The US Securities and Exchange Commission has issued notices of effectiveness for respective Ethereum-related exchange-traded funds (ETFs) arsenic they statesman trading today, July 23.

Available accusation connected the regulator’s website confirms the effectiveness of the S-1 filing of antithetic issuers, including VanEck, Grayscale, Bitwise, Invesco, and Fidelity, among others.

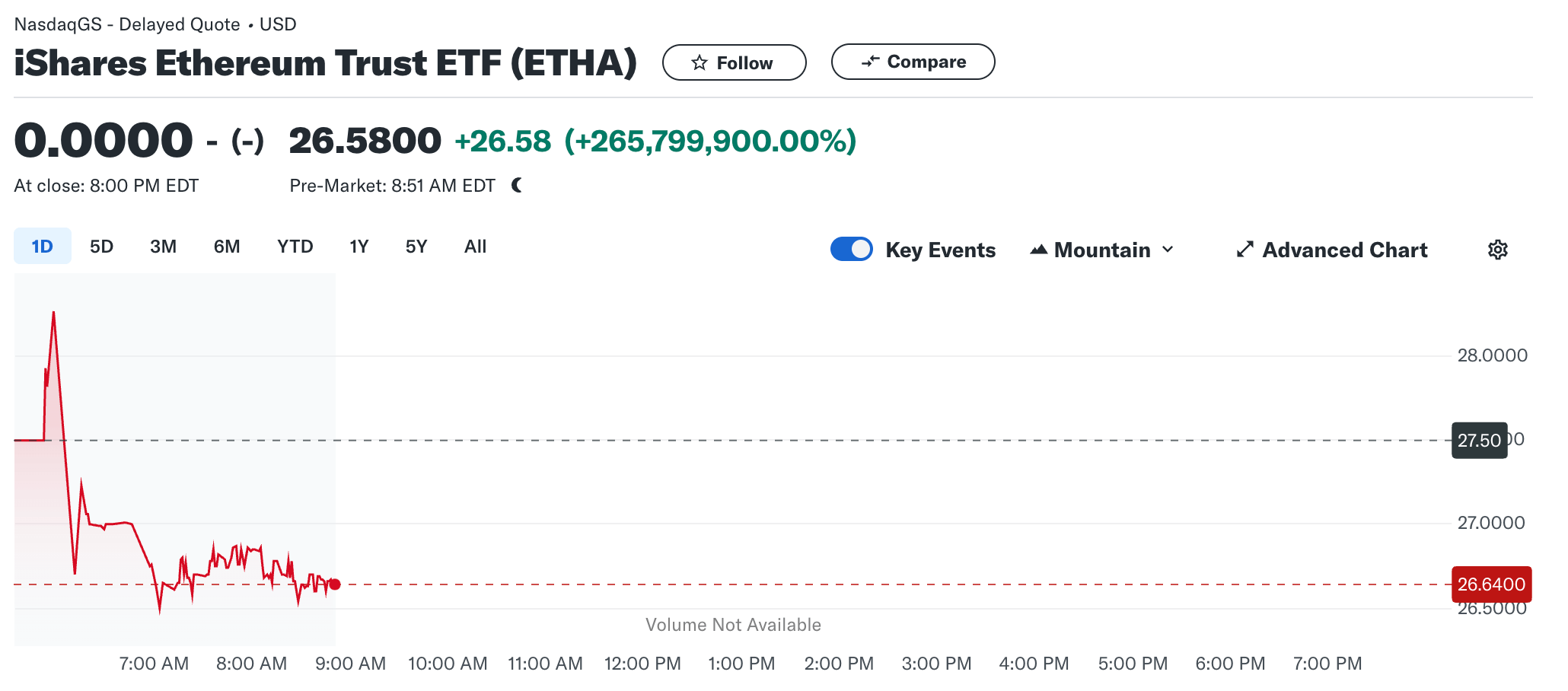

Pre-market trading is already open, with BlackRock’s iShares Ethereum Trust (ETHA) opening astatine $27.50 earlier falling somewhat to $26.64 arsenic of property time.

Ethereum ETF pre-market trading (Yahoo Finance)

Ethereum ETF pre-market trading (Yahoo Finance)On July 22, reports emerged that the SEC had fixed its last support for the spot Ethereum ETFs to statesman trading connected July 23. Asset absorption steadfast Grayscale confirmed that its Ethereum ETF products—the Grayscale Ethereum Mini Trust and Ethereum Trust Fund—would commencement trading connected the New York Stock Exchange today.

This improvement ends weeks of waiting for ETF products of the second-largest integer plus by marketplace capitalization, which the regulator had extensively investigated and initially suggested was a security.

Market experts hailed the move, pointing retired that the ETFs volition supply convenient access, liquidity, and transparency for investors looking to summation vulnerability to integer assets. Jay Jacobs, BlackRock’s US Head of Thematic and Active ETFs, said:

“Ethereum’s entreaty lies successful its decentralized quality and its imaginable to thrust integer translation successful concern and different industries.”

How volition ETH terms react?

While ETH’s terms has been mostly muted contempt the impending motorboat of the ETFs, blockchain probe steadfast Kaiko reported that it was unclear however the archetypal inflows from the products could interaction the asset.

Will Cai, caput of indices astatine Kaiko, said:

“The motorboat of the futures based ETH ETFs successful the US precocious past twelvemonth was met with underwhelming demand, each eyes are connected the spot ETFs’ motorboat with precocious hopes connected speedy plus accumulation. Although a afloat request representation whitethorn not look for respective months, ETH terms could beryllium delicate to inflow numbers of the archetypal days.”

Meanwhile, Bitwise’s CIO Matt Hougan predicted that the upcoming spot Ethereum ETFs volition propel the integer asset’s terms to caller all-time highs of much than $5,000. He said:

“By year-end, I’m assured the caller highs volition beryllium in. And if flows are stronger than galore marketplace commentators expect, the terms could beryllium overmuch higher still.”

The station Ethereum ETFs pre-market trading begins, each acceptable for authoritative debut astatine marketplace open appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)