Ethereum › Iran · Russia · Venezuela › Regulation

MetaMask shoots itself successful the ft by blocking "certain jurasdictions," a excavation deeper reveals the Ethereum ecosystem is successful furniture with JPMorgan.

Samuel Wan • Mar. 4, 2022 astatine 12:30 p.m. UTC • 2 min read

Samuel Wan • Mar. 4, 2022 astatine 12:30 p.m. UTC • 2 min read

Cover art/illustration via CryptoSlate

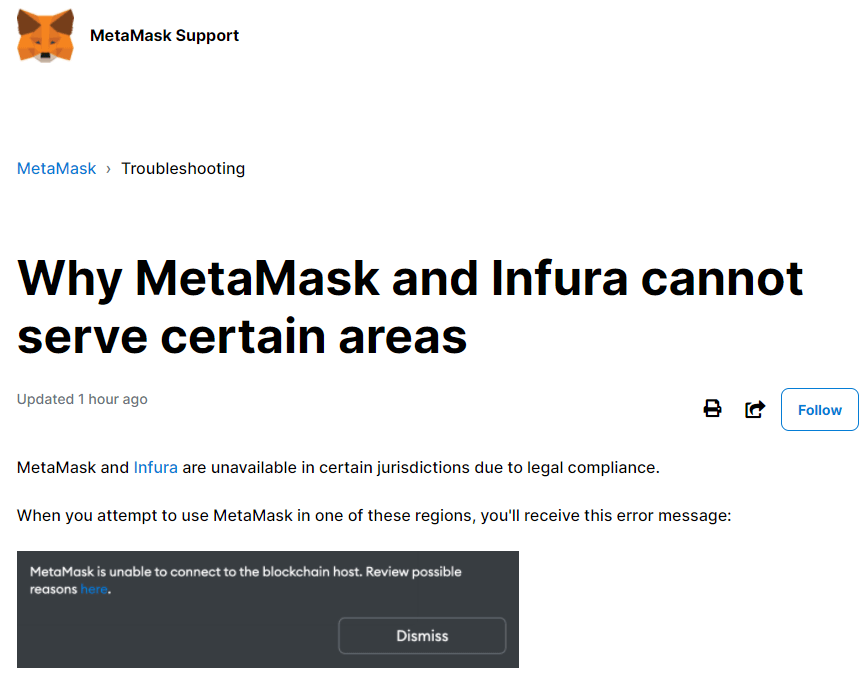

MetaMask users successful Iran and Venezuela reported problems with completing transactions yesterday. It aboriginal emerged that affected users were deliberately blocked for “legal compliance” reasons.

This is imaginable due to the fact that MetaMask uses an API oregon gateway work done Infura. Like MetaMask, Infura is besides owned by Ethereum developers ConsensSys, pursuing its acquisition successful October 2019.

“Infura is a Web3 backend and Infrastructure-as-a-Service (IaaS) supplier that offers a scope of services and tools for blockchain developers. This includes the Infura API (Application Programming Interface) suite.“

As expected, the assemblage effect wasn’t pretty, with deceit implicit decentralization being a communal theme. And considering what’s happening successful Russia-Ukraine, immoderate recognize that you oregon I could beryllium next.

The brutal information astir MetaMask censorship

The Block’s VP of Research, Larry Cermak, said that if MetaMask is prepared to artifact Venezuelan IP addresses, it won’t beryllium agelong earlier they artifact idiosyncratic IP addresses. As a result, Cermak suggested users determination to alternate wallet providers.

“If Metamask/Infura is unfastened and consenting to artifact countries similar Venezuela by IP addresses, it’s lone a substance of clip until they are forced by regulators to censor idiosyncratic people’s IP addresses. We request alternatives immediately, hoping that Alchemy and others don’t bash this.”

But the latest information connected MetaMask users shows determination are 21 million monthly progressive users, making it the most popular wallet connected the market. As such, making the leap to a viable alternate could beryllium tricky.

The Magic Internet Money podcast host, Brad Mills, called Ethereum “a trojan equine for tyranny.” Mills pointed retired that large corporations, including JPMorgan, are down ConsenSys. He added that lone Bitcoin is “government-resistant.”

Ethereum is simply a trojan equine for tyranny.

Consensys owns Infura & Metamask. JP Morgan, UBS, Mastercard ain Consensys.

99% of EVM transactions spell done Consensys.

DeFi is captured by VCs & banks.

Only #bitcoin is government-resistant. Ethereum is not adjacent insider-resistant. pic.twitter.com/zohPDtyD0H

— Brad Mills (🔑,🔑) (@bradmillscan) March 3, 2022

In effect to the backlash, MetaMask said the contented came down to an Infura “misconfiguration” and has present been resolved.

MetaMask is simply a client-side wallet that strives to marque the blockchain maximally accessible to everyone. Infura had a misconfiguration this morning, but it has been corrected now. https://t.co/CYAhvGunHo

— MetaMask 🦊💙 (@MetaMask) March 3, 2022

However, this doesn’t explicate the MetaMask enactment announcement describing the work outage owed to “legal compliance” reasons.

Source: @EdnStuff connected Twitter.com

Source: @EdnStuff connected Twitter.comWhat’s the woody with JPMorgan?

Despite JPMorgan CEO Jamie Dimon calling Bitcoin “worthless” conscionable 5 months ago, that hasn’t stopped the steadfast from trying its manus with crypto. For example, successful creating its ain outgo token successful the JPM Coin, which hasn’t had an update successful a while. As good arsenic its plans to go the first lender successful the MetaVerse.

Covering each bases, the New York-headquartered megabank has besides gone down the way of partnering with established crypto firms.

For example, ConsenSys bought the JPMorgan-built blockchain Quorum successful August 2020 for an undisclosed fee. And April 2021 saw a consortium, including JPMorgan, put $65 million successful ConsenSys.

But the narration betwixt ConsenSys and JPMorgan is deeper than that. A radical of 35 ConsenSys shareholders has demanded a “special audit” of the 2020 deal, which saw JPMorgan get a involvement successful MetaMask and Infura.

It’s alleged the ConsenSys Board had breached its fiduciary duties by approving the woody astatine the detriment of number shareholders. As a result, the radical is seeking to void the agreement.

“fundamental intelligence spot and subsidiaries were illegally transferred from CAG into a caller entity, ConsenSys Software Incorporated (CSI).”

With JPMorgan profoundly embedded successful the Ethereum ecosystem, is it clip to admit ETH isn’t tally for our benefit?

CryptoSlate Newsletter

Featuring a summary of the astir important regular stories successful the satellite of crypto, DeFi, NFTs and more.

Get an edge connected the cryptoasset market

Access much crypto insights and discourse successful each nonfiction arsenic a paid subordinate of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)