Ethereum (ETH), the second-largest cryptocurrency, has seen a important terms summation implicit the past month. The caller bullish unreserved successful the crypto market, coupled with BlackRock’s involvement, has pushed ETH to its year-to-date precocious of $2,139.

Ethereum Outshines Bitcoin And Altcoins

According to marketplace information supplier Kaiko, ETH has outperformed BTC and galore altcoins successful caller weeks, signaling a displacement successful marketplace dynamics.

Kaiko’s study highlights however ETH struggled to summation momentum implicit the past year, contempt palmy upgrades specified arsenic The Merge successful April.

However, the sentiment astir ETH changed dramatically erstwhile BlackRock filed for a spot ETH exchange-traded fund (ETF), starring to a reversal successful the ETH to Bitcoin (BTC) ratio.

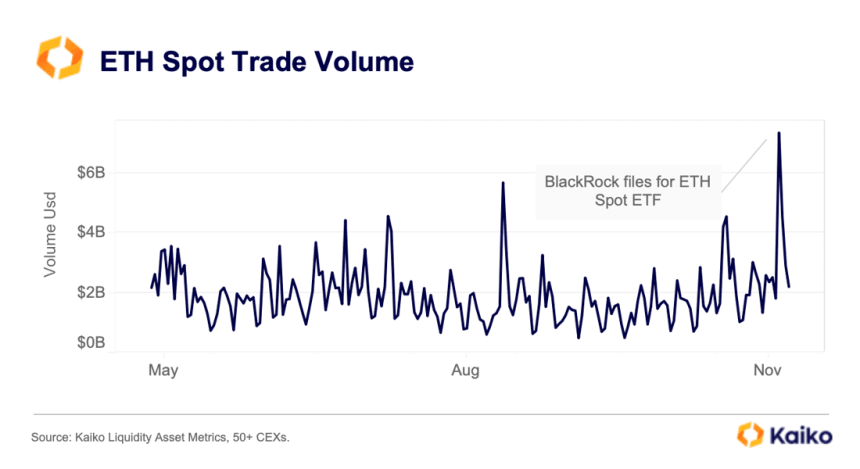

The interaction connected the marketplace was substantial, with ETH prices surging supra $2,000 for the archetypal clip since April. Additionally, regular spot commercialized volumes reached $7 billion, the highest level since the collapse of FTX.

ETH’s regular spot trading measurement surged to $7 billion. Source: Kaiko

ETH’s regular spot trading measurement surged to $7 billion. Source: KaikoThe ETH ETF communicative provided further impetus to the ongoing rally, amplified by improved planetary hazard sentiment and declining US Treasury yields.

The dominance of altcoin + ETH measurement comparative to BTC has risen to 60%, marking its highest level successful implicit a year. During bull rallies, altcoin measurement typically increases comparative to BTC.

This surge successful request has besides led to rising leverage, arsenic reflected successful the betterment of ETH unfastened involvement to aboriginal August levels. Notably, BTC unfastened involvement has declined implicit the past period owed to liquidations connected Binance, resulting successful the Chicago Mercantile Exchange (CME) outpacing Binance arsenic the largest BTC futures market.

Furthermore, ETH backing rates, a gauge of sentiment and bullish demand, person reached their highest levels successful implicit a year, indicating a important displacement successful sentiment. In November, some BTC and ETH 30-day volatility roseate to 40% and 50% respectively, pursuing a multi-year debased of astir 15% during the summertime months.

Crypto Expert Predicts ETH Breakout

Renowned crypto adept Michael Van de Poppe believes that ETH is connected the cusp of a important breakthrough. According to Van de Poppe, if Ethereum manages to surpass the important $2,150 absorption level, it could signify the extremity of the carnivore market.

Drawing a parallel with Bitcoin’s captious $30,000 barrier, Van de Poppe suggests that breaching this level could pave the mode for a important rally, perchance propelling Ethereum towards the terms scope of $3,100 to $3,600.

However, Ethereum has yet to interaction the $2,150 absorption line, arsenic it faces a pre-existing obstacle successful the signifier of its yearly precocious of $2,139. This pivotal level has halted the cryptocurrency’s bullish momentum, acting arsenic a formidable resistance.

As a result, Ethereum has been consolidating wrong a constrictive scope betwixt $2,050 and $2,100 for the past 3 days.

The forthcoming days volition uncover whether Ethereum tin flooded its contiguous absorption levels and found a consolidated presumption supra them. Alternatively, it whitethorn look a destiny akin to Bitcoin, which failed to surpass the $31,000 level for implicit 7 months earlier reaching its existent trading terms of $36,000.

Featured representation from Shutterstock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)