The long-awaited Shanghai and Capella update of Ethereum officially went unrecorded yesterday astatine 6:30 americium EST. The hard fork has gone disconnected without a hitch and is the archetypal large upgrade to the protocol since “The Merge” connected September 15, 2022.

For the archetypal clip successful implicit 2 years, stakers and validators are capable to retreat their staked ETH from the Beacon Chain. And contrary to immoderate alarming fears, the ETH terms has truthful acold failed to plummet.

The Latest Numbers On Pending Ethereum Withdrawals

According to token.unlocks, about 2 hours aft the Ethereum upgrade, astir 17,350 ETHs were withdrawn, and 128 ETH were deposited. The fig of ETH waiting for withdrawal astatine that clip was astir 319,000 ETH (about $563 million).

Since then, however, the fig has accrued significantly. As of property time, determination were 704,416 ETH waiting to beryllium withdrawn, according to data from Nansen. The full fig of staked ETH connected the Beacon Chain including rewards was 19,227,545 ETH. This means that astir 3.6% of each staked ETH are presently waiting to beryllium withdrawn.

The fig of validators waiting for a afloat exit was 19,621, with the full fig being 567,209 validators. The nett outflow since the update was activated is -55,438 ETH.

It is worthy noting that the mean terms of each stakers is $1,973, according to Nansen, which is conscionable supra the existent price. ETH frankincense lone needs to summation by 3% for the mean staker to beryllium successful profit.

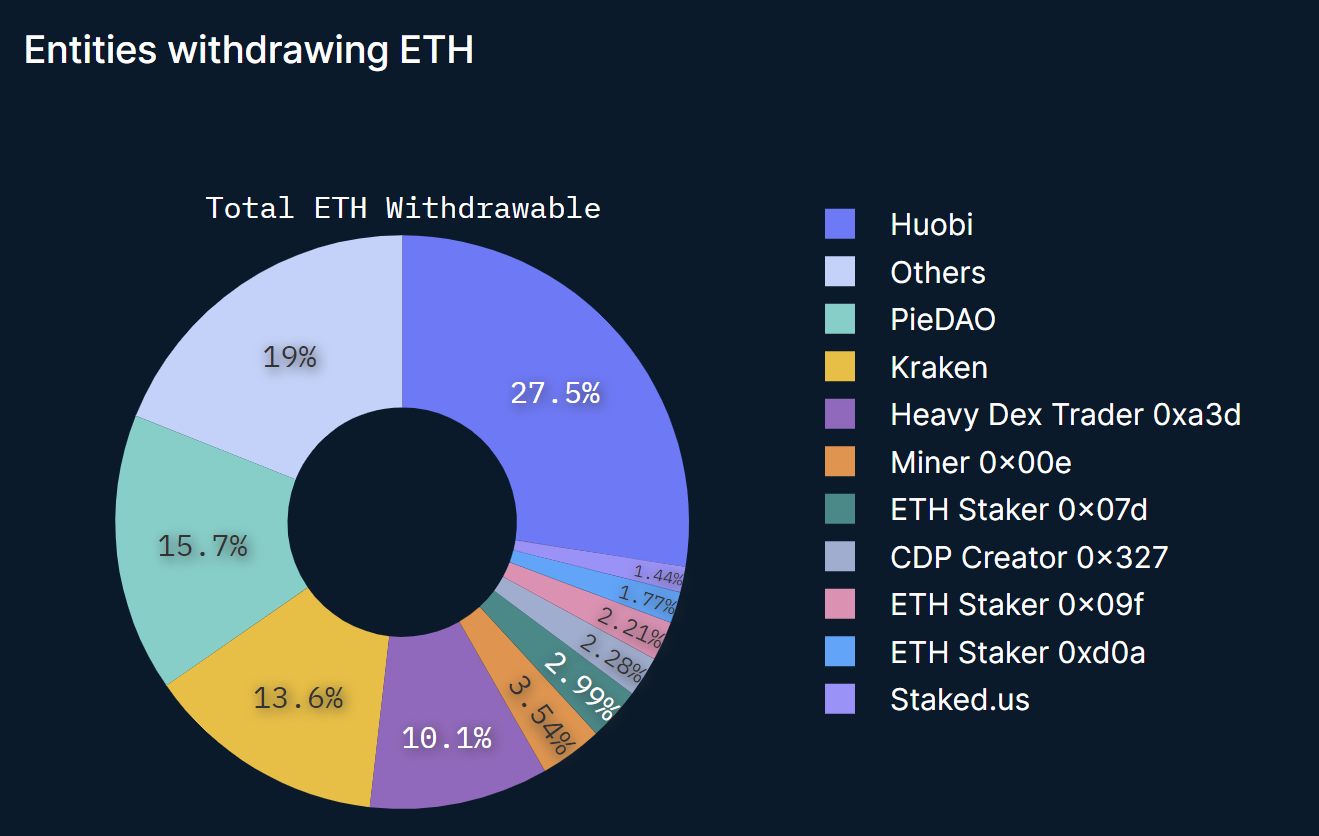

According to on-chain analytics tools, Huobi ranks archetypal with 27.5% of entities waiting to unwind their staked ETH, followed by others (19%), PieDAO (15.7%), Kraken (13.6%), and Heavy Dex Trader 0xa3d (10.1%).

Entities withdrawing ETH | Source: Nansen

Entities withdrawing ETH | Source: NansenAccording to radical acquainted with the matter, the ample fig of ETH withdrawals connected Huobi is chiefly related to the transportation of caller and aged shareholders, arsenic reported by Chinese writer Colin Wu. After the withdrawal is completed, the erstwhile proprietor of Huobi, Li Lin, has to bash a handover. “Some ETH whitethorn beryllium withdrawn and past deposited again.”

According to the authoritative Ethereum website, nary transaction interest is required for the withdrawals, arsenic the withdrawals bash not vie with the execution level artifact space. Moreover, the website states that a maximum of 16 withdrawals tin beryllium processed successful a azygous block.

This means that 115,200 withdrawals volition beryllium processed by validators successful a azygous day. Subsequently, Ethereum predicts that 400,000 withdrawals volition instrumentality 3.5 days, 600,000 withdrawals volition instrumentality 5.2 days, and 800,000 withdrawals volition instrumentality 7 days.

ETH Price Trends Up

The existent information suggests that determination is nary unreserved among investors to unstake ETH. Thus, fears astir an ETH dump look to beryllium proving unwarranted. With the existent numbers, the archetypal withdrawals could beryllium afloat settled successful arsenic small arsenic a week. The interaction connected the terms is apt to beryllium alternatively marginal.

Accordingly, the ETH terms presently looks precise bullish. At property time, ETH was trading astatine $1,921, eyeing a interruption supra $2,000.

ETH price, 1-day chart| Source: ETHUSD connected TradingView.com

ETH price, 1-day chart| Source: ETHUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)