Ethereum (ETH), the world’s second-largest cryptocurrency, is demonstrating robust momentum arsenic its terms stages a resurgence, reclaiming levels supra $2,000.

This bullish inclination gains traction concurrently with important developments successful the US Securities and Exchange Commission (SEC). The regulatory authorization is engaging successful discussions regarding the imaginable support of a spot Ethereum Exchange-Traded Fund (ETF).

This pivotal improvement has injected optimism into the Ethereum market, arsenic the imaginable of an ETF introduces caller possibilities for mainstream adoption and investment, further fueling the existent upward trajectory of Ether’s value.

Ethereum’s Ascending Triangle: Bullish Breakout Potential

Over the people of respective months, the terms of Ethereum has been successful a consolidation inclination that has resulted successful the enactment of an ascending triangle. Although the method enactment is bullish by nature, this is lone existent pursuing a profitable breakout.

Trend lines link the adjacent highs and higher lows of the ascending triangle configuration. This statement indicates that investors are increasing much assured and buying the dips at a faster pace.

Interestingly, today’s charts amusement determination are nary “dips” to buy, arsenic Ethereum broke past the vaunted $2,000 level to invited December connected a precocious note.

Ethereum is not lone keeping up, but besides rising to unprecedented heights. The terms of ETH is presently up 3% astatine $2,100, and investors and enthusiasts are excited astir the anticipation of a rally to $3,000 oregon adjacent higher.

Ether’s awesome occurrence against Bitcoin, outperforming the alpha cryptocurrency by astir 5%, is simply a large indicator of this. Important on-chain signals connote that ETH whitethorn proceed to outperform BTC this month.

Fidelity Filing Fuels Ethereum Optimism

The archetypal denotation of a bullish determination was a breakout implicit the intelligence $2,000 barrier, though determination has been a batch of see-saw motion around this level. More specifically, ETH is trading betwixt the play enactment level astatine $1,930 and the precocious for the 2nd 4th astatine $2,140. This is the 4th week successful a enactment that this has been happening.

#Ethereum Spot ETF filing by Fidelity!

Confirms my thesis that aft #Bitcoin gets its shine, we’ll spot Ethereum moving to $3,500 successful Q1 2024.

— Michaël van de Poppe (@CryptoMichNL) November 30, 2023

Crypto expert Michael van de Poppe has voiced his optimism for Ethereum successful airy of the Fidelity filing. Given this submission, helium affirms his condemnation that aft Bitcoin’s accelerated increase, Ethereum is positioned to attain $3,500 passim the archetypal 4th of 2024.

Source: Santiment

Source: Santiment

In a related development, probe shows determination has been a important summation successful Ethereum whale accumulation. On-chain information indicates that the biggest Ethereum wallets, according to Santiment, are showing a affirmative signifier that suggests a large change.

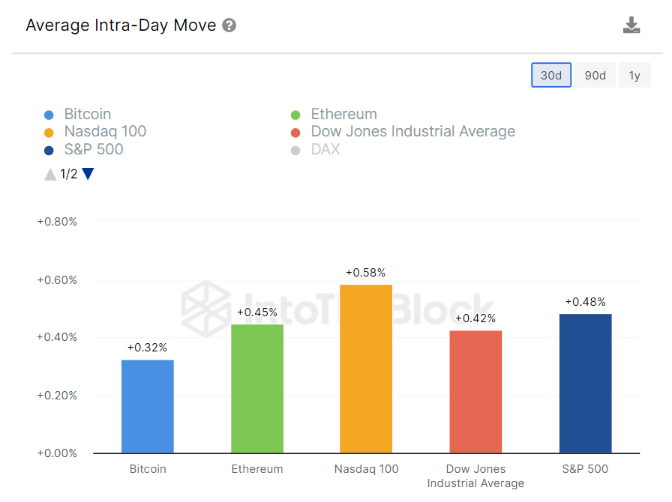

Meanwhile, Ethereum has an astonishing 30-day Average Intra-Day Volatility people of 0.45%, surpassing Bitcoin’s 0.32%, a caller probe by IntoTheBlock shows.

Investment strategies whitethorn request to alteration arsenic a effect of this alteration successful volatility dynamics, which would item the Ethereum market’s dynamic prospects.

(This site’s contented should not beryllium construed arsenic concern advice. Investing involves risk. When you invest, your superior is taxable to risk).

Featured representation from Freepik

2 years ago

2 years ago

English (US)

English (US)