Tim Robinson, Head of Crypto Research astatine BlueYard Capital, has unveiled groundbreaking simulations indicating that Ethereum’s implementation of “blobs” could beryllium exceptionally bullish for the semipermanent terms of ETH. In a bid of posts connected X, Robinson highlighted however blobs could revolutionize Ethereum’s scalability and economical dynamics.

“Many radical arguing astir blobs, but truthful acold nary 1 has simulated however they respond to demand… until now,” Robinson stated. “TL;DR: Blobs are insanely bullish for ETH agelong term.”

Why Blobs Are ‘Insanely Bullish’ For Ethereum Price

Blobs, introduced successful Ethereum Improvement Proposal (EIP)-4844, are ample information structures designed to heighten the network’s capableness by efficiently storing and processing information off-chain. This mechanics is pivotal for Layer 2 (L2) scaling solutions, enabling them to connection little transaction fees portion maintaining information done Ethereum’s consensus.

Robinson’s simulation projects Ethereum operating astatine 10,000 transactions per 2nd (TPS), burning 6.5% of its full ETH proviso annually, with L2 transactions costing an mean of $0.06. This script involves 16 MB of blobs per block, aligning with Ethereum co-founder Vitalik Buterin’s medium-term goals outlined successful his latest “The Surge” post.

“Yes, that’s Ethereum operating astatine 10k TPS, burning 6.5% a twelvemonth portion L2 transactions outgo an mean of $0.06, with 16 MB of blobs per block,” Robinson elaborated. “You thought L2’s were parasitic and Vitalik didn’t deliberation this through? Ah, saccharine summertime child, small bash you recognize however insane this volition get erstwhile the Ethereum ecosystem truly kicks into precocious gear.”

A cardinal penetration from Robinson’s probe is the accelerated escalation of ETH burning arsenic blob usage increases. “It’s absorbing however rapidly blobs spell from being escaped to burning a ton of ETH. It seems astir everyone doesn’t recognize this tipping point. It besides makes maine deliberation determination mightiness beryllium a amended pricing mechanism,” helium observed.

Robinson provides a simulation instrumentality illustrating the ETH pain rate‘s exponential maturation arsenic TPS scales from the existent ~180 TPS to 400 TPS. The information shows burned ETH expanding from astir 4 ETH per time to 1,832 ETH per day.

It’s absorbing however rapidly blobs spell from being escaped to burning a ton of ETH. It seems astir everyone doesn’t recognize this tipping point. It besides makes maine deliberation determination mightiness beryllium a amended pricing mechanism.

Here’s what it looks similar expanding from today’s ~180TPS to 400TPS pic.twitter.com/fjuK19NL6y

— Tim Robinson (@timjrobinson) October 29, 2024

The scalability imaginable is further enhanced by the implementation of Peer Data Availability Sampling (PeerDAS), which allows blob capableness to standard with the fig of validators. “Because full blob capableness scales with full validators, aft PeerDAS is implemented, blobs tin standard arsenic precocious arsenic needed,” Robinson explained. “There are 10k+ nodes to shard the load betwixt them. While different ecosystems conflict nether load, Ethereum volition proviso the satellite with cheap, abundant block-space portion being highly deflationary.”

An intriguing feedback loop identified by Robinson is the inverse narration betwixt ETH terms and the pain rate. “Another absorbing feedback loop is the little the ETH price, the higher the burn! As transaction prices are lower, much transactions are made, and the pain soars,” helium noted. “See however antithetic the pain is with ETH astatine $2k vs ETH astatine $10k”.

Another absorbing feedback loop is the little the ETH price, the higher the burn! As transaction prices are lower, much transactions are made, and the pain soars. See however antithetic the pain is with ETH astatine $2k vs ETH astatine $10k: pic.twitter.com/tbSbC6unwM

— Tim Robinson (@timjrobinson) October 29, 2024

Addressing the question of worth accrual for ETH, Robinson stated, “So however volition ETH accrue value? Being the astir useful, scarce, deflationary plus with 10,000+ teams utilizing Ethereum to turn their products volition astir apt bash it. Long term, ETH has the champion fundamentals successful the world; it conscionable takes clip for them to play out.”

The probe sparked enthusiasm and discussions wrong the ETH community. Mat (@materkel) commented connected X: “Will beryllium highly absorbing erstwhile we deed blob capacity. My conjecture is simply a batch of L2s inactive request to fig retired however to grip this lawsuit and decently interest their users. There volition beryllium a batch of inefficiencies to fix; we conscionable didn’t truly person aggregate competing L2s successful this script before. Once the particulate settles, we’ll person due terms find some for fees connected L2s unneurotic with blobs connected L1.”

Robinson responded, emphasizing the value of proactive analysis: “Yeah, absolutely! I’m trying to bring the information truthful we tin lick immoderate problems earlier we get there. The marketplace becomes much unchangeable with much blobs, but successful the aboriginal days, fees could beryllium rather volatile.”

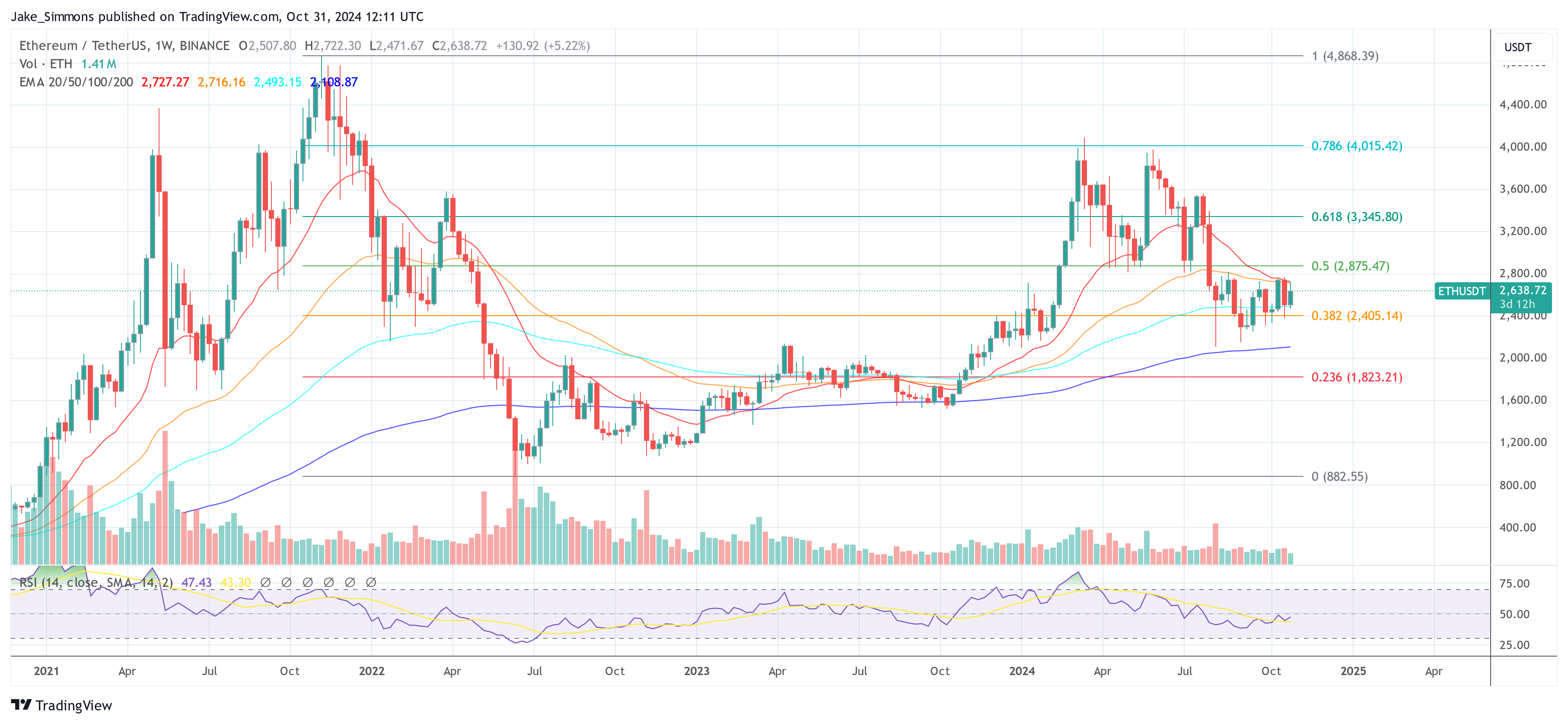

At property time, ETH traded astatine $2,638.

Ethereum terms needs to interruption the 0.5 Fib, 1-week illustration | Source: ETHUSDT connected TradingView.com

Ethereum terms needs to interruption the 0.5 Fib, 1-week illustration | Source: ETHUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)