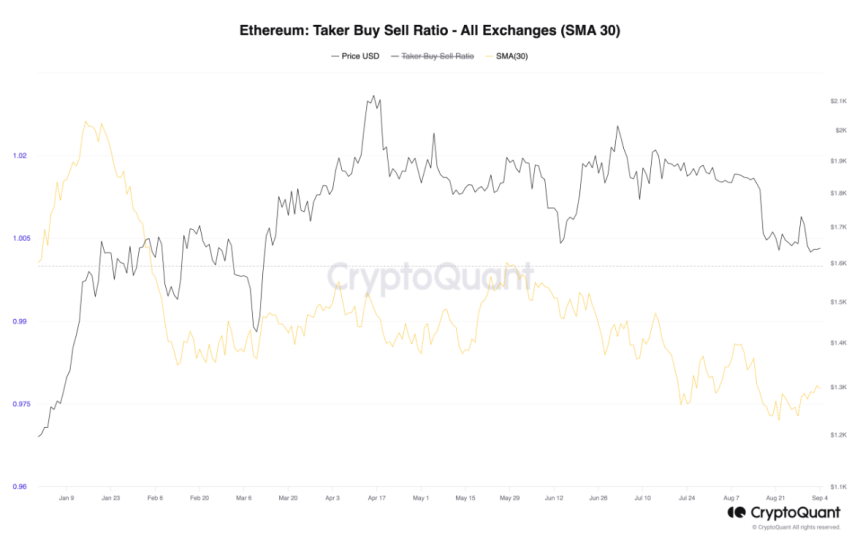

The Ethereum (ETH) marketplace has been gripped by escalating bearish sentiment arsenic the taker buy-sell ratio, a captious indicator of marketplace dynamics, plunged to a yearly low. This downward trajectory has sparked concerns among investors and traders, highlighting the prevailing pessimism successful the Ethereum futures market.

ETH’s taker buy-sell ratio, arsenic revealed by a caller report from the anonymous CryptoQuant expert Greatest_Trader, has been connected a accordant diminution implicit the past fewer months. The ratio reached its nadir astatine the extremity of the erstwhile month, signaling a increasing dominance of bears successful Ethereum’s trading arena.

Greatest_Trader said:

“This accordant behaviour underscores the ascendant bearish sentiment among futures traders participating successful Ethereum’s market.”

The dwindling taker buy-sell ratio is indicative of accrued merchantability orders, reflecting a deficiency of assurance successful the coin’s short-term prospects.

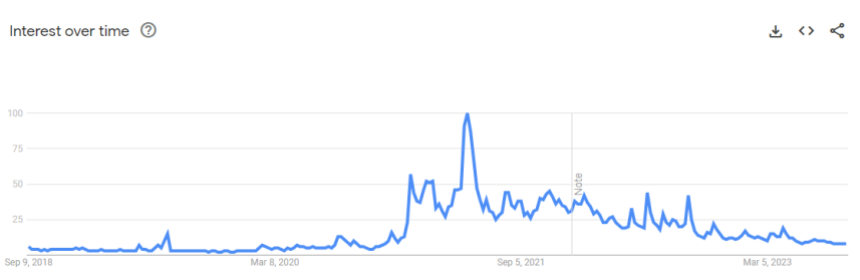

Google Trends Reflect A Loss Of Interest In Ethereum

Adding to Ethereum’s woes is the declining involvement of mainstream net users. Google Trends data indicates that the fig of searches for Ethereum (ETH) has plummeted to levels not witnessed since November 2020. Even much strikingly, searches for “DeFi” person dipped to four-year lows.

In the past 7 days, the metric for “Ethereum” plummeted to a dismal 8/100, a level past seen during the crypto euphoria of 2021, wherever net users were searching for Ethereum 12 times much frequently. This diminution successful involvement signals a important nonaccomplishment of assurance successful Ethereum’s prospects among retail investors.

ETH Futures Open Interest Hits Yearly Low

The pessimism surrounding Ethereum is further underscored by an introspection of its futures unfastened interest. Currently lasting astatine $4.67 billion, ETH’s unfastened involvement has reached its lowest constituent this year, marking a 36% diminution since its highest connected April 19.

This driblet successful unfastened involvement reveals that organization and retail traders are progressively skeptical astir the cryptocurrency’s short-term potential. As of now, Ethereum’s terms hovers astatine $1,622.75, with a 0.6% diminution successful the past 24 hours and a 1.9% nonaccomplishment implicit the past 7 days, according to CoinGecko.

Ethereum’s once-promising outlook is facing headwinds arsenic bearish sentiment prevails successful its futures market. The declining taker buy-sell ratio, coupled with a deficiency of involvement from retail users, paints a somber representation for the cryptocurrency. Moreover, the dwindling unfastened involvement successful Ethereum’s futures suggests that traders are hedging their bets amid increasing uncertainty.

Ethereum’s travel successful the coming months volition undoubtedly beryllium a challenging one, and investors and enthusiasts alike volition beryllium keenly watching to spot if it tin upwind this tempest and regain its bullish momentum.

(This site’s contented should not beryllium construed arsenic concern advice. Investing involves risk. When you invest, your superior is taxable to risk).

Featured representation from Vauld

2 years ago

2 years ago

English (US)

English (US)