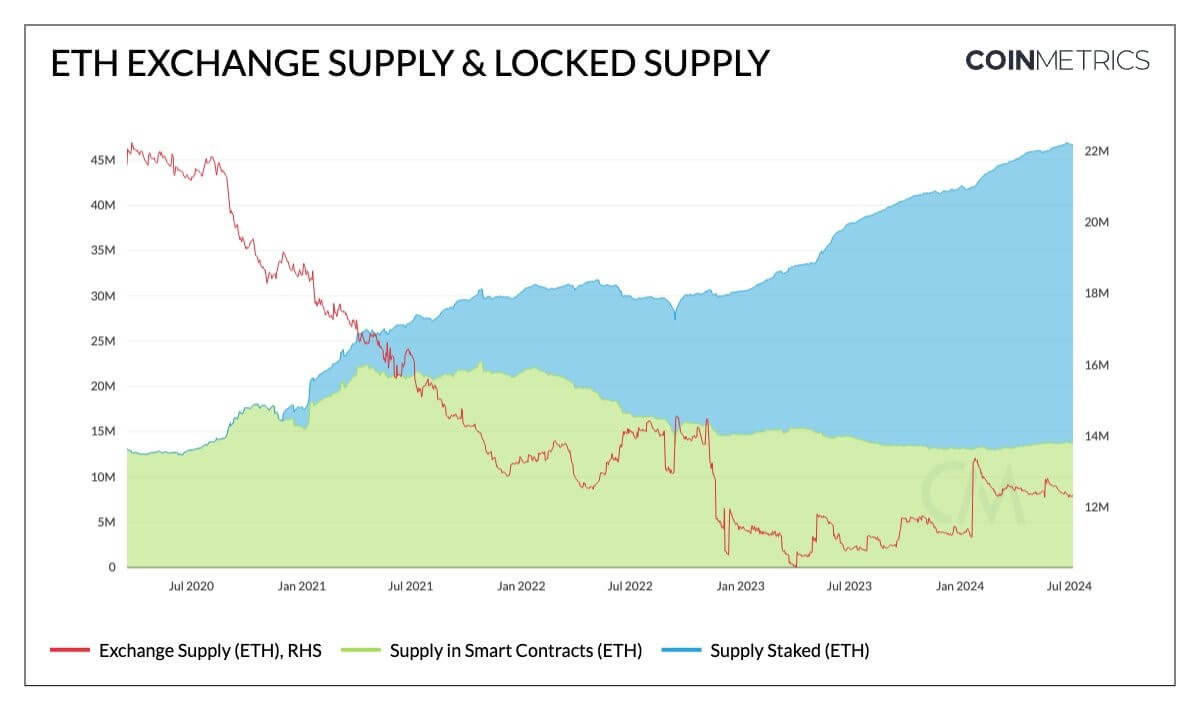

Approximately 40% of Ethereum proviso is locked arsenic the marketplace anticipates the last support for ETH spot-based exchange-traded funds (ETFs).

A breakdown of this “locked supply” shows that implicit 33 cardinal ETH is staked connected the network, representing astir 28% of Ethereum’s full supply, according to Dune Analytics data.

Proof-of-stake networks similar Ethereum necessitate users to “lock up” their integer assets to enactment its information and operations, and successful return, they gain rewards.

Ethereum Locked Supply (Source: CoinMetrics)

Ethereum Locked Supply (Source: CoinMetrics)Additionally, 12% of the proviso is locked successful astute contracts and bridges, which are seeing precocious adoption lately. For example, A.J. Warner, Chief Strategy Officer astatine Offchain Labs, noted that ETH successful the Arbitrum One span has consistently accrued implicit the past 3 years.

Market observers judge this important ETH lockup and the impending ETF support volition boost ETH prices. Tom Dunleavy, Managing Partner astatine MV Capital, pointed retired that the support of spot Ether ETFs volition importantly interaction the market. He stated:

“The spot ETH ETF flows are going to rapidly determination this market.”

ETF approval

Meanwhile, anticipation continues to turn surrounding the last approvals for a spot Ethereum ETF successful the United States.

On July 9, Bitwise’s Chief Commercial Officer, Katherine Dowling, said the ETFs are nearing approval, pointing retired that the Securities and Exchange Commission (SEC) was addressing lone a fewer remaining issues.

Dowling suggested the products mightiness beryllium approved implicit the summer, a sentiment echoed by Bloomberg ETF expert James Seyffart.

Seyffart speculated that support could travel by the extremity of the period contempt his debased assurance successful nonstop motorboat day predictions. He said:

“I person reasonably debased assurance successful those motorboat day predictions astatine this point. There’s nary deadline & SEC’s Corp Fin is taking its clip present (I don’t blasted them). But these changes were precise minimal and [i don’t know] wherefore the ETFs wouldn’t beryllium acceptable to spell wrong a mates of weeks.”

Meanwhile, crypto bettors connected Polymarket expect the products to motorboat earlier the extremity of the month, with an 87% accidental of being listed for trading by July 26.

The station Ethereum braces for spot ETF boost arsenic 40% of proviso remains locked appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)