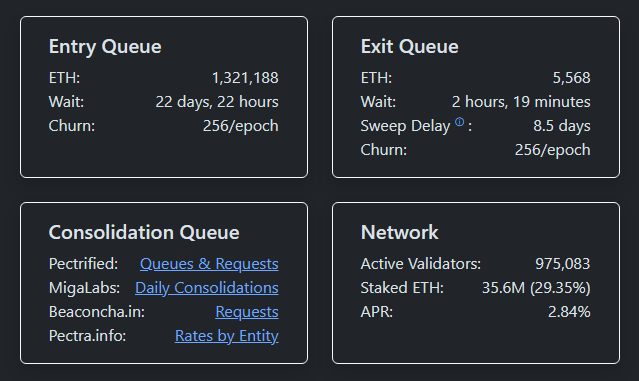

According to Beaconcha.in information and marketplace reports, the Ethereum validator exit queue has shrunk to conscionable 32 ETH, with a hold clip of astir 1 minute. That is simply a steep driblet from its mid-September highest of 2.67 cardinal ETH — a autumn of astir a 100 percent. Markets often respond erstwhile locked assets are freed up for sale. Right now, that circumstantial root of contiguous selling seems to person faded.

Validator Exit Queue Near Empty

The exit mechanics limits however accelerated validators tin halt validating and propulsion retired their afloat stake. With the queue adjacent zero, determination is nary backlog waiting to currency out. That reduces 1 signifier of tense selling.

Validators inactive gain rewards portion queued and tin look penalties if they enactment badly, but the bottleneck that erstwhile forced dilatory exits is gone. Reports amusement the withdrawal process for partial payouts remains separate, and those smaller payouts proceed without affecting the full-exit flow.

Source: Validator Queue

Source: Validator QueueEntry Queue Hits Fresh Highs

Based connected reports, the introduction queue has climbed to astir 1.3 cardinal ETH, its largest level since mid-November. Large operators are sending chunks of ETH into staking. BitMine began staking connected Dec. 26 and added 82,560 ETH to the queue connected Jan. 3. The steadfast present lists 659,219 ETH staked, worthy astir $2.1 cardinal astatine existent prices.

BitMine’s wider holdings basal astatine conscionable implicit 4.1 cardinal ETH, representing astir 3.4% of the full proviso and valued adjacent $13 billion. Those moves adhd real, measurable request for staked Ether and assistance explicate wherefore less validators look anxious to leave.

Exchange Balances And Liquidity

Exchange reserves for ETH beryllium astatine multi-year lows. That matters due to the fact that erstwhile less coins are parked connected trading platforms, automatic oregon panic selling becomes harder to propulsion off. Traders and analysts constituent to this arsenic a crushed selling unit is easing.

Some manufacture figures person been quoted saying the exit queue is “basically empty,” and that selling unit is drying up arsenic staking outpaces withdrawals. Still, the marketplace tin determination by different means — derivatives, lending desks, and off-exchange trades tin displacement vulnerability without touching the staking queues.

BULLISH: $ETH surpasses Netflix to reclaim its presumption arsenic the 36th-largest plus by marketplace cap. pic.twitter.com/NetdCcdtSa

— CoinGecko (@coingecko) January 6, 2026

Market Cap Milestone And What It Means

Meanwhile, successful different development, marketplace watchers besides noted that Ethereum has moved past Netflix to beryllium the 36th-largest plus by market cap. That header grabs attention. It says thing astir capitalist absorption connected blockchain assets close now.

But crossing a market-cap threshold is not the aforesaid arsenic a nonstop crushed to buy. Valuation rankings alteration often, and they tin beryllium driven by terms moves that are themselves shaped by flows, news, oregon macro shifts alternatively than a alteration successful the underlying business.

Featured representation from Pexels, illustration from TradingView

3 weeks ago

3 weeks ago

English (US)

English (US)