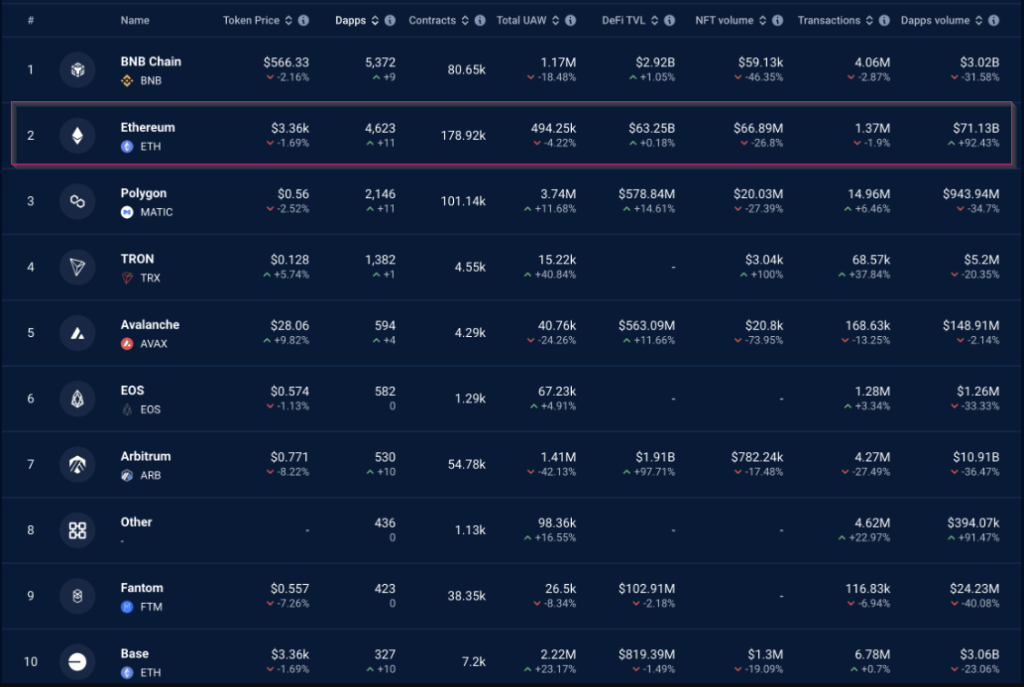

Ethereum (ETH) has go a beacon successful the oversea of blockchains, boasting a staggering 92% surge successful dApp (decentralized application) measurement implicit the past week. This news, however, comes with a furniture of complexity, revealing a scenery of some accidental and imaginable setbacks for the starring blockchain.

Cheap Gas Fuels The Fire

Analysts property the dApp measurement detonation to the Dencun upgrade successful March, which importantly reduced state fees – the outgo associated with processing transactions connected the Ethereum network.

Lower fees person historically enticed users, and this caller improvement seems to beryllium nary different. The surge successful enactment suggests a revitalized Ethereum, perchance attracting caller projects and fostering a much vibrant dApp ecosystem.

NFT Mania Drives The Numbers

While the wide dApp measurement (see illustration below) paints a rosy picture, a person look reveals a much nuanced story. The surge appears to beryllium driven chiefly by a surge successful NFT (Non-Fungible Token) trading and staking activity.

Source: DappRadar

Source: DappRadarApplications similar Blur and Uniswap’s NFT aggregator saw important hikes, highlighting the booming NFT marketplace connected Ethereum. This inclination indicates a thriving niche wrong the Ethereum dApp landscape, but raises questions astir the platform’s diversification beyond NFTs.

A Look At User Engagement

A funny wrinkle emerges erstwhile examining idiosyncratic engagement metrics. Despite the awesome measurement increase, the fig of unsocial progressive wallets (UAW) connected the Ethereum web has really decreased.

This disconnect suggests that the existent enactment mightiness beryllium driven by a smaller, much progressive idiosyncratic base. While precocious measurement is surely a affirmative indicator, it’s important to spot broader idiosyncratic information to guarantee the sustainability of the dApp ecosystem.

A Glimmer Of Hope?

One affirmative semipermanent indicator for Ethereum is the inclination of decreasing speech holdings, arsenic reported by Glassnode. This suggests ETH holders are moving their assets disconnected exchanges, perchance reducing merchantability unit and contributing to terms stability.

If this inclination continues, ETH could perchance people reaching $4,000 this 4th oregon adjacent surpass its all-time high. However, this terms prediction remains speculative and depends connected assorted marketplace forces.

Ether terms seen climbing successful the adjacent fewer weeks. Source: CoinCodex

Ether terms seen climbing successful the adjacent fewer weeks. Source: CoinCodexEthereum At A Crossroads

Ethereum finds itself astatine a crossroads. The Dencun upgrade has demonstrably revitalized dApp activity, peculiarly successful the NFT space. However, the uneven dApp show and declining UAW rise concerns astir the semipermanent viability of this growth. Network growth, measured by the fig of caller addresses joining the network, is besides slowing down, according to Santiment, perchance hindering wider adoption.

The short-term terms outlook for ETH remains uncertain. While the semipermanent indicators, similar decreasing speech holdings, suggest imaginable for terms appreciation, the network’s maturation slowdown mightiness pb to a short-term terms dip.

Looking Forward

The coming months volition beryllium important for Ethereum. The level needs to capitalize connected the renewed involvement successful dApps by attracting a broader idiosyncratic basal and fostering a much divers dApp ecosystem beyond NFTs. Addressing scalability issues and ensuring user-friendly interfaces volition besides beryllium cardinal to sustaining growth.

If Ethereum tin navigate these challenges, it has the imaginable to solidify its presumption arsenic the premier level for decentralized applications. However, if it fails to adapt, different blockchains waiting successful the wings mightiness capitalize connected its shortcomings.

Featured representation from Pexels, illustration from TradingView

1 year ago

1 year ago

English (US)

English (US)