Ethereum’s rally this period has been sharp, but traders are being warned to ticker September closely.

Ether climbed astir 20% since the commencement of August, trading astatine $4,745 astatine the clip of publication. Prices adjacent pierced $4,860 aft dovish remarks from US Federal Reserve Chair Jerome Powell astatine the Jackson Hole symposium, a determination that galore successful crypto spot arsenic a imaginable spark for much gains.

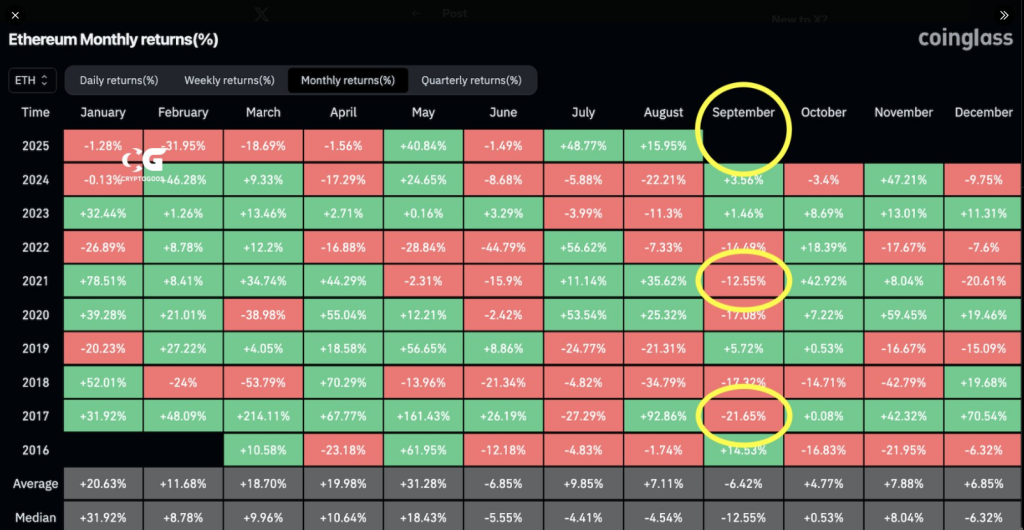

Historic September Pullbacks

According to CoinGlass, past offers a cautionary note: determination person been lone 3 cases since 2016 wherever Ether roseate successful August and past slid successful September.

In 2017, Ether jumped 92% successful August and past dropped 20% the pursuing month. In 2020, August gains of 25% were followed by a 17% pullback successful September.

And successful 2021, a 35% ascent successful August gave mode to a 12% gaffe successful September. CryptoGoos, a trader connected X, summed it up bluntly: seasonality successful September during post-halving years tends to beryllium negative.

$ETH seasonality successful September during post-halving years is typically negative.

Will this clip beryllium different? pic.twitter.com/h9hJ40V3np

— CryptoGoos (@crypto_goos) August 22, 2025

That signifier does not mean a repetition is guaranteed. Reports person disclosed that some marketplace operation and capitalist profiles are antithetic present than successful those earlier years.

In 2016 and 2020, short-term losses successful September were followed by multi-month recoveries, with Ether posting upside successful the last 3 months of those years. So portion past matters, it does not determine outcomes connected its own.

New Money, New Dynamics

Flows into spot Ether ETFs this period person been ample capable to drawback attention. Based connected reports from Farside, spot Ether ETFs saw astir $2.70 cardinal nett inflows successful August, portion spot Bitcoin ETFs experienced astir $1.2 cardinal successful nett outflows implicit the aforesaid period.

At the aforesaid time, companies that clasp crypto connected their equilibrium sheets present power a sizable chunk of Ether. Reports amusement full Ether held by treasury companies topped $13 cardinal successful worth connected Aug. 11.

Arkham reported that BitMine president Tom Lee bought different $45 cardinal of Ether, lifting BitMine’s stack to $7 billion.

Those numbers alteration the math. Big organization stacks and ETF request tin marque sharp, short-term moves much persistent than successful anterior cycles.

Capital appears to beryllium rotating; Bitcoin dominance has fallen 5% implicit the past 30 days to 55%, which marketplace participants mostly property to funds moving into assets beyond Bitcoin.

What Traders Might Do Next

Traders and portfolio managers volition apt support an oculus connected macro signals and travel data. A softer involvement complaint outlook from Powell is simply a bullish origin for hazard assets, but seasonality and erstwhile post-August declines are reasons to enactment cautious.

Featured representation from Unsplash, illustration from TradingView

3 months ago

3 months ago

English (US)

English (US)