Ethereum is emerging arsenic the vanguard for a revolutionary fiscal system. Advocates of the 2nd astir invaluable blockchain extol the virtues of astute contracts, envisioning a aboriginal marked by marketplace transparency, tokenized funds, and expeditious colony times.

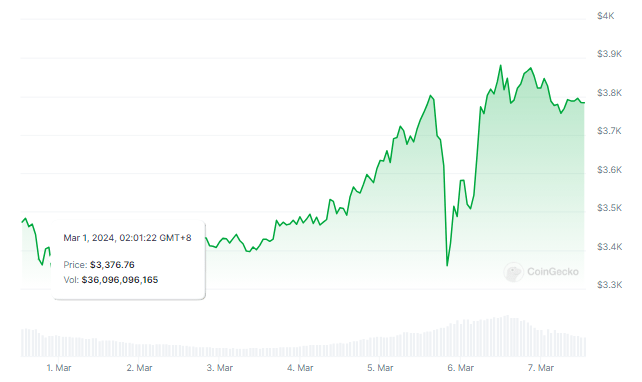

At the clip of writing, Ether was trading astatine $3,780, up 2% and 8% successful the regular and play timeframes, information from Coingecko shows.

Ethereum’s Untapped Institutional Potential

Experts reason that Ethereum is yet to acquisition its institutionalized hype cycle, lagging down the fervor witnessed by Bitcoin.

Robby Greenfield, the visionary co-founder and CEO of Umoja Labs, foresees a important uptick successful organization involvement successful Ethereum, peculiarly fueled by the impending Bitcoin halving and the cascading inflows from Bitcoin ETFs.

Greenfield’s bold prediction places Ethereum connected a trajectory to constrictive the spread with Bitcoin’s gains, asserting that the cryptocurrency could surpass the $10,000 milestone this year.

Institutional investors, helium believes, volition play a pivotal relation successful propelling Ethereum to caller heights, bringing astir a surge successful buying pressure.

ETH terms enactment successful the past week. Source: Coingecko

ETH terms enactment successful the past week. Source: Coingecko

Regulatory Crossroads: The SEC’s Stance On Ethereum ETFs

While optimism runs high, the way to Ethereum’s ascendancy is not without regulatory hurdles.

The US Securities and Exchange Commission, led by Chair Gary Gensler, whitethorn follow a cautious attack toward approving an Ethereum ETF, dissimilar the comparatively smoother support process witnessed with Bitcoin ETFs.

Gensler’s hesitance stems from a past wherever the SEC reluctantly gave the motion to Bitcoin ETFs aft a ineligible conflict with Grayscale.

The SEC is acceptable to scrutinize Ethereum ETF applications, including those from fiscal giants BlackRock and Fidelity, successful May.

Despite manufacture expectations, the support likelihood vary, with Polymarket estimating a 43% likelihood and JPMorgan offering a much optimistic 50% chance.

Ethereum’s Catalyst: The Dencun Upgrade

JPMorgan highlights a imaginable catalyst for Ethereum’s growth—the Dencun upgrade. Crafted to heighten scalability by reducing costs for assorted rollup solutions, this upgrade facilitates the batching of crypto transactions into smaller information chunks settled connected the Ethereum network.

Unlike Bitcoin’s programmed scarcity with a capped token proviso of 21 million, Ethereum’s proviso remains infinite, presenting a unsocial dynamic successful the crypto landscape.

Eugene Cheung, Bybit’s caput of institutions, underscores the affirmative implications of the Dencun upgrade for Ethereum supporters.

With furniture 2 solutions built connected apical of Ethereum, the blockchain is evolving into a colony furniture for a caller integer infrastructure spanning gaming, trading, and investing.

In the eyes of some, the looming determination connected Ethereum ETFs is conscionable the opening act.

Bloomberg ETF expert Eric Balchunas dismisses an Ethereum ETF arsenic “small potatoes,” characterizing it arsenic an underwhelming prelude to much important developments wrong the crypto sphere.

Featured representation from Pexels, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)