Ethereum has experienced a monolithic drop, reaching its lowest level since precocious November 2023. The full marketplace has been deed by utmost volatility, uncertainty, and assertive terms swings, with ETH losing implicit 20% of its worth successful conscionable hours. Investors fearfulness that this correction could widen further arsenic Ethereum struggles to reclaim cardinal request levels.

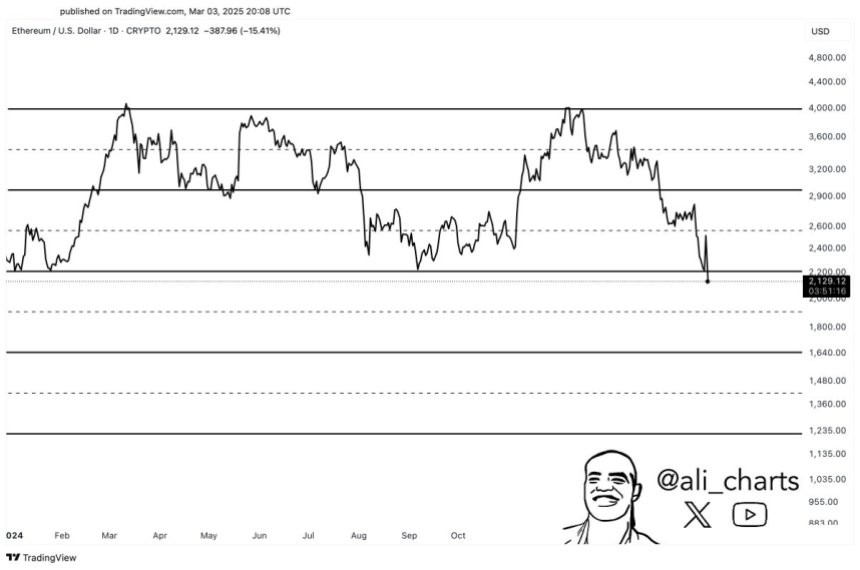

Analysts are intimately monitoring Ethereum’s terms action, arsenic the adjacent fewer days could find the short-term outlook for the second-largest cryptocurrency. Top expert Ali Martinez shared a method investigation connected X, suggesting that Ethereum is connected the verge of breaking retired of a parallel transmission to the downside. If this propulsion beneath the $2,000 people happens, ETH could beryllium acceptable for a deeper correction earlier immoderate betterment attempts.

Ethereum’s weakness raises concerns astir the broader crypto market, arsenic altcoins person besides been deed hard during this latest sell-off. Sentiment remains bearish, and traders are waiting for confirmation of whether ETH volition regain spot oregon proceed dropping toward little request zones. The adjacent fewer trading sessions volition beryllium important successful determining whether Ethereum tin clasp supra captious enactment oregon if further downside is inevitable.

Ethereum Faces More Downside Risk

Ethereum’s terms enactment has been underwhelming arsenic the broader crypto marketplace struggles to find stability. Despite little rallies and crisp declines, ETH has failed to found a wide trend, leaving investors uncertain astir its aboriginal direction. The plus has been stuck successful a prolonged downtrend, consistently mounting caller lows and reinforcing the bearish sentiment crossed the market.

Currently, Ethereum is trading astatine carnivore marketplace prices with small to nary signs of a sustainable recovery. As the marketplace operation weakens, galore investors expect ETH to driblet adjacent further. Analyst Martinez has highlighted a concerning development, noting that Ethereum appears to beryllium breaking down from a parallel transmission that has contained terms for months. ETH could beryllium connected way for a crisp determination toward $1,250, a level that would awesome a deeper marketplace collapse.

Ethereum breaking beneath multi-year enactment level | Source: Ali Martinez connected X

Ethereum breaking beneath multi-year enactment level | Source: Ali Martinez connected XA driblet to $1,250 would not lone reenforce Ethereum’s bearish outlook but besides service arsenic a cardinal awesome for a broader marketplace breakdown. This script could pb to panic selling crossed the board, dragging different large assets little and confirming an extended carnivore market. Despite occasional terms swings, Ethereum remains astatine a captious juncture, with bulls struggling to reclaim cardinal enactment levels. Unless ETH tin reclaim mislaid crushed and found a beardown enactment base, the hazard of further downside remains high.

With Ethereum failing to amusement spot amid marketplace volatility, investors stay cautious, anticipating little terms levels earlier immoderate meaningful betterment tin instrumentality place. The coming days volition beryllium important successful determining whether ETH tin stabilize oregon if Martinez’s $1,250 people volition go a reality, confirming the bearish outlook for the full crypto market.

ETH Testing Critical Demand Level

Ethereum is trading astatine $2,090 aft a play of anemic terms action, marking a 30% diminution since February 24. This important driblet has near investors questioning whether ETH tin support its semipermanent bullish operation oregon if a deeper correction is imminent.

ETH Trading Below Key Levels | Source: ETHUSDT illustration connected TradingView

ETH Trading Below Key Levels | Source: ETHUSDT illustration connected TradingViewCurrently, Ethereum is astatine a captious enactment level that indispensable clasp to prolong immoderate anticipation of a bullish continuation. A breakdown beneath this level would apt corroborate a carnivore marketplace scenario, pushing ETH toward little terms levels arsenic selling unit intensifies. The uncertainty surrounding Ethereum’s terms enactment has near traders cautious, arsenic immoderate further weakness could accelerate the decline.

However, a betterment remains imaginable if ETH tin reclaim the $2,500 absorption level. Such a determination would awesome renewed buying momentum and could spark a beardown recovery, perchance reversing the caller bearish trend. If Ethereum manages to flip $2,500 into support, it would bespeak renewed assurance successful the plus and acceptable the signifier for higher terms targets.

For now, each eyes are connected Ethereum’s quality to support $2,090. The coming days volition beryllium important successful determining whether ETH tin stabilize oregon if the marketplace is heading toward a much prolonged bearish phase.

Featured representation from Dall-E, illustration from TradingView

7 months ago

7 months ago

English (US)

English (US)