The trove stolen from decentralized lender Radiant Capital successful October 2024 has astir doubled successful worth arsenic Ether climbed, blockchain information shows.

Decentralized concern (DeFi) protocol Radiant Capital was hacked successful mid-October 2024 erstwhile the crosschain lending protocol suffered a $58 cardinal cybersecurity breach connected BNB Chain and Arbitrum.

Radiant Capital, a crosschain lending protocol connected BNB Chain and Arbitrum, mislaid astir $58 cardinal successful a mid-October breach. The attacker aboriginal swapped proceeds into Ether (ETH) and present holds astir 21,957 ETH worthy astir $103 million, according to Lookonchain, up from an estimated $58 cardinal astatine the clip of the exploit.

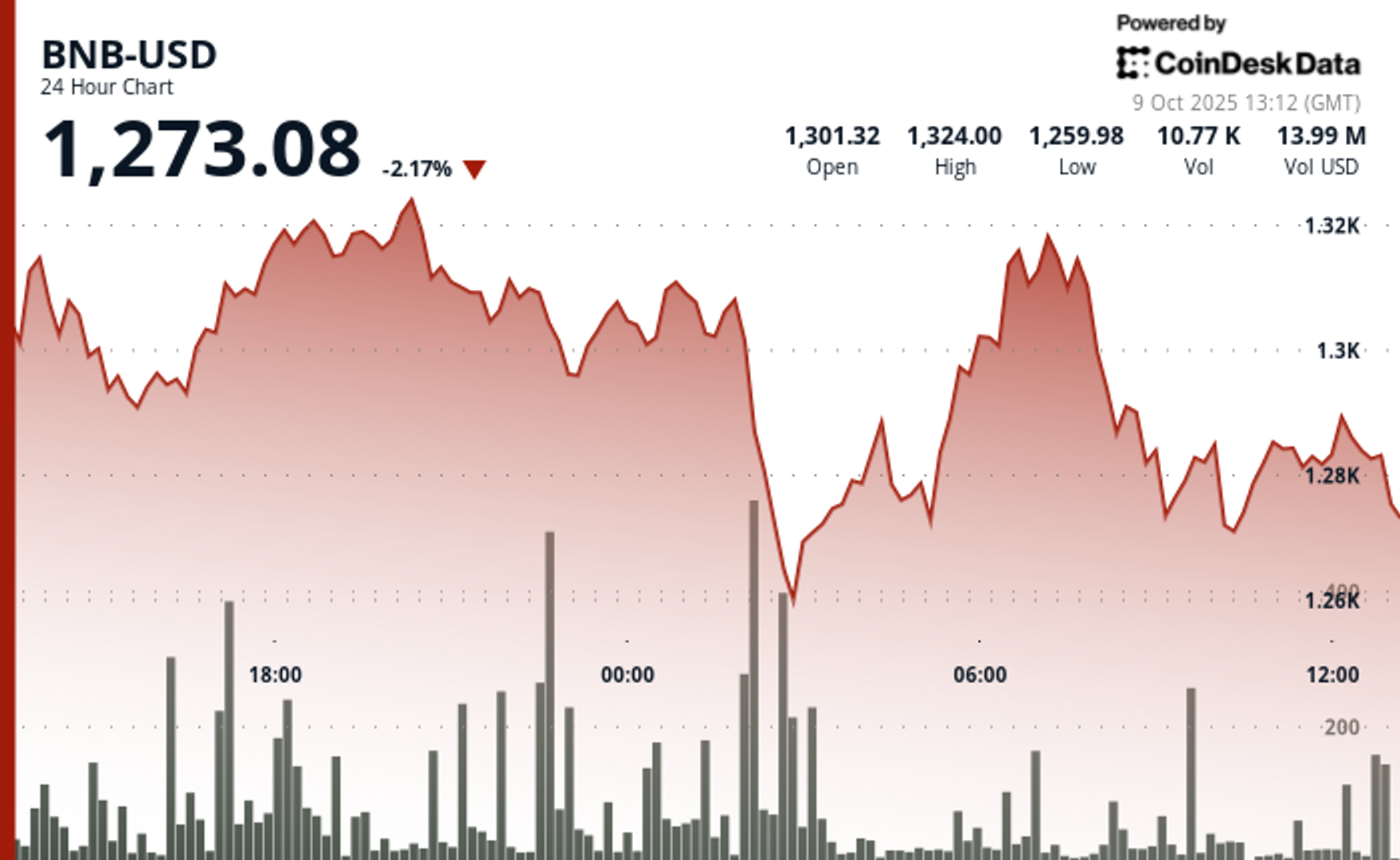

Ether closed Oct. 15, 2024, supra $2,300 and traded supra $4,700 astatine the clip of writing.

Related: US spot Ether ETFs spot 2nd-biggest inflows connected grounds arsenic ETH nears caller high

Not an concern bet, analysts say

The investigations squad astatine blockchain forensics steadfast AMLBot told Cointelegraph that, though it yet led to profits, this commercialized was apt an uninted effect of evasion techniques. “It’s much apt that the exploiter’s determination to clasp ETH was driven by operational information and liquidity considerations alternatively than a deliberate market-timing strategy,” the AMLBot squad said.

The investigators explained that attackers thin to swap their funds to Bitcoin (BTC) oregon ETH. The 2 main reasons for this are to mitigate the hazard of token freezes since those assets cannot beryllium frozen, dissimilar large stablecoins.

Another crushed is that Bitcoin and Ether are already supported by highly liquid marketplace infrastructure and wide support. This makes it easier to determination them crossed ecosystems.

“Given these patterns, it’s much plausible that the ETH holdings simply benefited from broader marketplace maturation alternatively than being the effect of a conscious concern stake connected terms appreciation,“ the investigators concluded.

Ether’s terms rises arsenic its proviso dwindles

Ether’s emergence since the exploit is attributed to aggregate factors. Ether spot ETFs started trading successful the US successful precocious July 2024 — closing 1 twelvemonth of trading past month — and person seen a full nett US dollar travel of $12.12 cardinal truthful far, according to CoinGlass data.

This information besides shows that large-scale accumulation done regulated means has been ongoing, starring to a decrease successful the magnitude of Ether connected exchanges. More assets are present retired of circulation acknowledgment to staking, with mid-June reports showing that the proviso of staked Ether reached an all-time precocious of implicit 35 cardinal ETH. More caller information from Dune Analytics shows that this fig present exceeds 36 cardinal ETH.

Another origin is the increasing ETH treasuries astatine corporates. According to a study released successful precocious July, those companies already had implicit $100 cardinal of Ether successful their coffers astatine the time.

Regulatory code has besides shifted, including the SEC’s June 2024 determination to drop its probe into whether ETH is simply a security.

Carol Goforth, a prof astatine the University of Arkansas School of Law, said astatine the time that the lawsuit being dropped was a “pretty bully denotation that the bureau does not judge it tin person a tribunal that ETH is simply a security.”

Related: Ethereum is the ‘biggest macro trade’ for adjacent 10-15 years: Fundstrat

A increasing ecosystem and improving infrastructure

Ethereum besides rolled retired its Dencun upgrade conscionable months earlier the hackers filled their coffers. This update includes Ethereum Improvement Proposal (EIP) 4844. The EIP introduced danksharding and proto-danksharding, importantly improving web scalability and layer-2 support.

Ethereum’s layer-2 ecosystem besides grew, with regular transactions reaching 12.42 cardinal connected Aug. 12, 2024.

That maturation has continued, with GrowThePie data from Wednesday showing that Ethereum layer-2 protocols processed astir 13.88 cardinal transactions that day. Previous highs exceeded 16 cardinal transactions successful a day.

Magazine: How Ethereum treasury companies could spark ‘DeFi Summer 2.0’

1 month ago

1 month ago

English (US)

English (US)