Ethereum (ETH) presently trades astir 11% beneath its section highs of astir $2,730. Investors are optimistic astir a imaginable terms surge successful the coming days, driven by encouraging on-chain data.

Key metrics from Glassnode bespeak a diminution successful ETH inflows into exchanges, suggesting that investors are holding onto their assets alternatively than selling. This inclination typically points to accrued accumulation and could foreshadow a bullish breakout.

As the broader crypto marketplace evolves, Ethereum investors stay vigilant, anticipating a bullish reclaim that could propel prices higher. The alteration successful speech inflows could signify that traders are positioning themselves for a imaginable upward movement, arsenic they look much inclined to clasp their holdings during this important phase.

Should Ethereum successfully interruption supra captious absorption levels, it could reignite bullish momentum and pull further investment. The adjacent fewer days volition beryllium pivotal for ETH, arsenic traders intimately show terms enactment and on-chain metrics for signs of a resurgence. With the close conditions, Ethereum whitethorn acceptable its sights connected caller highs, reinforcing the wide affirmative sentiment successful the market.

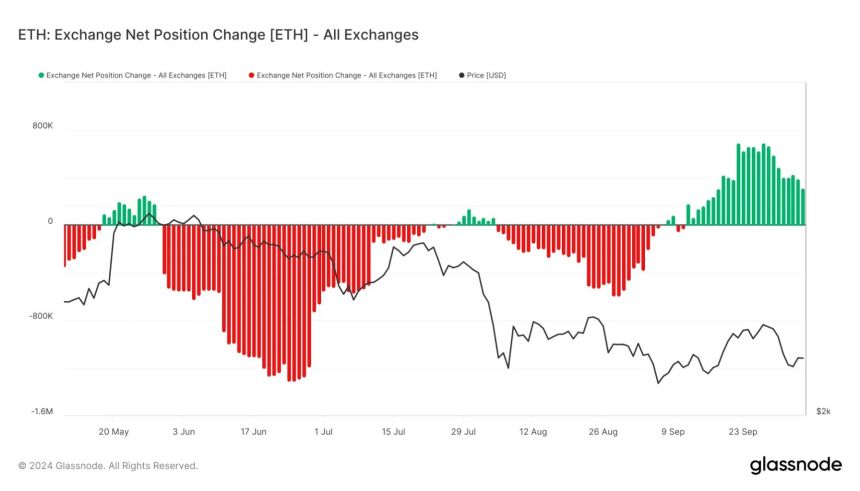

Ethereum Exchanges’ Net Position Change Decreases

Ethereum (ETH) is presently astatine a important terms level pursuing a 15% dip from its section highs. The broader crypto manufacture is brimming with anticipation for a monolithic rally aft the Federal Reserve’s determination to chopped involvement rates a mates of weeks ago. However, contempt the optimistic outlook, prices person struggled to ascent higher, leaving galore investors connected edge.

Fortunately, on-chain information from Glassnode suggests a simplification successful selling pressure, which could amended marketplace sentiment and pave the mode for a imaginable ETH rebound. One cardinal metric to see is the Ethereum Exchanges’ Net Position Change indicator, which has been downward since mid-September. This indicator tracks the travel of ETH into and retired of exchanges, and its caller diminution signifies that inflows person dropped significantly.

Ethereum Exchange Net Position Change decreases. | Source: Glassnode

Ethereum Exchange Net Position Change decreases. | Source: GlassnodeLower inflows typically bespeak reduced selling pressure, arsenic less investors are moving their assets onto exchanges to sell. This displacement successful momentum reflects a affirmative alteration successful marketplace sentiment, suggesting that investors whitethorn beryllium little inclined to liquidate their positions astatine existent terms levels.

As selling enactment decreases, Ethereum could summation immoderate much-needed breathing country to retrieve from its caller decline.

Moreover, accrued assurance among investors mightiness pb to upward terms question successful the coming days. Ethereum whitethorn beryllium positioned for a resurgence if this inclination continues, perchance mounting the signifier for a bullish breakout arsenic marketplace dynamics displacement successful its favor. As traders stay vigilant, each eyes volition beryllium connected ETH to spot if it tin capitalize connected this improved sentiment and regain upward momentum.

ETH Testing Crucial Supply Levels

Ethereum (ETH) is trading astatine $2,448 aft facing rejection astatine the 4-hour 200 exponential moving mean (EMA) astatine $2,516. The terms besides struggled to support momentum supra the 4-hour 200 moving mean (MA) astatine $2,458, indicating a captious infinitesimal for ETH. If Ethereum fails to reclaim some of these cardinal levels successful the coming days, it whitethorn beryllium astatine superior hazard of dropping towards the $2,200 area, perchance triggering a deeper correction.

ETH loses some the 1D 200 EMA & MA. | Source: ETHUSDT illustration connected TradingView

ETH loses some the 1D 200 EMA & MA. | Source: ETHUSDT illustration connected TradingViewConversely, if ETH manages to interruption supra and clasp these important indicators, it could awesome a bullish inclination reversal, opening the doorway for a surge toward the $2,700 absorption area. The result successful the adjacent fewer days volition beryllium captious for determining Ethereum’s trajectory.

Traders and investors volition intimately show these levels, arsenic the quality to reclaim them could supply the momentum needed for ETH to regain spot and effort to trial higher terms levels. The existent terms enactment reflects the uncertainty successful the market, making it imperative for ETH to asseverate itself decisively to animate assurance and thrust a rally.

Featured representation from Dall-E, illustration from TradingView

1 year ago

1 year ago

English (US)

English (US)