On-chain information shows that Ethereum realized volatility has present declined to uncommon levels observed lone 3 times earlier successful history.

Ethereum 1-Month Realized Volatility Has Plummeted To Just 39.8%

As per information from the on-chain analytics steadfast Glassnode, the period of December 2022 was historically quiescent for some Ethereum and Bitcoin. The “realized volatility” is an indicator that measures the modular deviation of regular returns from the mean for the marketplace successful question.

The indicator is usually taken implicit a rolling window, with the one-week and one-month versions being mostly the astir utile timespans for it. In the discourse of the existent discussion, the applicable metric is the one-month realized volatility.

When the worth of the metric is high, it means the asset’s terms has been showing greater fluctuations from the mean recently. Such a inclination implies that the marketplace is providing a precocious trading hazard currently. On the different hand, debased values suggest returns haven’t deviated overmuch from the mean, and hence that the terms has been stuck successful stale consolidation.

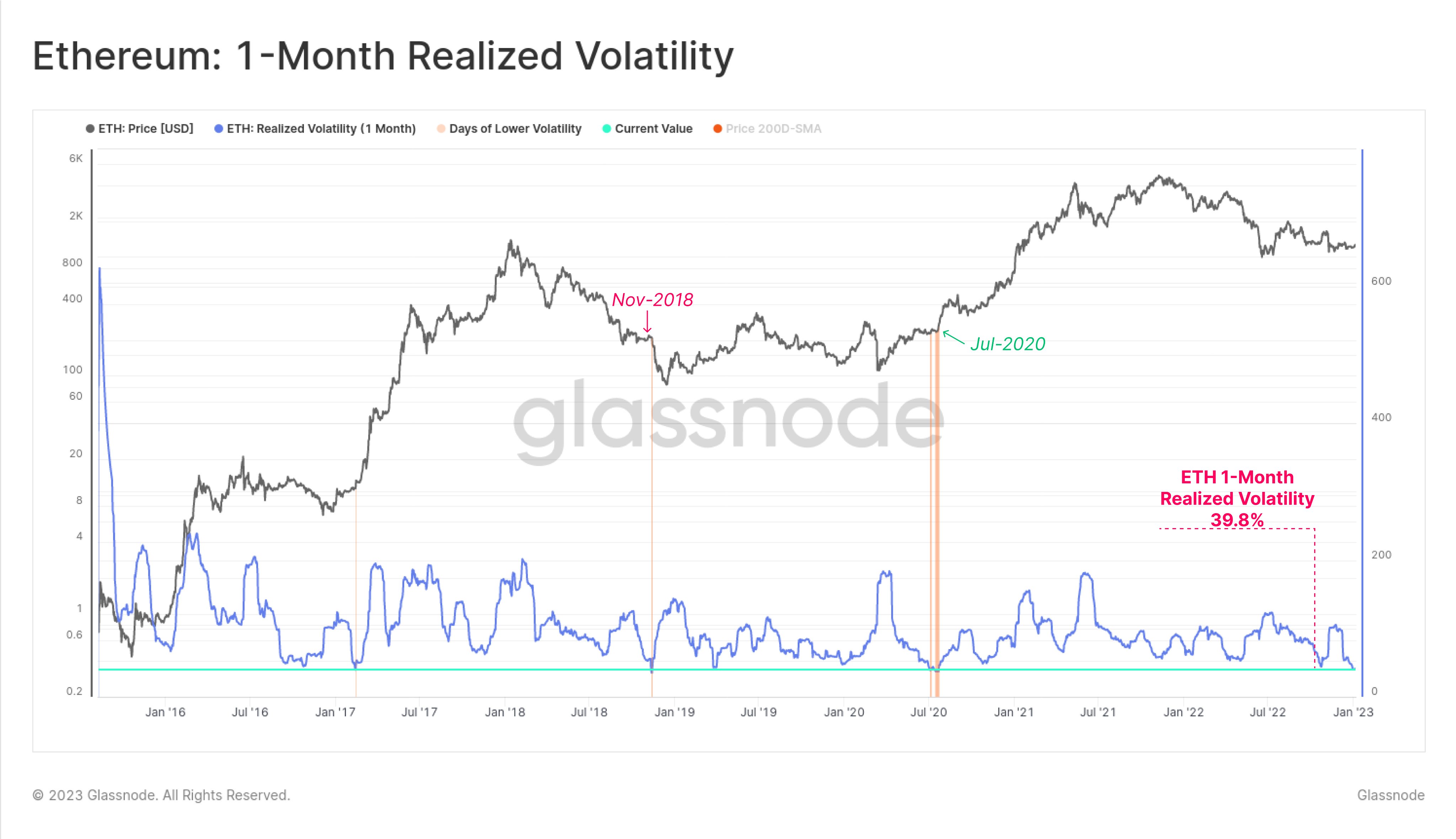

Now, present is simply a illustration that shows the inclination successful the one-month Ethereum realized volatility implicit the past fewer years:

As displayed successful the supra graph, the Ethereum one-month realized volatility has plunged to conscionable 39.8% recently, suggesting that the past period has had precise small diverseness successful day-to-day returns. This existent level of the indicator is really a historically debased value, and arsenic is evident from the chart, determination person lone been 3 instances successful the past of the crypto wherever the terms has been this stable.

Interestingly, aft each occurrence of the volatility hitting these lows, the terms has made a crisp determination and the indicator has jumped backmost up. An important illustration of this was backmost successful November 2018, erstwhile the worth of ETH collapsed toward the bottommost of the carnivore marketplace successful a abrupt move, aft the metric had reached these uncommon levels.

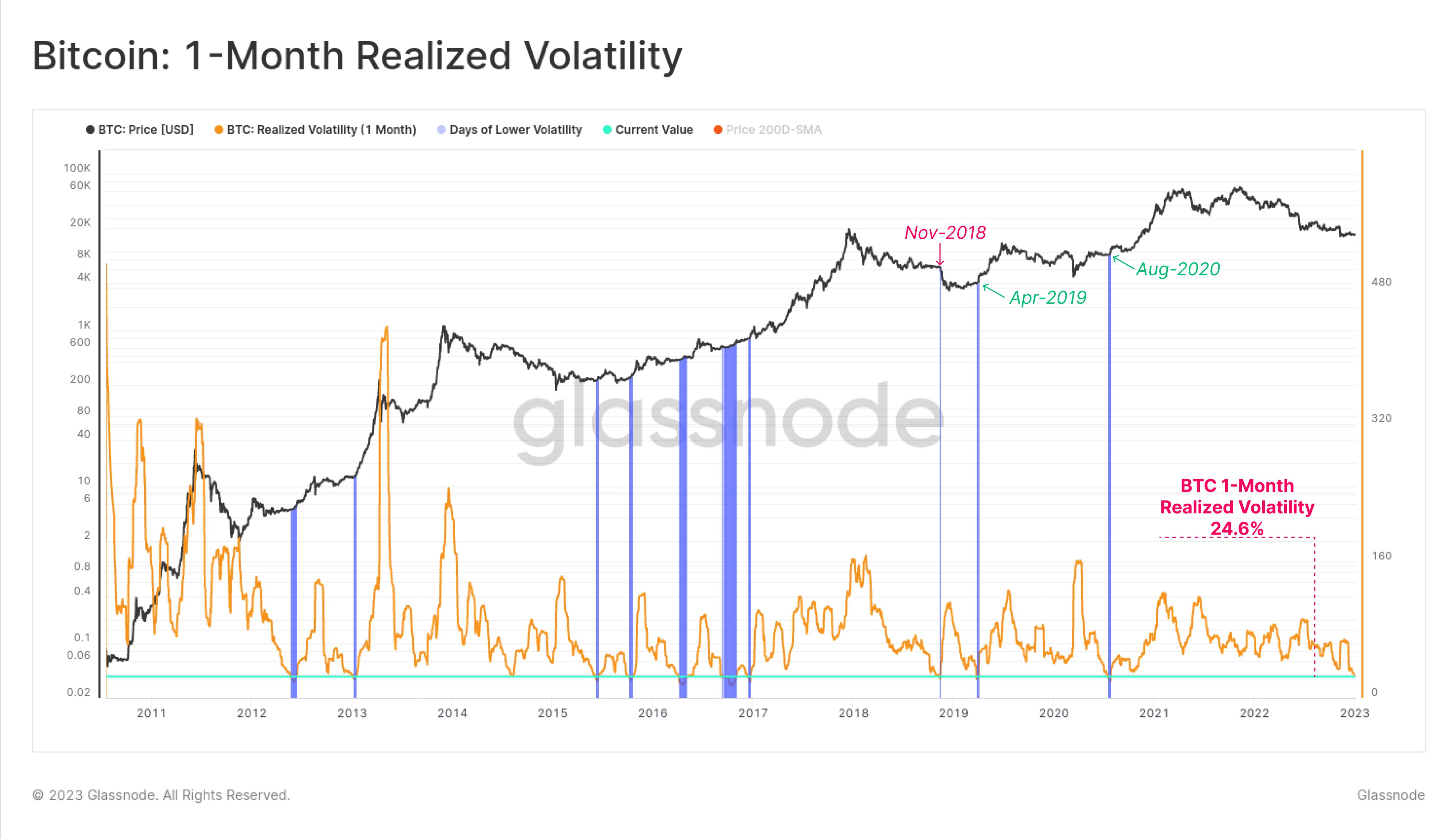

Glassnode besides points retired that, conscionable similar for Ethereum, the one-month realized volatility for Bitcoin has besides plunged to humanities lows recently, arsenic the beneath illustration highlights.

As you tin spot above, the Bitcoin one-month realized volatility has lone been little than the existent worth (24.6%) a fewer times successful the full past of the crypto. A notable lawsuit present was besides successful November 2018, where, conscionable similar ETH, BTC crashed down to signifier its bottom.

If these humanities trends are thing to consider, past the existent highly debased values successful the one-month volatility for Ethereum and Bitcoin could mean some the cryptos whitethorn soon spot a important spike successful the metric soon, but the accompanying terms determination could beryllium toward either direction.

ETH Price

At the clip of writing, Ethereum’s price floats astir $1,300, up 8% successful the past week.

Featured representation from Kanchanara connected Unsplash.com, charts from TradingView.com, Glassnode.com

2 years ago

2 years ago

English (US)

English (US)