Ethereum has been exhibiting a robust and sustained upward trend, showing its mettle successful the volatile cryptocurrency market. At the clip of writing, the terms of ETH was hovering astir $3,743, surpassing its moving averages with sizeable bullish momentum.

The cryptocurrency assemblage is present eagerly anticipating the breach of the important $3,500 terms threshold, marking a imaginable milestone for Ethereum’s continued ascent to the highly-coveted $4,000 terms tag.

Notably, the existent terms has surged good supra the 50-day moving average, which stands astatine astir $2,700, underscoring the spot of the ongoing bullish trend. Furthermore, the 100-day moving average, situated astatine $2,400, serves arsenic different important enactment level. Historically, these cardinal supports person proven instrumental successful propelling Ethereum prices higher upon retesting.

ETH Surge: Price Correction In The Offing?

Ethereum (ETH) surged alongside Bitcoin (BTC) connected February 28th, reaching wrong spitting region of its all-time precocious of $3,500. While bulls celebrate, a method indicator hints astatine a imaginable intermission successful the rally.

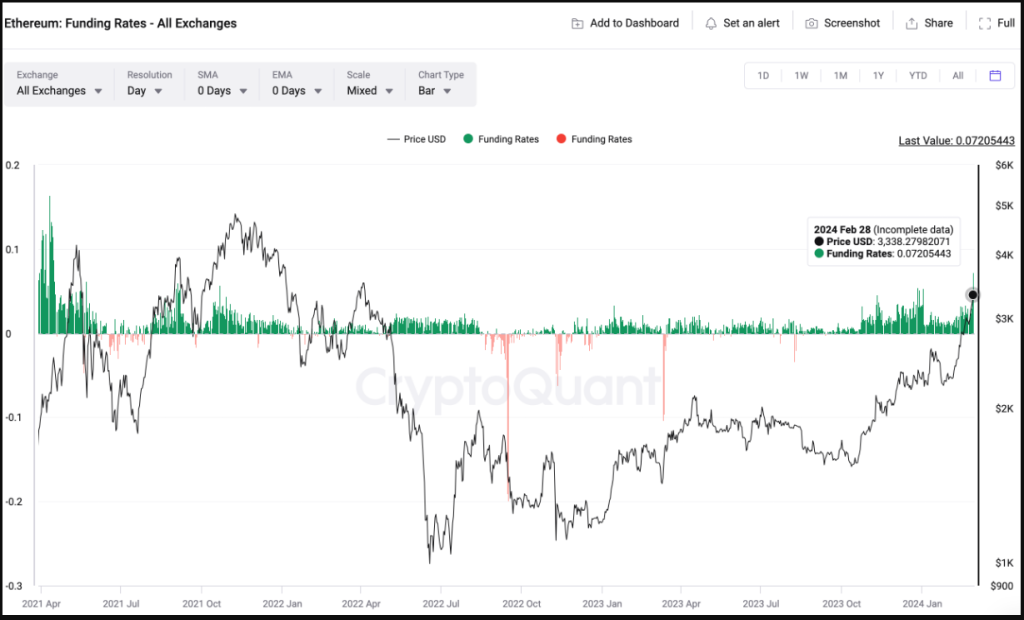

The CryptoQuant Funding Rates metric, reflecting fees paid successful perpetual futures contracts, reveals a important spike for ETH connected February 28th. Reaching 0.07%, it marks the highest level since April 2021, exceeding the 0.06% highest observed earlier ETH’s erstwhile highest of $4,800 successful November 2021. Historically, specified surges successful backing rates person often preceded terms corrections.

Source: CryptoQuant

Source: CryptoQuant

The precocious CryptoQuant Funding Rates not lone suggest a imaginable intermission successful the rally but besides rise concerns astir the sustainability of the existent momentum. Typically, specified melodramatic surges bespeak excessive bullish sentiment and overheated markets fueled by highly leveraged agelong positions.

There are 2 reasons wherefore this script is highly complex. First off, successful the lawsuit that prices crook around, it exposes bulls to important losses. Second, it raises the anticipation of a agelong squeeze, an uncommon concern successful which beardown short-term selling pushes holders of agelong positions to liquidate, frankincense quickening the terms decrease.

ETH up 16% successful the play chart. Source: Coingecko

ETH up 16% successful the play chart. Source: Coingecko

Imagine a domino effect: leveraged agelong positions get called upon borderline calls, forcing liquidation, which triggers further selling, pushing prices down further, and causing much borderline calls. This cascading effect tin pb to panic selling and important losses for overly optimistic investors.

Although determination is nary assurance that a prolonged compression volition occur, the accrued backing rates service arsenic a harsh reminder of the inherent risks that are associated with chasing a highly stretched rally.

💤 A dormant pre-mine code containing 72 #ETH (243,771 USD) has conscionable been activated aft 8.6 years!https://t.co/K8769uQJ0w

— Whale Alert (@whale_alert) February 28, 2024

Old Ethereum Whales Reappear, Sparking Crypto Speculation

In different development, a pre-mine Ethereum wallet that had remained inactive for astir nine years has been reopened, according to information released by the cryptocurrency tracker Whale Alert. It has 72 ETH valued astatine $243,771 successful it.

This tracking level discovered that these 72 ETH funds had been moved to different anonymous cryptocurrency wallet. In summation to this wallet, according to caller sources, a fig of dormant Ethereum whales awoke successful February and held premined Ethereum worthy 100 ETH, 429 ETH, 3,465 ETH (valued astatine astir $10.4 million), and 100 ETH. They had each been dormant for astir 9 years.

Featured representation from Pixabay, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)