Friday brought carnage onto crypto markets arsenic U.S.-China commercialized tensions ratcheted up with Trump threatening a monolithic summation successful tariffs against Chinese goods.

Worst-hit among the crypto benchmark CoinDesk 20 Index constituents was Ethereum's autochthonal token ether (ETH), nosediving 7% from Friday's league precocious and hitting its weakest terms since precocious September beneath $4,100. Its diminution acold outpaced bitcoin's (BTC) 3.5% driblet beneath $118,000 and the index's 5% plunge.

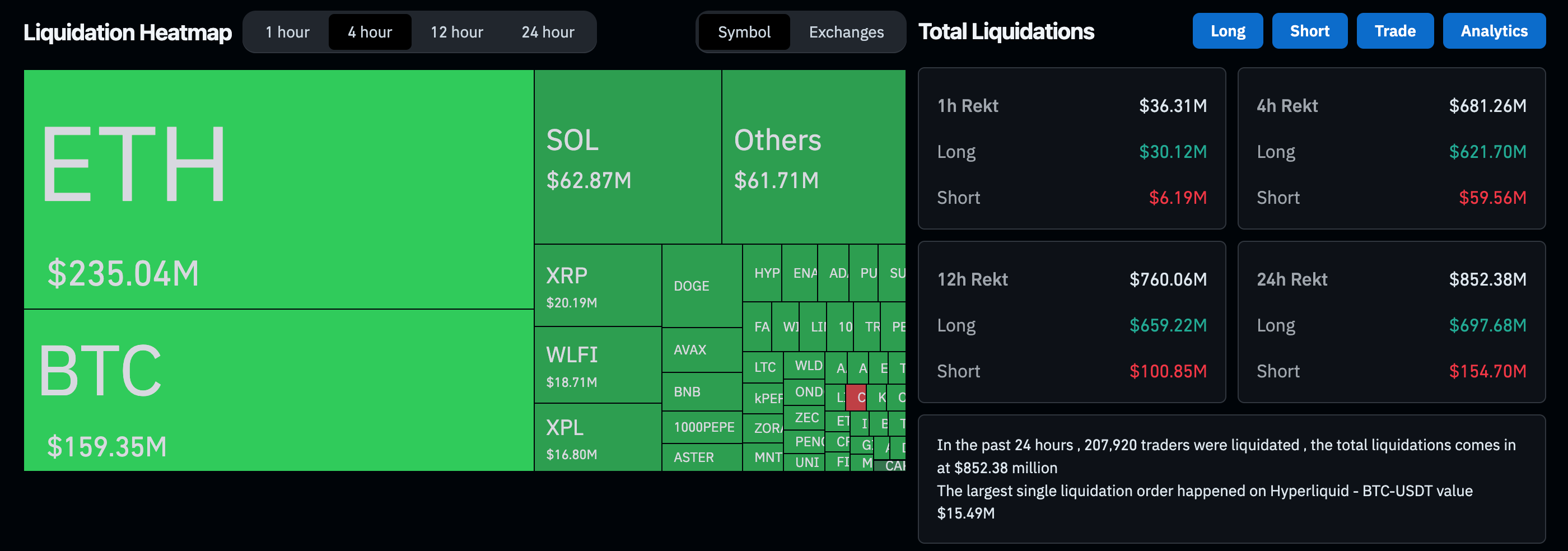

The broad-market downturn spurred a liquidation cascade crossed crypto derivatives markets, wiping retired implicit $600 cardinal of leveraged trading positions among each assets, CoinGlass data shows.

ETH besides led successful liquidations with implicit $235 cardinal agelong positions wiped retired done the session. Longs are leveraged bets seeking to nett from the asset's terms rise.

Technical breakdown

Behind the liquidation cascade was ETH's breakdown of captious enactment levels, CoinDesk Research's method investigation exemplary suggested.

• Selling unit materialized astatine astir 14:00 UTC with a measurement of 372,211 units, astir treble than the 24-hour mean of 190,747 units.

• Volume-based absorption confirmed astir $4,287.

• Primary absorption identified astatine $4,141 during failed betterment attempt.

• Potential enactment forming conscionable beneath $4,100 wherever buyers emerged.

1 month ago

1 month ago

English (US)

English (US)