According to Fundstrat research, Ether could ascent overmuch higher earlier the extremity of 2025, with terms targets ranging from $10,000 to arsenic precocious arsenic $15,000.

Reports amusement Ether jumped astir 60% implicit the past 30 days and deed a four-year precocious adjacent $4,770 successful aboriginal trading, portion different sum enactment the token astatine $4,694 and noted a 78% surge implicit an eight-week stretch.

Those moves person pushed Ether adjacent to its all-time peak, and money managers are taking notice.

Fundstrat Targets And Rationale

According to Fundstrat’s main accusation serviceman Tom Lee and caput of integer plus probe Sean Farrell, organization forces and caller rules are cardinal drivers.

They constituent to stablecoin enactment and tokenized projects being built mostly connected Ethereum, and they mention regulatory efforts specified arsenic the GENIUS Act and the SEC’s alleged Project Crypto arsenic factors that could velocity Wall Street’s determination onto blockchain rails.

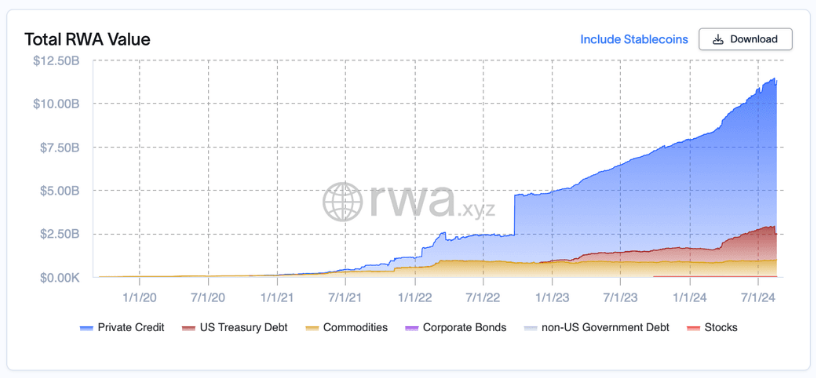

Based connected data, Ethereum holds a commanding 55% stock of the $25 cardinal real-world plus tokenization sector, a stat that Fundstrat uses to reason for broader organization adoption.

Source: rwa.xyz

Source: rwa.xyzInstitutional Demand And Big Buyers

Reports person disclosed large-scale firm accumulation that respective analysts accidental is taking proviso disconnected the market.

BitMine Immersion Technologies has reportedly added astir 1.2 cardinal ETH since aboriginal July, leaving the institution with astir $5.5 cardinal worthy of Ether connected its books. Company banal (BMNR) has been volatile, with immoderate sum pointing to a 1,300% leap implicit a abbreviated period.

Fundstrat and different observers accidental those kinds of firm treasuries, combined with caller ETF flows, could make a structural bid for ETH if the buying is sustained.

Rachael Lucas, a crypto expert astatine BTC Markets, described these positions arsenic strategical and long-term, saying they region “substantial liquidity” from trading pools.

Market Momentum And Price Claims

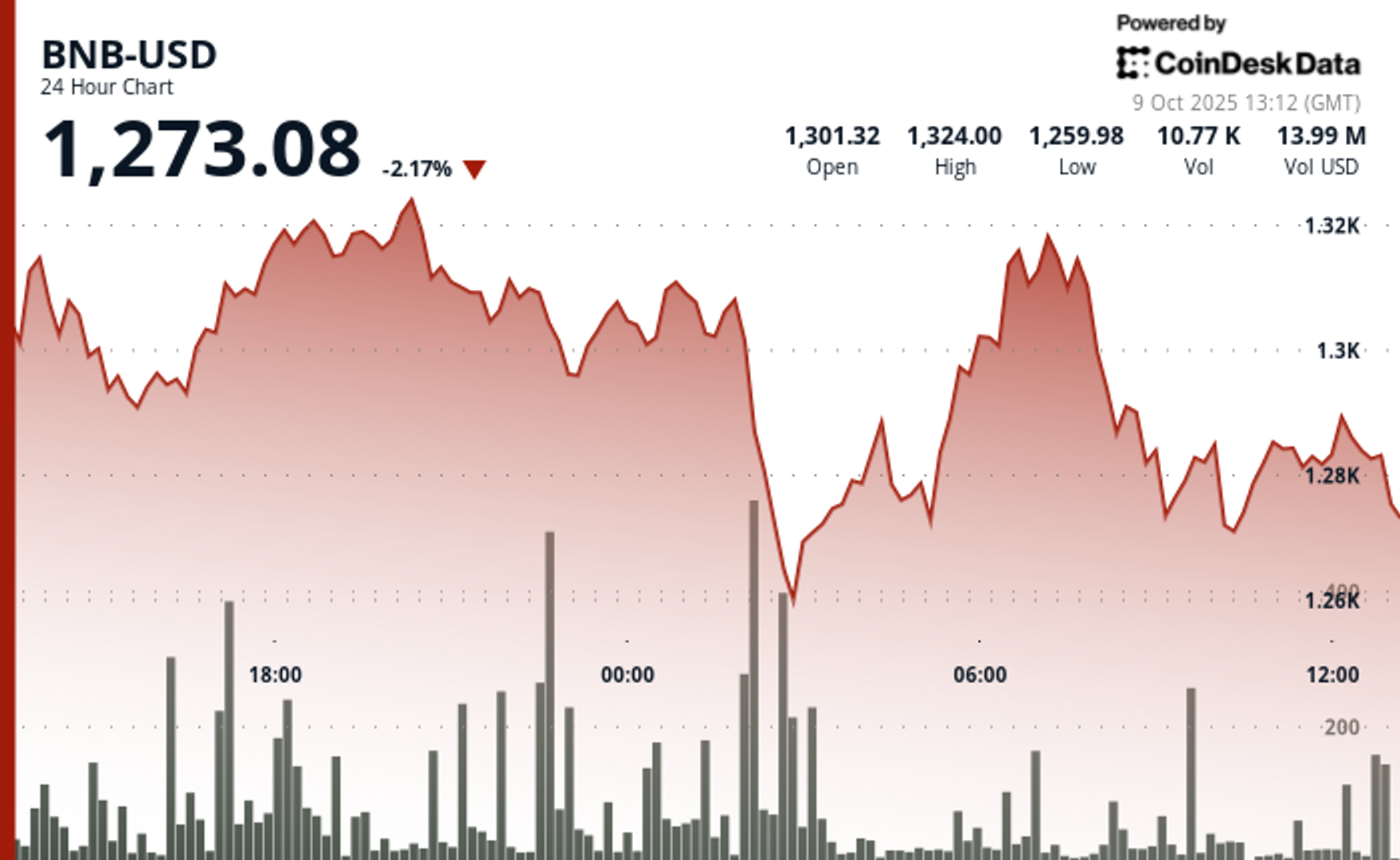

According to Fundstrat, Ether is outperforming Bitcoin this year. One acceptable of figures enactment ETH’s year-to-date summation astatine 28% against Bitcoin’s 18%, portion different reports much precocious showed ETH up 41% YTD and Bitcoin up 30% YTD, with BTC trading adjacent $121,000 successful that snapshot.

Source: FundStrat

Source: FundStratBased connected reports, Fundstrat’s analysts presumption ETH arsenic a major macro trade for the adjacent 10 to 15 years if organization and regulatory trends proceed to propulsion request higher.

Analysts caution that lofty targets volition request sustained, ample inflows to go reality. Watch for the gait and consistency of ETF flows, firm treasury disclosures, and immoderate regulatory moves astir stablecoins and custody rules.

There’s besides a applicable concern: big, concentrated buys tin tighten markets rapidly but whitethorn besides reverse if sentiment shifts oregon liquidity needs change.

According to investigation and nationalist comments from Fundstrat, the bullish lawsuit for Ether is wide and backed by circumstantial numbers: $10,000 to $15,000 targets, firm treasuries holding millions of ETH, and accelerated caller gains.

Featured representation from Meta, illustration from TradingView

1 month ago

1 month ago

English (US)

English (US)