Summary:

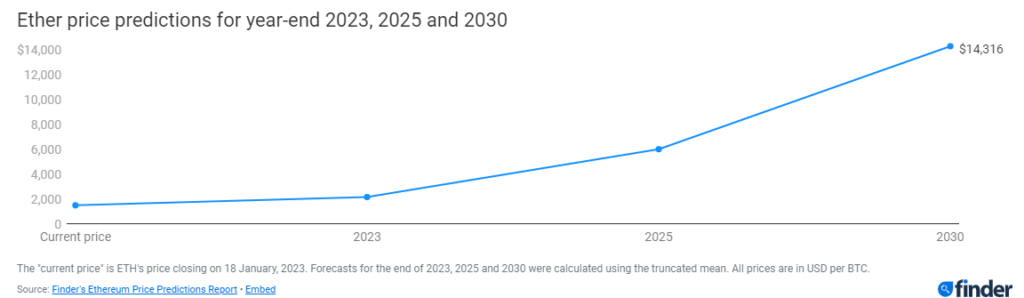

- The mean fig of 56 manufacture experts expect ETH to deed decorativeness 2023 supra $2,000 and deed $6,000 by 2025.

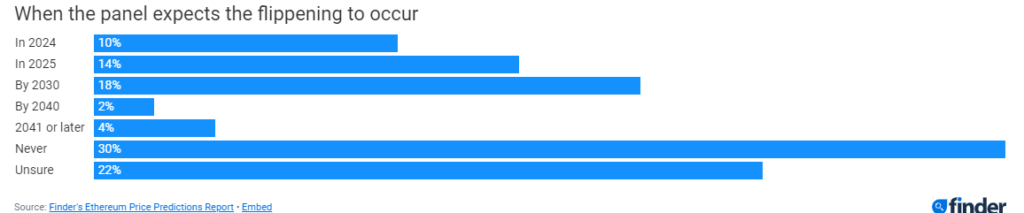

- Finder’s panelists besides opined that Ethereum could flippen Bitcoin arsenic the largest crypto by marketplace headdress by 2024.

- 56% of Finder’s experts said present is the clip to bargain Ether and 60% judge ETH is underpriced astatine its existent levels.

A report from Finder connected crypto’s largest altcoin Ether (ETH) said that the token could skyrocket to $6,000 by 2025 arsenic the markets retrieve pursuing a murky twelvemonth successful 2022. Finder’s investigation successful January engaged 56 manufacture experts connected what they judge the aboriginal holds for Ethereum and its autochthonal plus ETH.

Ether (ETH) Price Predictions

The sheet mean predicted cardinal terms levels for the largest altcoin by 2023, 2025, and 2030. Amid uncertainty wrong the broader fiscal industry, tightening monetary policies from the fed, and planetary ostentation levels, astir panelists expect ETH to adjacent 2023 astatine astir oregon conscionable supra $2,000. Currently, the token trades astatine astir $1600 aft crypto prices rallied successful January.

ETH/USDT by TradingView

ETH/USDT by TradingViewFinder’s panelists crook much bullish down the line, predicting that ETH is acceptable to scope $6,000 by 2025 and $14,000 by 2030. Founder of Seasonal Tokens Ruadhan O noted that transaction costs connected Ethereum volition emergence arsenic planetary economies recover, and this volition incentivize users to bargain much tokens. The accrued buying unit volition propel ETH to higher prices arsenic much validators and users flock to the network, Ruadhan said.

Ben Ritchie, Managing Director of Digital Capital Management AU, opined that Ethereum volition powerfulness done harsh marketplace conditions and “dominate the marketplace arsenic the starring astute declaration platform”. Ritchie added that this should boost ETH’s terms arsenic much businesses make decentralized applications (dapps) connected Ethereum and web enactment increases.

Origin Protocol co-founder Josh Fraser hailed Ethereum arsenic the basal furniture of innovation for astir of DeFi and NFTs. DefiLlama information showed that Ethereum boasts implicit $29 cardinal successful full worth locked (TVL), the highest of immoderate DeFi chain. Some of the astir salient NFT projects similar Bored Apes, Azuki, and CryptoPunks besides tally atop Ethereum’s chain. Fraser believes these factors volition enactment ETH connected way for $14,000 by 2025.

CEO of Standard DAO Aaron Rafferty expressed bullish sentiment connected ETH with a semipermanent constituent of view. Rafferty noted that ETH proviso volition drop, causing plus scarcity and hiked token prices.

The past 2 years person been highly affirmative fundamentally for Ethereum from EIP 1559 to the Merge, [which] erstwhile combined, caused a deflationary effect to the protocol. As much companies similar Mastercard and Visa usage the protocol and much scaling solutions are integrated implicit the adjacent fewer years, we should spot on-chain proviso trim exponentially successful the agelong word to the constituent that it volition beryllium astir intolerable to bargain [ETH] from an unfastened speech successful 2030.

Indeed, not each the panelists reached a statement connected ETH’s aboriginal prices and immoderate experts predicted much symptom successful the marketplace earlier users acquisition upward momentum. AskTraders’ elder expert for crypto and forex, Nick Ranga, foresees “more downside successful the abbreviated term”. Ranga argued that geopolitical tensions coupled with higher vigor prices could stifle markets until 2024.

Jeremy Cheah echoed a akin bearish presumption connected ETH owed to a deficiency of regulated extortion for crypto retail investors. Cheah who is an subordinate prof of DeFi astatine Nottingham Trent University predicted that ETH volition extremity 2023 astatine $1000. Cheah added that the token mightiness lone scope $2000 by 2025.

ETH Underpriced? When flippening?

60% of the experts agreed that ETH is presently underpriced astatine $1600. 56& of the panelists besides chimed that present is the clip to stockpile ETH. About 12% of the 56% specialists opined that ETH is overpriced and 16% urge offloading Ether tokens now, expecting different downturn successful crypto plus prices successful the abbreviated term.

Perhaps the astir salient bony of contention passim Finder’s study revolved astir whether Ethereum tin flippen Bitcoin to go the largest cryptocurrency by marketplace cap. Ethereum’s marketplace headdress presently sits astir $194 billion, portion Bitcoin boasts a monolithic $445 cardinal contempt dense slumps successful crypto prices since marketplace highs successful November 2021.

ETH Market Cap

ETH Market Cap BTC Market Cap

BTC Market Cap18% of manufacture experts predicted that the flippening could get by 2030. 30% of Finder’s specialists deliberation the flippening volition ne'er happen.

Despite contrary opinions regarding Ethereum flippening Bitcoin, immoderate experts judge ETH’s concatenation holds much committedness compared to Bitcoin.

Ethereum looks to beryllium much absorbing than Bitcoin. The semipermanent charts item the quality to acceptable ever-higher lows from June 2022. Also, Ether has returned supra the 200-week average, thing Bitcoin cannot yet boast of.

– Alexander Kuptsikevich, elder marketplace expert for FxPro.While not each 56 panelists agreed connected terms ETH terms levels successful the abbreviated word and agelong term, the wide sentiment among manufacture experts suggests bullish question for Ethereum and its autochthonal plus arsenic the particulate settles and the broader crypto markets recover.

3 years ago

3 years ago

English (US)

English (US)