The past fewer weeks person been a rollercoaster thrust for Ethereum. Buoyed by a waning Bitcoin dominance and an influx of traders seeking greener pastures, Ethereum’s terms surged towards captious absorption levels adjacent $2,500.

Yet, a palpable anxiousness lingers successful the air, fueled by questions astir Ethereum’s semipermanent scalability and the expanding chorus of bearish whispers. Can the second-largest crypto navigate this tightrope locomotion and reclaim its DeFi crown, oregon volition it instrumentality a tumble from grace?

Ethereum Rises: Growth, Innovations, And Challenges

Beneath the aboveground of rising terms charts lies a analyzable communicative of intertwined strengths and weaknesses. Ethereum’s awesome 87% year-on-year marketplace headdress surge, catapulting it from $140 cardinal to a hefty $267 billion, paints a representation of robust growth.

The Merge upgrade, a landmark lawsuit streamlining Ethereum’s blockchain, and the burgeoning DeFi ecosystem pulsating with innovative applications are cardinal contributors to this ascent.

However, lurking beneath this facade is simply a captious bottleneck: Ethereum’s Layer 1 scalability limitations. The network’s notorious precocious transaction fees and sluggish throughput person go thorns successful the broadside of DeFi expansion, frustrating some users and developers yearning for a smoother experience.

As of writing, connected this 26th of December, Ethereum’s terms hovers astir $2,233, coating the regular and play charts reddish with a dip of astir 1.5%, information from Coingecko shows. This caller descent adds further intrigue to the analyzable creation Ethereum is performing adjacent the captious $2,500 absorption level.

This delicate creation betwixt bullish aspiration and bearish unit underscores the fragile equilibrium successful the market. On 1 hand, the optimism surrounding Ethereum’s aboriginal imaginable continues to gully successful traders.

On the different hand, the specter of precocious transaction fees and scalability woes, alongside whispers of a imaginable carnivore market, keeps selling unit simmering conscionable beneath the surface.

Ethereum At $2,300: Bulls’ Battle, Bears’ Threats

For Ethereum bulls, the $2,300 level is simply a important battleground. If they tin muster capable buy-side unit to prolong a ascent supra this mark, it could pave the mode for a surge towards the coveted $2,500 absorption level. This breakthrough would beryllium a important intelligence victory, injecting caller assurance into the marketplace and perchance triggering a caller upward inclination phase.

However, the bears are not retired for the count. Their sights are acceptable connected breaching the $2,200 enactment level, which would solidify their grip and perchance trigger a much important decline. Should this script unfold, the $2,000 people could travel into play, with further losses imaginable if selling unit remains unchecked.

Adding to the intrigue is the origin of speech supply. A caller summation successful Ethereum tokens connected exchanges indicates much readily disposable ETH for sellers, perchance amplifying downward pressure. This highlights the delicate equilibrium betwixt marketplace sentiment and method factors successful determining Ethereum’s aboriginal trajectory.

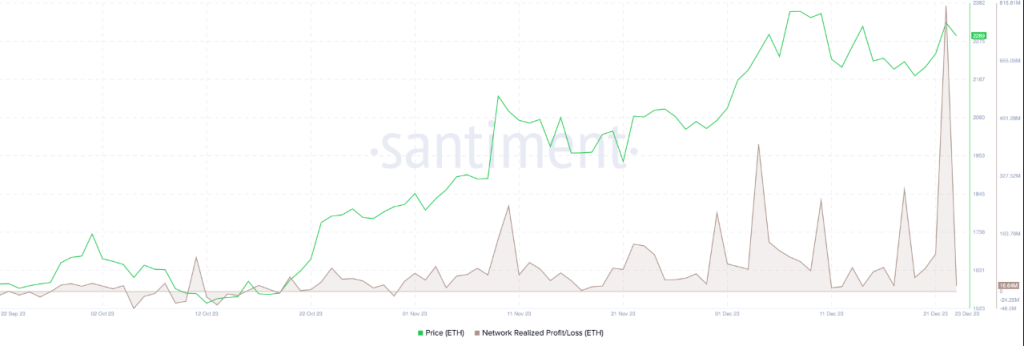

Meanwhile, the ETH traders’ profit-taking is evident successful the Network Realized Profit/Loss betwixt October 31 and December 23. A important magnitude of profit-taking whitethorn origin the terms of ETH to decline.

Ethereum’s Critical Crossroads Ahead

Looking ahead, Ethereum’s way hinges connected its quality to navigate this analyzable landscape. Addressing its scalability issues done Layer 2 solutions and imaginable aboriginal upgrades volition beryllium important for maintaining and expanding its DeFi dominance.

Rekindling developer and idiosyncratic assurance by reducing transaction fees and improving web throughput is besides paramount. Only by tackling these interior challenges and adapting to the ever-evolving crypto sphere tin Ethereum genuinely reclaim its throne arsenic the king of DeFi.

The adjacent fewer weeks are apt to beryllium pivotal for Ethereum. Will it standard the $2,500 tallness and cement its presumption arsenic a person successful the crypto revolution? Or volition interior limitations and outer pressures unit it to look a precipitous drop?

Featured representation from Shutterstock

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)