On-chain information shows the Ethereum proviso connected exchanges has continued to driblet little recently, a motion that could beryllium bullish for the asset.

Ethereum Supply On Exchanges Has Gone Down Recently

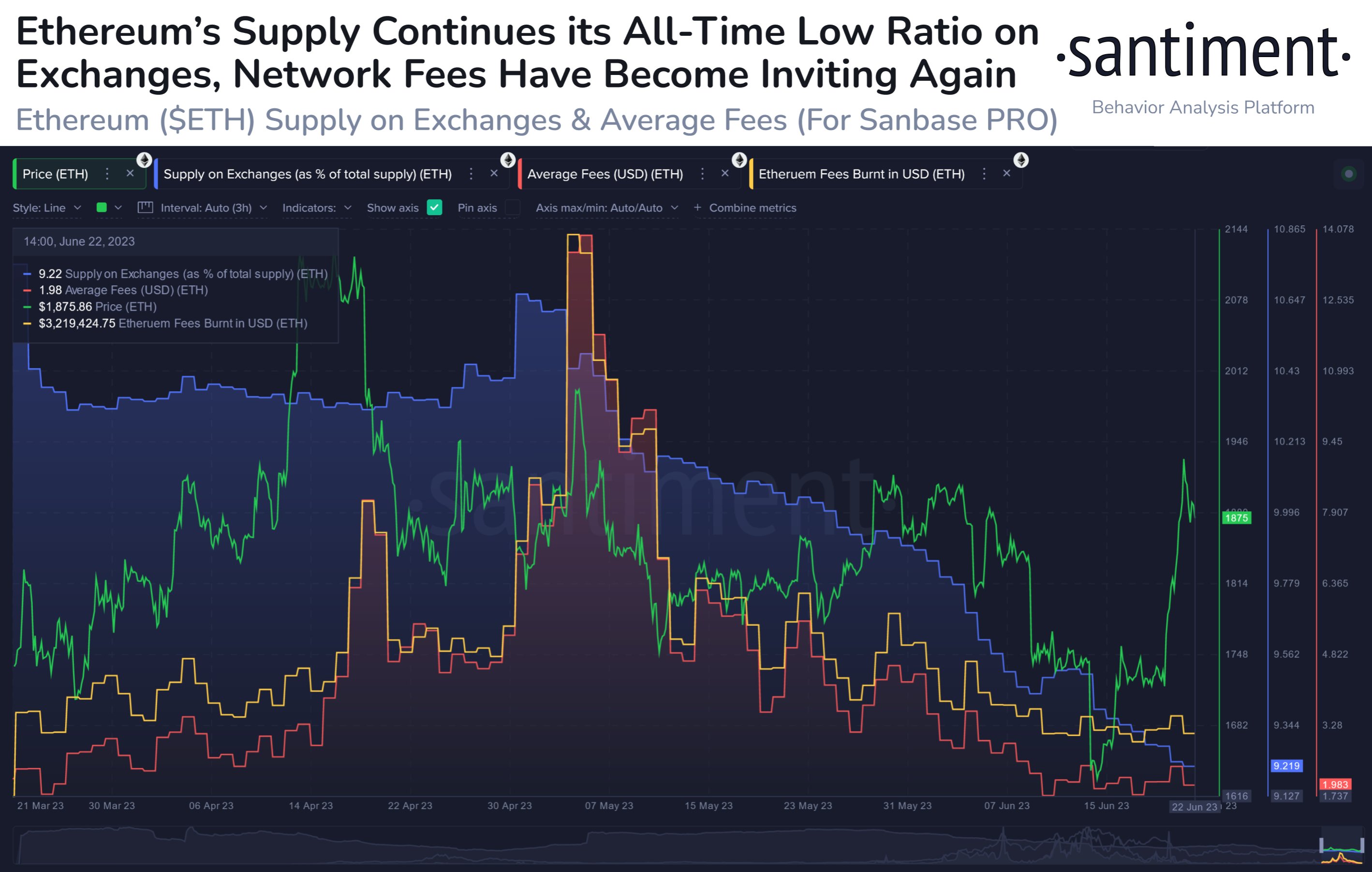

According to information from the on-chain analytics steadfast Santiment, proviso has continued to permission exchanges recently. The applicable indicator present is the “supply connected exchanges,” which measures the full percent of the Ethereum proviso that’s sitting successful the wallets of each centralized exchanges.

When the worth of this metric increases, it means that a nett fig of coins is entering the proviso of these platforms. As 1 of the main reasons wherefore investors mightiness privation to deposit their ETH to the exchanges is for selling-related purposes, this benignant of inclination tin person a bearish effect connected the asset’s value.

On the different hand, decreasing values of the indicator connote the holders are withdrawing their coins from these platforms close now. Such a trend, erstwhile prolonged, whitethorn beryllium a hint that the investors are accumulating currently, and hence, tin beryllium bullish for the cryptocurrency.

Now, present is simply a illustration that shows the inclination successful the Ethereum proviso connected exchanges implicit the past fewer months:

As displayed successful the supra graph, the Ethereum proviso connected exchanges has been successful a downtrend during the past fewer weeks, implying that investors person been perpetually taking retired their coins from these platforms.

When these withdrawals started, the indicator had reached what was fundamentally an all-time debased (the lone clip the metric’s worth was little was mode backmost during the archetypal week of the plus going unrecorded for nationalist trading).

As the holders person continued to transportation their ETH retired of the exchanges, caller all-time lows successful the metric person continued to beryllium hit. Interestingly, adjacent aft the latest sharp rally successful the Ethereum terms has occurred, the metric hasn’t deviated from its downward trajectory.

Usually, during accelerated increases successful the asset’s value, the proviso connected exchanges tends to spell up arsenic immoderate investors look to instrumentality vantage of the profit-taking opportunity.

Since the indicator has lone continued to spell down further recently, it’s imaginable that adjacent if determination is immoderate selling going on, determination is besides capable buying going to marque up for it.

In the chart, Santiment has besides included the information for the “average fees,” an indicator that measures the mean magnitude of fees that investors are attaching to their Ethereum transactions currently.

From the graph, it’s disposable that this metric has been comparatively debased recently. It would look that adjacent though the rally has taken place, the web enactment hasn’t yet exploded, arsenic the fees mostly sprout up erstwhile determination is simply a precocious magnitude of postulation connected the blockchain.

The analytics steadfast notes, however, that this setup is rather akin to that observed backmost successful March, pursuing which Ethereum saw a accelerated emergence toward the $2,100 level.

ETH Price

At the clip of writing, Ethereum is trading astir $1,800, up 12% successful the past week.

Featured representation from DrawKit Illustrations connected Unsplash.com, charts from TradingView.com, Santiment.net

2 years ago

2 years ago

English (US)

English (US)