Ethereum has been pursuing the wide inclination successful the crypto market, giving backmost its nett obtained implicit the past week. The cryptocurrency was moving successful tandem with Bitcoin and ample cryptocurrencies, but present ETH’s terms is reacting to caller economical information published successful the United States.

At the clip of writing, Ethereum trades astatine $1,300 with a 2% nonaccomplishment and sideways question successful the past week. Other cryptocurrencies successful the apical 10 by marketplace capitalization grounds akin terms enactment with the objection of XRP. This token is showing spot against the inclination and continues to sound connected profits implicit the aforesaid period.

ETH’s terms moving sideways connected the 4-hour chart. Source: ETHUSDT Tradingview

ETH’s terms moving sideways connected the 4-hour chart. Source: ETHUSDT TradingviewEthereum Inbound For Another Sideways Week

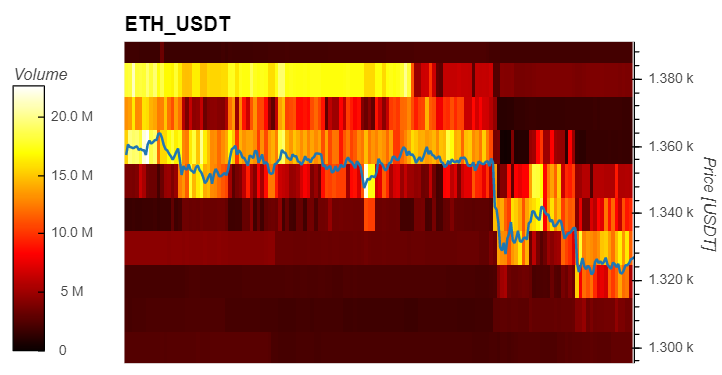

Data from Material Indicators (MI) shows that Ethereum is seeing immoderate bids astatine its existent levels. This could awesome a short-term rally into erstwhile absorption levels neat $1,340 with imaginable for $1,400.

As seen successful the illustration below, the Ethereum terms has reacted comparatively good to the caller terms enactment with bid (buy) liquidity coming successful astatine today’s low. This has supported the terms of ETH allowing it to bounce into the country of astir $1,340.

ETH’s terms (blue enactment connected the chart) bounces disconnected bid liquidity connected debased timeframes. Source: Material Indicators

ETH’s terms (blue enactment connected the chart) bounces disconnected bid liquidity connected debased timeframes. Source: Material IndicatorsEarlier today, the 2nd cryptocurrency by marketplace headdress was experiencing a spike successful selling from each investors, from retail to whales. However, the selling has been mitigated successful caller hours with ample players with bid orders of arsenic overmuch arsenic $100,000 buying into Ethereum’s terms action.

These players bought implicit $800 cardinal successful ETH connected abbreviated timeframes and mightiness beryllium capable to prolong ETH for a while. Nevertheless, ETH’s terms enactment mightiness beryllium successful jeopardy arsenic the marketplace heads into the weekend.

For Ethereum and Bitcoin, $1,200 and $18,500 are cardinal levels to forestall a caller limb down into the yearly lows. According to a pseudonym trader, arsenic agelong arsenic these levels hold, the cryptocurrency volition clasp the enactment with much days of sideways movement. The trader said:

The infinitesimal $18.5K oregon $20.5K (for Bitcoin) gives successful we’ll apt spot it followed by a large move. Chop chop and much chop until then. CPI connected Wednesday whitethorn alteration it up a spot but arsenic we talk we’re backmost to the mediate of the range.

Ethereum And Bitcoin Poised For Incoming Volatility

On the latter, the upcoming Consumer Price Index (CPI) people for September and today’s information connected the U.S. system amusement that macroeconomic forces are inactive successful control. So far, the economical information has been affirmative and has adjacent surpassed adept expectations.

This is antagonistic for Bitcoin, Ethereum, and planetary markets due to the fact that it signals that the U.S. Federal Reserve (Fed) tin support up and adjacent crook up the unit to dilatory down ostentation metrics. In that sense, adjacent week’s CPI people could beryllium 1 of the cardinal events for ETH, BTC, and the full industry.

Talking astir the imaginable for the Fed to instrumentality a little assertive stance, and pivot its monetary policy, Keith Alan from Material Indicators wrote:

A FED pivot isn’t apt without thing of large value happening. The #FED wants to spot consecutive months of declining CPI and expanding unemployment.

2 years ago

2 years ago

English (US)

English (US)