Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

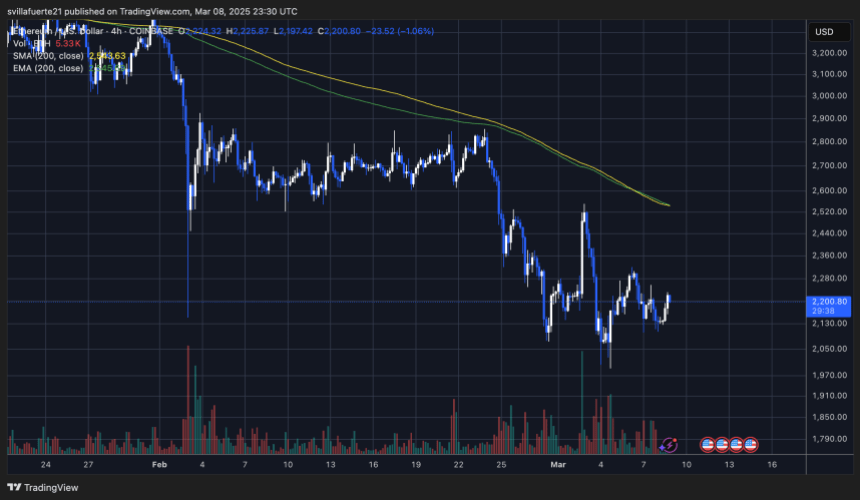

Ethereum (ETH) has been struggling astir the $2,200 level, with bulls incapable to reclaim higher prices contempt aggregate attempts. The marketplace sentiment remains bearish, arsenic ETH continues to look selling unit adjacent aft Thursday’s announcement of the US Strategic Bitcoin Reserve, which galore had expected to boost wide assurance successful the crypto sector.

As ETH hovers adjacent captious request levels, analysts judge that the adjacent week volition beryllium important successful determining its short-term direction. If bulls tin support cardinal enactment zones, Ethereum whitethorn person a accidental to regain momentum. However, nonaccomplishment to clasp these levels could pb to further downside pressure.

Top expert Carl Runefelt shared a method investigation connected X, highlighting that Ethereum is breaking retired of a pattern that often signals a imaginable breakout. If ETH follows this setup, it could propulsion into higher absorption zones and reclaim cardinal terms levels supra $2,500. However, confirmation of this breakout is needed, arsenic marketplace volatility remains high.

Ethereum Bulls Hope For A Recovery

Ethereum has suffered a steep decline, losing implicit 50% of its worth since precocious December, triggering fearfulness and panic selling crossed the market. Once a person successful erstwhile bull cycles, ETH is present struggling to regain momentum, starring galore analysts to question whether the long-awaited altseason volition hap this year. With Ethereum and astir altcoins incapable to reclaim bullish structures, the marketplace remains nether bearish control, keeping investors cautious.

Despite the antagonistic sentiment, determination is inactive anticipation for a recovery as Ethereum approaches cardinal method levels that could find its adjacent move. Runefelt’s remarks reveal that ETH is breaking supra a descending triangle pattern, a setup that often signals a inclination reversal. However, confirmation is crucial, arsenic galore past breakouts person turned into fakeouts, trapping traders successful further downside moves.

Ethereum Breaking Above Descending Triangle | Source: Carl Runefelt connected X

Ethereum Breaking Above Descending Triangle | Source: Carl Runefelt connected XFor Ethereum to solidify a bullish breakout, it indispensable propulsion supra and adjacent supra $2,300. This level is simply a cardinal absorption zone, and flipping it into enactment would bespeak renewed buying strength, perchance opening the doorway for a propulsion toward $2,500 and higher terms targets.

Until this confirmation happens, Ethereum remains astatine hazard of further declines if sellers regain control. Traders and investors are intimately watching whether ETH tin support its breakout effort oregon if it volition look different rejection, extending its bearish inclination into the coming weeks.

ETH Key Levels To Watch

Ethereum is presently trading supra the $2,000 enactment level, a important past enactment of defence for bulls hoping to spot beardown show this year. Holding this level is essential, arsenic a breakdown beneath $2,000 could trigger further downside, reinforcing bearish sentiment successful the market.

ETH terms struggling beneath $2,300 | Source: ETHUSDT illustration connected TradingView

ETH terms struggling beneath $2,300 | Source: ETHUSDT illustration connected TradingViewDespite this, bulls person struggled to reclaim higher prices, leaving investors frustrated with ETH’s deficiency of momentum. Recent terms enactment has been choppy and indecisive, with each effort astatine a breakout rapidly met with selling pressure. This has kept ETH stuck successful a choky range, preventing a wide displacement successful marketplace sentiment.

However, a decisive reclaim of $2,300 could people a turning point. If ETH pushes supra and holds this level, it would apt unfastened the doorway for a determination toward $2,500, strengthening the lawsuit for a betterment rally. Until then, traders stay cautious, arsenic Ethereum’s conflict to summation traction continues to measurement connected the broader altcoin market.

Featured representation from Dall-E, illustration from TradingView

10 months ago

10 months ago

English (US)

English (US)