Ethereum (ETH) is poised for a important breakthrough arsenic it inches person to the captious intelligence obstruction of $2,000, mirroring the bullish sentiment sweeping done the cryptocurrency market, mostly led by Bitcoin (BTC).

Market analysts are optimistic astir Ethereum’s imaginable breakout earlier October ends, with bargain orders anticipated to substance a important 12.25% surge, propelling the terms to $1,958.

In addition, investors person steadfastly held onto their investments successful DeFi assets wrong the Ethereum ecosystem, demonstrating unwavering assurance adjacent successful the look of the enduring crypto marketplace challenges.

Despite the tumultuous quality of the crypto market, these investors stay committed to the imaginable and committedness of DeFi, believing successful its quality to revolutionize accepted fiscal systems.

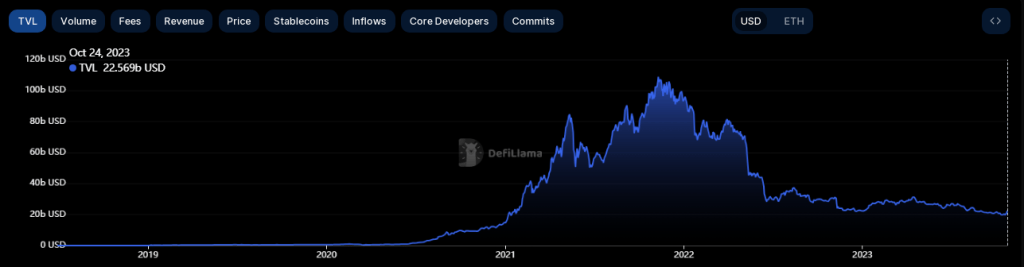

As per insights provided by DefiLlama, these assets collectively correspond an awesome full worth locked astatine $21.27 billion, reflecting the important spot and fiscal committedness placed successful the Ethereum DeFi scenery by the capitalist community. This information solidifies its presumption arsenic a cornerstone of the broader crypto fiscal landscape.

Ethereum TVL. Source: DeFiLlama

Ethereum TVL. Source: DeFiLlama

As traders eagerly await this upswing, trading measurement is projected to witnesser a notable spike, reflecting increasing capitalist involvement successful securing vulnerability to Ether beyond the existent absorption levels.

Reinforcing the affirmative outlook, the Relative Strength Index (RSI) stands astatine 75, indicating that Ethereum’s upward trajectory is poised to persist. Nevertheless, caution prevails arsenic oversold conditions whitethorn trigger profit-taking among traders keen connected safeguarding their capital.

This dual sentiment of optimism and caution sets the signifier for a important juncture successful Ethereum’s terms action.

ETH Signs Of Struggle Amidst A Resistance

A separate analytical report underscores Ethereum’s recurring conflict with a cardinal absorption level, evident from the persistent terms fluctuations converging astir this threshold. Historical information points to the ramifications of prolonged resistance, often resulting successful crisp terms retracements.

For Ethereum, this could connote a much pronounced marketplace correction, peculiarly considering the broader marketplace dynamics presently astatine play. Investors and traders are advised to intimately show these absorption levels, which could importantly interaction short-term marketplace sentiment and terms movements.

Unveiling Ethereum: Low Network Activity

Underlying Ethereum’s terms fluctuations, an alarming inclination emerges concerning the platform’s subdued web activity. Despite its estimation arsenic a thriving ecosystem for decentralized applications, the caller dip successful on-chain operations raises concerns astir waning involvement oregon a imaginable displacement of absorption towards alternate blockchain platforms.

An progressive web isn’t solely reliant connected transaction volumes; it signifies ongoing development, upgrades, and the motorboat of caller projects. The caller diminution successful web enactment suggests a imaginable lull successful these captious endeavors, prompting marketplace participants to reevaluate the semipermanent sustainability of Ethereum’s dominance wrong the blockchain space.

ETH seven-day terms action. Source: Coingecko

ETH seven-day terms action. Source: Coingecko

As Ethereum’s price hovers astatine $1,813, notching a 7.0% surge wrong 24 hours and a 14% upward inclination implicit the past 7 days, marketplace observers stay vigilant arsenic the cryptocurrency continues to navigate done captious absorption levels and grapples with web enactment concerns.

As the cryptocurrency marketplace continues to mature, Ethereum’s aboriginal trajectory is intricately linked to its quality to code these challenges and uphold its presumption arsenic a starring blockchain platform, captious for the broader ecosystem’s maturation and stability.

(This site’s contented should not beryllium construed arsenic concern advice. Investing involves risk. When you invest, your superior is taxable to risk).

Featured representation from Distinct Today

2 years ago

2 years ago

English (US)

English (US)