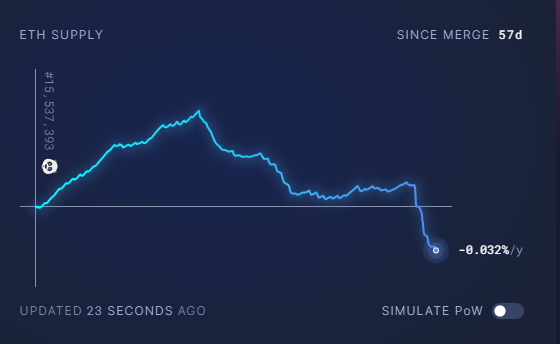

Ethereum became the astir deflationary successful its history, arsenic the yearly proviso dipped beneath zero for the archetypal clip since the Merge.

According to Ultrasound Money, the yearly ostentation complaint has fallen to -0.032/year, which indicates that the web is present burning much Ethereum than its minting.

The antagonistic ostentation complaint has decreased Ethereum’s nett proviso by 5,598 since Ethereum switched to proof-of-stake statement connected September 15.

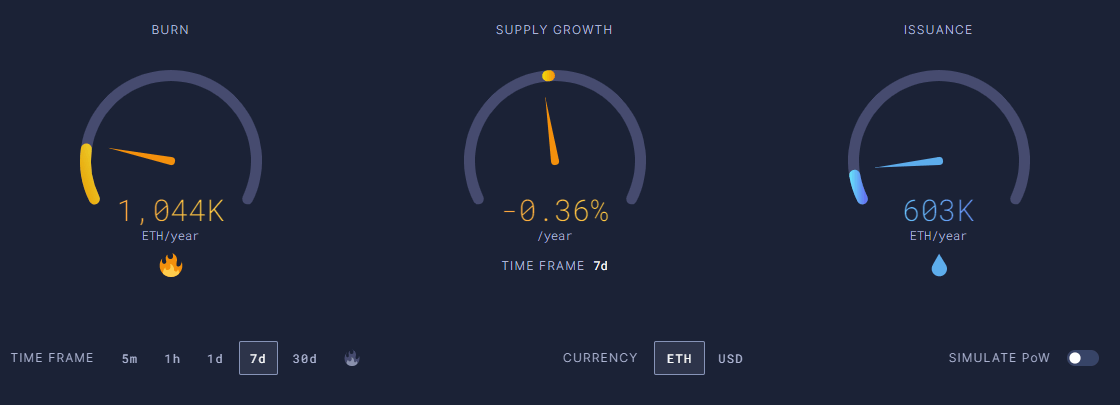

Within a 7-day timeframe, Ethereum has burned 1,044k tokens against 603,000 issued, a complaint of 773,000 tokens per year, which shows ETH’s proviso is going down by 0.36% per year.

The caller changes tin beryllium attributed to the Merge upgrade and the abrupt emergence successful transactions owed to marketplace uncertainties.

After Ethereum’s upgrade from Proof-of-Work (PoW) to Proof of Stake(PoS), Ethereum became a deflationary asset. The upgrade replaced miners with validators replaced successful moving the blockchain, causing a important simplification successful recently minted ETH. As a result, Ethereum’s annualized ostentation complaint dropped to astir zero aft the Merge, but it took immoderate clip to scope the existent level.

Moreover, the caller surge successful Ethereum web enactment during the FTX debacle accrued ETH burn.

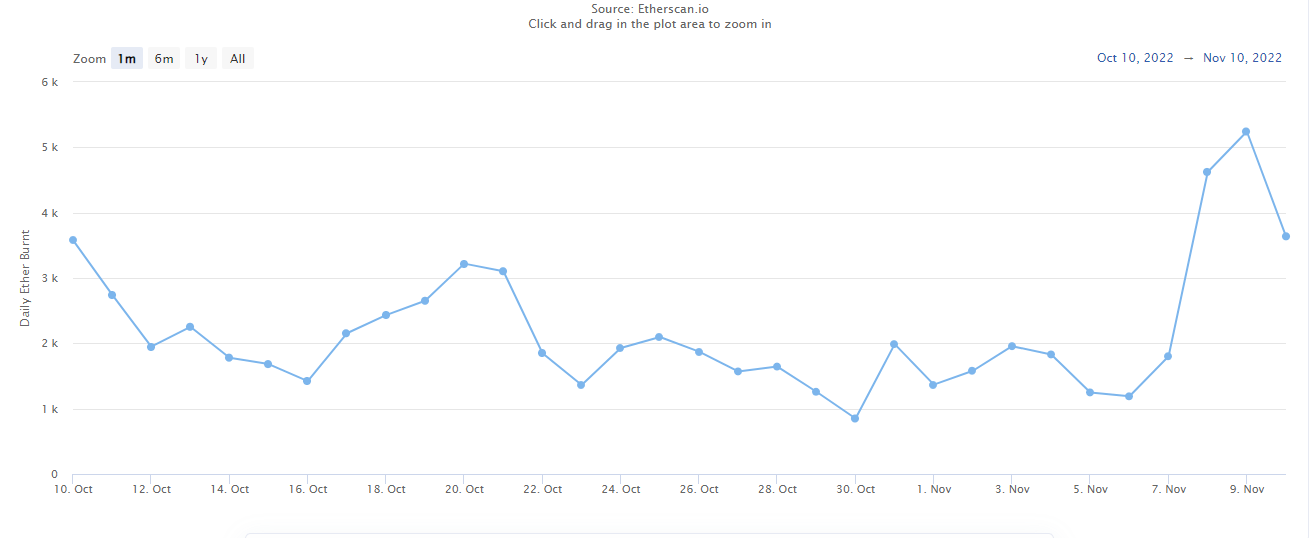

Recently, Etherscan reported the highest regular tally since June, arsenic 5,242 ETH burned connected Wednesday. The magnitude of ETH burned this week was implicit 15,305 arsenic of Thursday.

Source: Daily ETH Burn

In total, 2.72 cardinal ETH person been burned connected the Ethereum web since August 2021, aft the Ethereum Improvement Proposal (EIP)-1559 went live. In essence, the EIP relates ETH pain to web usage.

Ethereum to outperform Bitcoin?

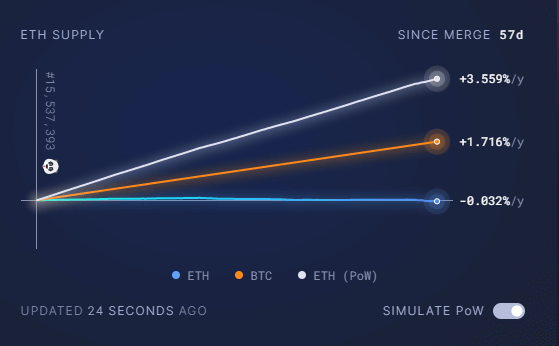

Compared to the PoW, the ostentation complaint of Ethereum was 3.559% per year, with 4,931k Ethereum being issued annually. On the different hand, Bitcoin has a maturation complaint of 1.716% per year.

Ether’s deflationary prospects whitethorn boost its scarcity overall, and when the panic caused by the FTX fades, Ether’s tokenomics could outperform bitcoin.

Currently, Ethereum is trading astatine $1277.15, down 29.4% from its 7-day precocious of $1653.29.

The station Ethereum becomes astir deflationary successful past arsenic enactment spikes amid FTX collapse appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)