Recent developments successful the crypto marketplace bespeak a beardown bullish sentiment among Ethereum traders, peculiarly successful the options market.

Amid the increasing anticipation for imaginable approvals of spot Ethereum exchange-traded funds (ETFs), determination has been a noticeable displacement successful enactment pricing, with Ethereum telephone options becoming much costly than enactment options crossed each expiries.

This pricing signifier suggests the marketplace is optimistic astir Ethereum’s terms prospects. Notably, A telephone enactment gives the holder the right, but not the obligation, to bargain an plus astatine a specified terms wrong a circumstantial clip frame.

This enactment benignant is typically purchased by traders who judge the asset’s terms volition increase. Conversely, a enactment enactment provides the holder the close to merchantability the plus astatine a predetermined terms and is often utilized arsenic extortion against a diminution successful the asset’s price.

Market Indicators Point To A Bullish Ethereum

Luuk Strijers, CEO of Deribit, highlighted this inclination successful his connection with The Block. He noted that the “put minus telephone skew is antagonistic crossed each expiries and expanding further beyond the end-of-June expiry, a rather bullish signal.”

Additionally, the basis, oregon the annualized premium of the futures terms implicit the spot price, has accrued to astir 14%, further reinforcing the bullish outlook.

The investigation reveals that traders similar to acquisition telephone options astatine a premium compared to enactment options, peculiarly for those acceptable to expire astatine the extremity of June and later.

This signifier is simply a motion of a bullish market, indicating that traders are not arsenic funny successful securing extortion against imaginable terms drops arsenic they are successful anticipating that Ethereum’s value volition support climbing.

Meanwhile, aft the US Securities and Exchange Commission (SEC) unexpectedly asked for changes successful filings, determination has been a resurgence successful optimism regarding the imaginable support of spot Ethereum ETFs.

This optimism has translated into important marketplace activity, with Deribit experiencing astir unprecedented trading volumes. Strijers remarked, “We recorded an astir unprecedented trading measurement of $12.5 cardinal notional implicit the past 24 hours.”

This surge successful trading measurement and marketplace involvement reflects however traders and investors presumption themselves to capitalize connected the imaginable support of spot Ethereum ETFs.

According to data from Deribit, implicit $480,000 calls volition expire by the extremity of this month, with a notional worth of much than $1.7 billion.

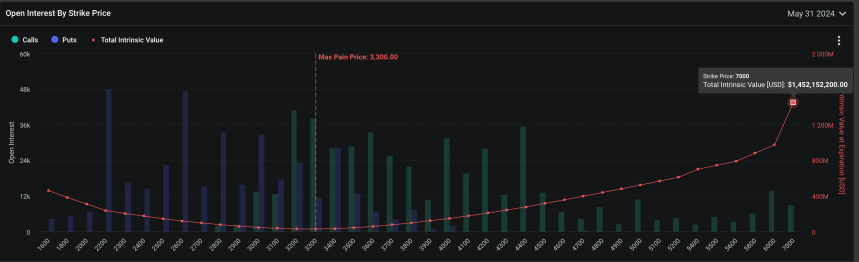

Ethereum Open Interest By Strike Price. | Source: Deribit

Ethereum Open Interest By Strike Price. | Source: DeribitThe information further reveals that the onslaught terms reaches arsenic precocious arsenic $7,000, with a full intrinsic worth of $1.452 billion, indicating that galore Ethereum options traders are highly bullish connected ETH.

ETH Price Performance And Forecast

Meanwhile, Ethereum is undergoing flimsy retracement, down by 2.4% successful the past 24 hours, with a trading terms of $3,690. Despite this pullback, the plus has maintained a beardown uptrend, rising astir 25% implicit the past 7 days.

As the market’s anticipation astir spot ETH ETFs grows, a salient crypto expert has suggested a imaginable terms question for Ethereum, indicating a little pullback astatine around $4,000 earlier surging to caller all-time highs.

According to the analyst, portion determination mightiness beryllium immoderate bumps, reaching an all-time precocious of $5,000 seems “inevitable” for Ethereum.

$ETH: I deliberation we pullback concisely astir 4k but this surely breaks each clip highs if/when ETF gets approved. This inactive seems similar a escaped commercialized for ETH going to ATH, which is astatine 5k. Could beryllium immoderate bumps on the mode but it seems inevitable.

I person some SOL and ETH and not… pic.twitter.com/IznlJ0RAyl

— Altcoin Sherpa (@AltcoinSherpa) May 22, 2024

Featured representation created with DALL·E, Chart from TradingView

1 year ago

1 year ago

English (US)

English (US)