Ethereum (ETH), the 2nd largest cryptocurrency by marketplace cap, experienced a terms driblet of implicit 3% wrong the past 24 hours. The crushed is presumably a important sell-off carried retired by a salient whale. The whale deposited 25,000 ETH (worth astir $47.24 million) connected Binance, lone to retreat a important magnitude of USDT soon afterwards.

As the on-chain information supplier Lookonchain reports, the whale has astir apt already sold a portion of his ETH. According to the on-chain data, the whale withdrew 16 cardinal successful USDT. “The driblet successful ETH terms [a fewer hours] agone was astir apt owed to the sell-off of this whale,” the analysts note, further explaining that the whale inactive owns astir 8,000 ETH ($14.7 million) unsold.

Nevertheless, ETH bulls proceed to amusement strength. A look astatine the 1-hour illustration of Ethereum reveals that the terms has formed a bull flag. In method analysis, a emblem is simply a short-term consolidation signifier that occurs aft a beardown terms determination and indicates a impermanent interruption successful the trend.

A bullish emblem forms during an uptrend with the flagpole pointing upwards, followed by a consolidation signifier earlier a imaginable continuation of the upward movement. For now, the signifier has held, ETH has bounced up from the 4H 200 EMA astatine $1,825. In this respect, the bulls stay successful power (despite the whale) for the clip being.

ETH bull flag, 1-hour illustration | Source: ETHUSD connected TradingView.com

ETH bull flag, 1-hour illustration | Source: ETHUSD connected TradingView.comBasically, 2 scenarios are conceivable. If the aforementioned enactment levels are breached to the downside, particularly the underside of the flag, Ethereum could look a further terms diminution towards $1,750. Conversely, a breakout from the emblem signifier to the upside (around $1,900) could trigger a terms emergence towards $2,000.

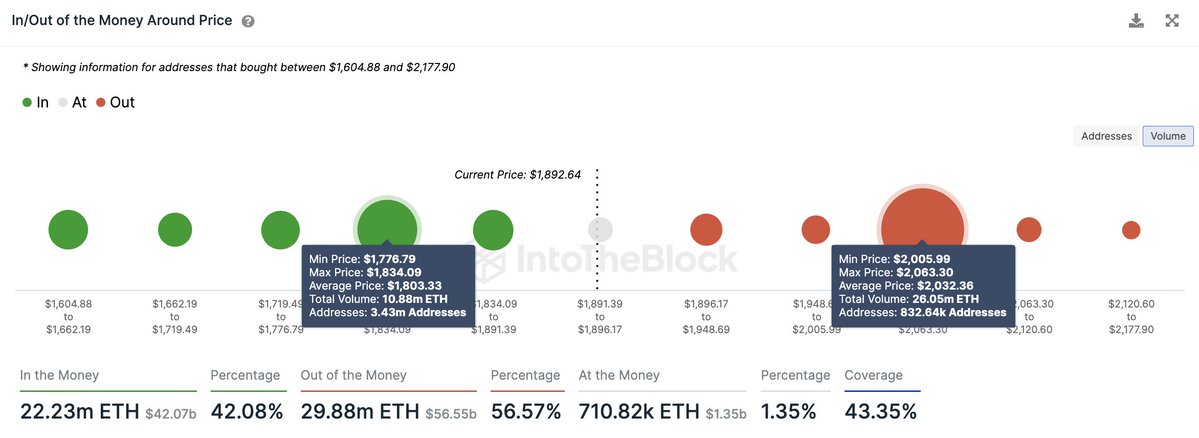

However, according to expert Ali Martinez, that’s wherever the terms volition deed Ethereum’s cardinal proviso wall, which is successful the $2,000 to $2,060 range, wherever 832,640 addresses person bought implicit 26 cardinal ETH. “If ETH tin interruption done this absorption barrier, we tin expect an upswing to $2,330 oregon adjacent $2,750,” Martinez believes.

In/ Out of the wealth astir terms | Source: Twitter @ali_charts

In/ Out of the wealth astir terms | Source: Twitter @ali_chartsEthereum Options Expiry On Friday Confirms Outlook

The astir important lawsuit this week for Bitcoin, Ethereum and the full crypto marketplace volition beryllium the expiration of implicit $7 cardinal successful options tomorrow, Friday, June 30. The existent options measurement connected the largest speech Deribit is 14,107 calls, 9,445 puts and a put-call ratio of 0.67 for Bitcoin. For Ethereum, determination are presently 76,776 calls, 39,779 puts and a put-call ratio of 0.52.

Options Volume [Deribit]$BTC: 📈Calls=14,107.70, 📉Puts=9,445.50, ⚖️Put-call ratio=0.67 $ETH: 📈Calls=76,776.00, 📉Puts=39,779.00, ⚖️Put-call ratio=0.52

— coinoptionstrack bot (@optionstrackbot) June 29, 2023

A put-call ratio beneath 1 typically means that the fig of telephone options is higher than the fig of enactment options, which indicates a much bullish marketplace sentiment. In this case, the put-call ratio for ETH is 0.52, which means that determination are much telephone options compared to enactment options. Thus, the ratio indicates that marketplace participants are much prone to bullish bets connected the ETH price.

Featured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)