The ETH/BTC ratio represents the comparative spot of Ethereum (ETH) against Bitcoin (BTC). With the 2 being the 2 largest coins by marketplace headdress and the 2 largest crypto ecosystems successful general, it makes consciousness to comparison their narration to amended recognize the market. Tracking the ETH/BTC ratio is important arsenic it reflects the market’s sentiment towards ETH comparative to BTC. A rising ratio shows that ETH is outperforming BTC, which indicates either accrued assurance successful ETH oregon a diminution successful the terms of BTC.

While semipermanent holders mightiness not wage overmuch attraction to the ratio, progressive traders usage it to marque decisions astir their trading positions to instrumentality vantage of volatility. Furthermore, the ratio provides a measurement of the comparative spot of ETH against BTC, which helps america recognize shifts successful marketplace dominance that could pb to volatility.

This week began with a bang for ETH/BTC arsenic the ratio saw unthinkable volatility. The marketplace has been abuzz with speculation astir the support of spot Ethereum ETFs successful the US. This anticipation notably impacted ETH and BTC prices, subsequently impacting the ratio.

For the amended portion of the past 30 days, the ratio remained comparatively stable, astatine astir 0.0485 astir April 24. At the time, some ETH and BTC saw lone mean terms fluctuations with nary important divergence that would summation the ratio.

We saw the archetypal notable summation successful the ratio astir April 27, erstwhile it touched 0.0513. This correlated to a tiny spike successful ETH’s price, rising from $3,140 to $3,250. This summation pushed the ratio up due to the fact that BTC remained comparatively unchangeable astatine the time. This summation continued until the extremity of April. However, the affirmative momentum was breached successful May arsenic the ratio declined. It dropped to 0.0451 connected May 16, erstwhile it began to recover, climbing to 0.0513 by May 20. This dilatory and dependable summation turned into an astir vertical ascent betwixt May 20 and May 21, peaking astatine astir 0.0560.

Graph showing the ETH/BTC ratio from April 24 to May 22, 2024 (Source: CoinMarketCap)

Graph showing the ETH/BTC ratio from April 24 to May 22, 2024 (Source: CoinMarketCap)While Bitcoin besides saw important terms enactment astatine the time, reaching $71,400 connected May 20, ETH saw a overmuch much assertive spike. It surged to implicit $3,790 by May 21, adjusting somewhat to $3,730 connected May 22 and reaching arsenic precocious arsenic $3,948 connected May 23 anterior to immoderate determination connected an Ethereum ETF.

Such a crisp spike successful the ratio comes arsenic nary surprise, arsenic analysts person revised the odds of an ETH ETF support to 75% amid rumors of the SEC’s imaginable favorable stance. These rumors person been capable to thrust speculation arsenic traders positioned themselves to capitalize connected the expected inflows into ETH upon the ETF approval.

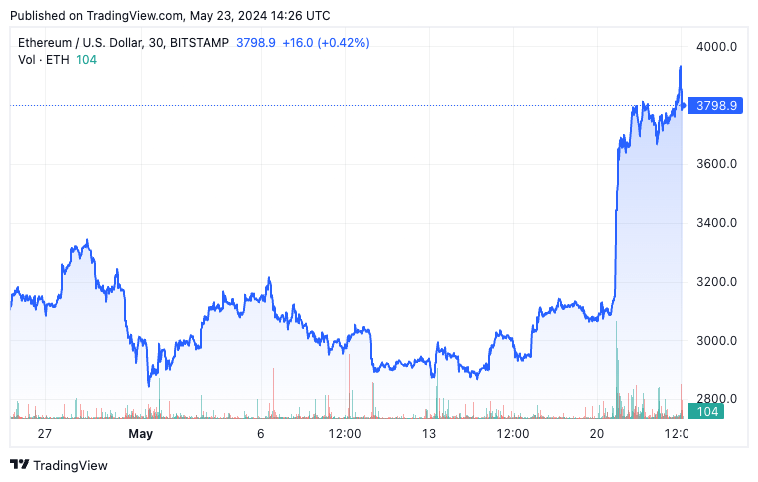

Graph showing the terms of Ethereum (ETH) from April 24 to May 22, 2024 (Source: CryptoSlate ETH)

Graph showing the terms of Ethereum (ETH) from April 24 to May 22, 2024 (Source: CryptoSlate ETH)The imaginable support of ETH ETFs is simply a large measurement towards organization adoption of Ethereum, akin to the interaction we’ve seen with Bitcoin ETFs. However, with US regulators struggling for years to determine whether to statement ETH a commodity oregon a security, the support of an ETH ETF would person overmuch much important implications for the broader crypto market. This imaginable has fueled the rally successful ETH, arsenic seen successful the narrowing discount successful Grayscale’s Ethereum Trust and the increased minting of USDT connected Ethereum successful anticipation of the ETF.

The station Ethereum ETF rumors thrust melodramatic emergence successful ETH/BTC ratio appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)