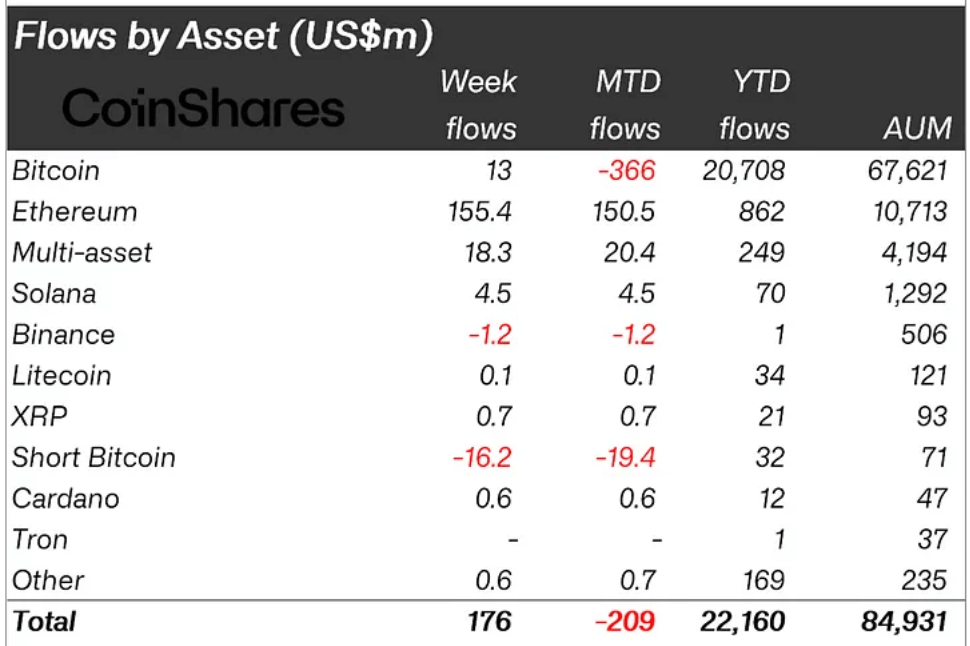

Crypto concern products experienced important inflows of $176 cardinal arsenic investors capitalized connected caller terms dips, according to CoinShares‘ latest play report.

James Butterfill, the caput of probe astatine CoinShares, noted that the full assets nether absorption (AUM) for crypto ETPs dipped to $75 cardinal amid the correction but person rebounded to $85 cardinal arsenic of the latest report.

The trading measurement for exchange-traded products (ETPs) surged to $19 cardinal during the period, exceeding this year’s play mean of $14 billion.

Ethereum dominates

Ethereum saw the astir important payment from the marketplace correction, with $155 cardinal successful inflows past week. This brings its year-to-date inflows to $862 million, the highest since 2021, chiefly owed to the caller motorboat of US spot-based ETFs.

Market experts person praised Ethereum ETFs’ performance since their motorboat successful July. For context, Nate Geraci, president of ETF Store, pointed retired that BlackRock’s iShares Ethereum ETF is present 1 of the apical six ETF launches successful 2024.

Geraci remarked:

“The iShares Ethereum ETF has attracted implicit $900 cardinal successful little than 3 weeks and is apt to deed $1 cardinal this week.”

Meanwhile, Bitcoin had a mixed show past week. The flagship integer plus started the week with outflows but saw a inclination reversal towards the end, arsenic investors piled successful $13 cardinal to BTC-related concern products.

Crypto Investment Products Inflows (Source: CoinShares)

Crypto Investment Products Inflows (Source: CoinShares)In contrast, abbreviated Bitcoin ETPs experienced their astir important outflows since May 2023, amounting to $16 million, oregon 23% of its AUM. This simplification successful AUM for abbreviated positions reflects a important capitalist withdrawal.

Other integer assets, including Solana, XRP, Cardano, and Litecoin, besides saw humble inflows of astir $6 cardinal past week.

Interestingly, inflows were seen successful each regions, indicating a wide affirmative sentiment toward the plus people pursuing the caller terms correction.

The US led with $89 million, followed by Switzerland with $20 million, Brazil with $19 million, and Canada with $12.6 million. However, the US remains the lone state to acquisition nett outflows month-to-date, totaling $306 million.

The station Ethereum accounts for 88% of crypto concern products’ $176 cardinal inflow appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)