staked, these ETF holdings unsocial could summation the magnitude of full staked ETH by much than 10%. And that’s without factoring successful further inflows from investors drawn to the committedness of earning staking output wrong an ETF wrapper. The question present truthful isn’t can institutions stake: it’s erstwhile and however they’ll bash it.

That “how” matters, however: if ETH ETF staking is approved, issuers whitethorn default to third-party operators oregon way staking done a fistful of custodians. This could effect successful validator powerfulness concentrating quickly, particularly considering existent custody providers, creating centralized entities. Lido inactive leads with implicit 30% of staked ETH, but nether the hood determination are much than 500 operators with the inception of Community Staking Module past year. But if a question of organization ETH wealth flows into conscionable a fewer trusted intermediaries, Ethereum risks drifting toward a validator oligopoly connected centralized operators.

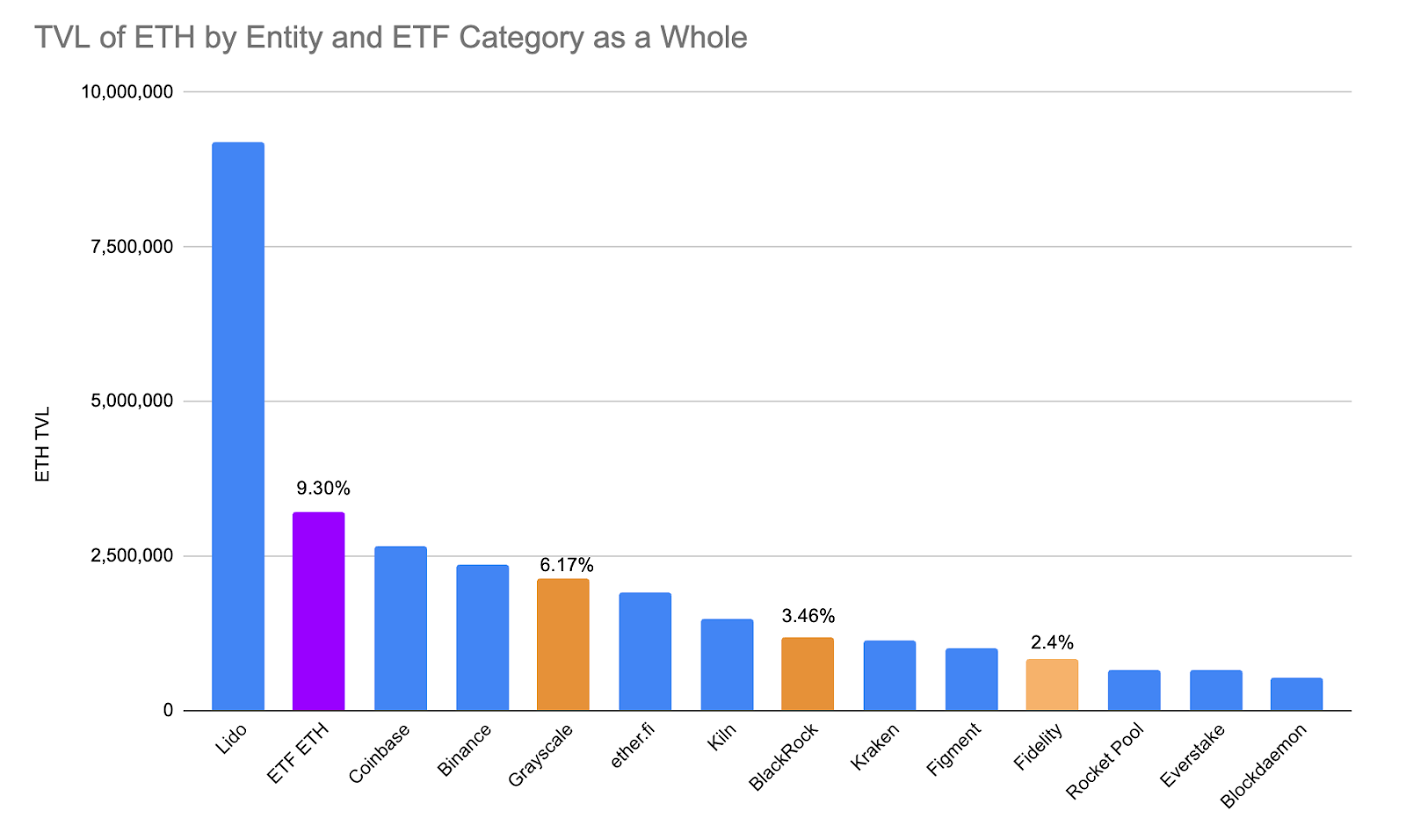

This illustration shows the full ETH held by ETFs successful purple, which would beryllium the 2nd largest staker arsenic a category, and successful orangish the apical 3 ETFs holding ETH. TVL= full worth locked.

On the flip side, there’s a uncommon accidental for ETF issuers to spell direct, running their ain nodes.

Vertical integration into staking infrastructure allows issuers to some decentralize the web and unlock economical upside. The modular validator interest — typically 5–15% of staking rewards — is presently captured by operators and the liquid staking protocol managing the staking pools, specified arsenic Lido, RocketPool and adjacent the centralized wallet exchanges pools.

However, if ETF managers tally their ain nodes oregon spouse with autarkic providers, they tin reclaim that borderline and boost money performance. In an manufacture competing connected ground points, that borderline matters. We’re already seeing an M&A inclination underway. Bitwise’s acquisition of a staking operator is nary coincidence: it’s a awesome that astute plus managers are positioning for a aboriginal wherever staking isn’t conscionable a back-end work but a halfway portion of the fund’s worth chain.

This improvement represents Ethereum’s fork successful the road, successful which institutions tin either dainty staking arsenic a plug-and-play checkbox, reinforcing centralization and systemic risk, oregon they tin assistance physique a much credibly neutral protocol by distributing operations crossed validators.

With a abbreviated queue, an expanding acceptable of validators and billions of ETH sitting idle, the timing couldn’t beryllium better. So arsenic the institutionalization of staking looks progressively likely, let’s marque definite it’s done right, reinforcing the foundations of what blockchain is each about.

7 months ago

7 months ago

English (US)

English (US)